Answered step by step

Verified Expert Solution

Question

1 Approved Answer

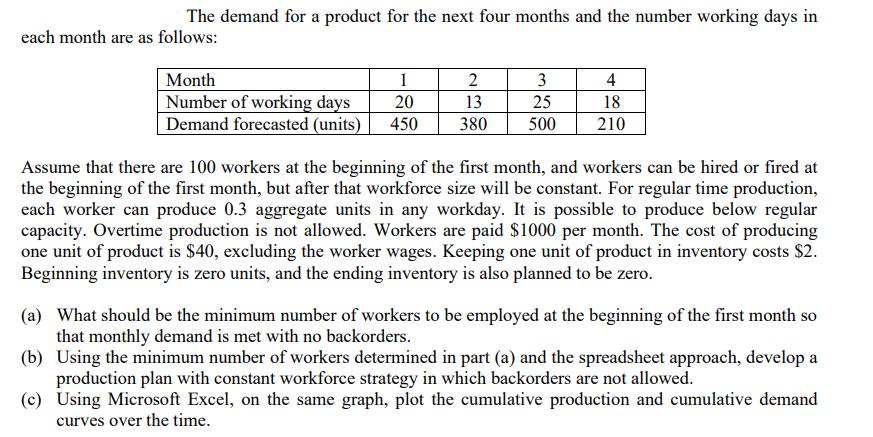

The demand for a product for the next four months and the number working days in each month are as follows: Month Number of

The demand for a product for the next four months and the number working days in each month are as follows: Month Number of working days Demand forecasted (units) 1 20 450 2 13 380 3 25 500 4 18 210 Assume that there are 100 workers at the beginning of the first month, and workers can be hired or fired at the beginning of the first month, but after that workforce size will be constant. For regular time production, each worker can produce 0.3 aggregate units in any workday. It is possible to produce below regular capacity. Overtime production is not allowed. Workers are paid $1000 per month. The cost of producing one unit of product is $40, excluding the worker wages. Keeping one unit of product in inventory costs $2. Beginning inventory is zero units, and the ending inventory is also planned to be zero. (a) What should be the minimum number of workers to be employed at the beginning of the first month so that monthly demand is met with no backorders. (b) Using the minimum number of workers determined in part (a) and the spreadsheet approach, develop a production plan with constant workforce strategy in which backorders are not allowed. (c) Using Microsoft Excel, on the same graph, plot the cumulative production and cumulative demand curves over the time.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the minimum number of workers to be employed at the beginning of the first month we need to calculate the maximum production capacity required to meet the monthly demand without backord...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started