Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The demand function for widgets is qP (p) = 120-2p and the supply function is q (p) = 4p. (a) Find the equilibrium price

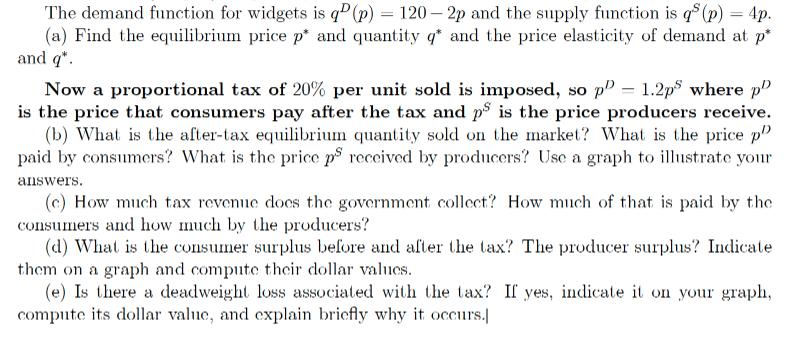

The demand function for widgets is qP (p) = 120-2p and the supply function is q (p) = 4p. (a) Find the equilibrium price p* and quantity q* and the price elasticity of demand at p* and q*. Now a proportional tax of 20% per unit sold is imposed, so p = 1.2ps where p is the price that consumers pay after the tax and ps is the price producers receive. (b) What is the after-tax equilibrium quantity sold on the market? What is the price p paid by consumers? What is the price ps received by producers? Use a graph to illustrate your answers. (c) How much tax revenue does the government collect? How much of that is paid by the consumers and how much by the producers? (d) What is the consumer surplus before and after the tax? The producer surplus? Indicate them on a graph and compute their dollar values. (e) Is there a deadweight loss associated with the tax? If yes, indicate it on your graph, compute its dollar value, and explain briefly why it occurs.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To find the equilibrium price and quantity we need to solve the equilibrium conditions of the demand and supply functions Demand function qD 120 2p ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started