Answered step by step

Verified Expert Solution

Question

1 Approved Answer

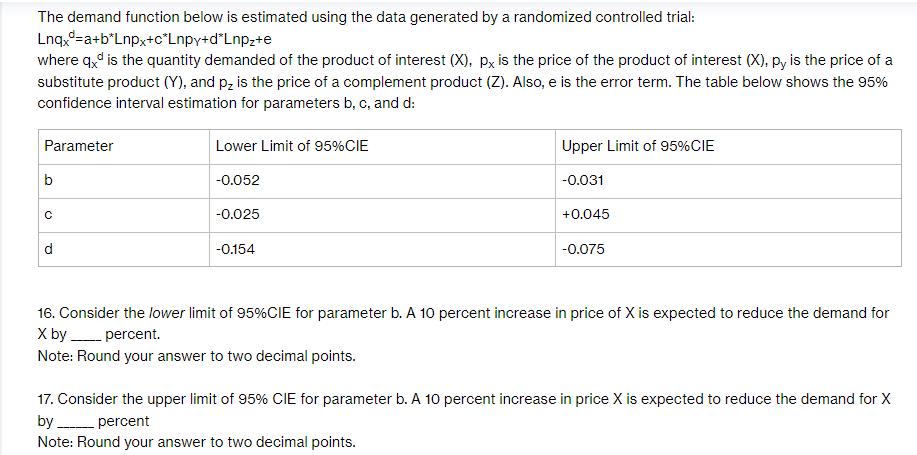

The demand function below is estimated using the data generated by a randomized controlled trial: Lnqx=a+b*Lnpx+c*Lnpy+dLnpz+e where qx is the quantity demanded of the

The demand function below is estimated using the data generated by a randomized controlled trial: Lnqx=a+b*Lnpx+c*Lnpy+dLnpz+e where qx is the quantity demanded of the product of interest (X), px is the price of the product of interest (X), py is the price of a substitute product (Y), and p is the price of a complement product (Z). Also, e is the error term. The table below shows the 95% confidence interval estimation for parameters b, c, and d: Parameter b C d Lower Limit of 95%CIE -0.052 -0.025 -0.154 Upper Limit of 95%CIE -0.031 +0.045 -0.075 16. Consider the lower limit of 95%CIE for parameter b. A 10 percent increase in price of X is expected to reduce the demand for X by___ percent. Note: Round your answer to two decimal points. 17. Consider the upper limit of 95% CIE for parameter b. A 10 percent increase in price X is expected to reduce the demand for X by _______ percent Note: Round your answer to two decimal points.

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution To calculate the expected reduction in demand for X based on the lower lim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started