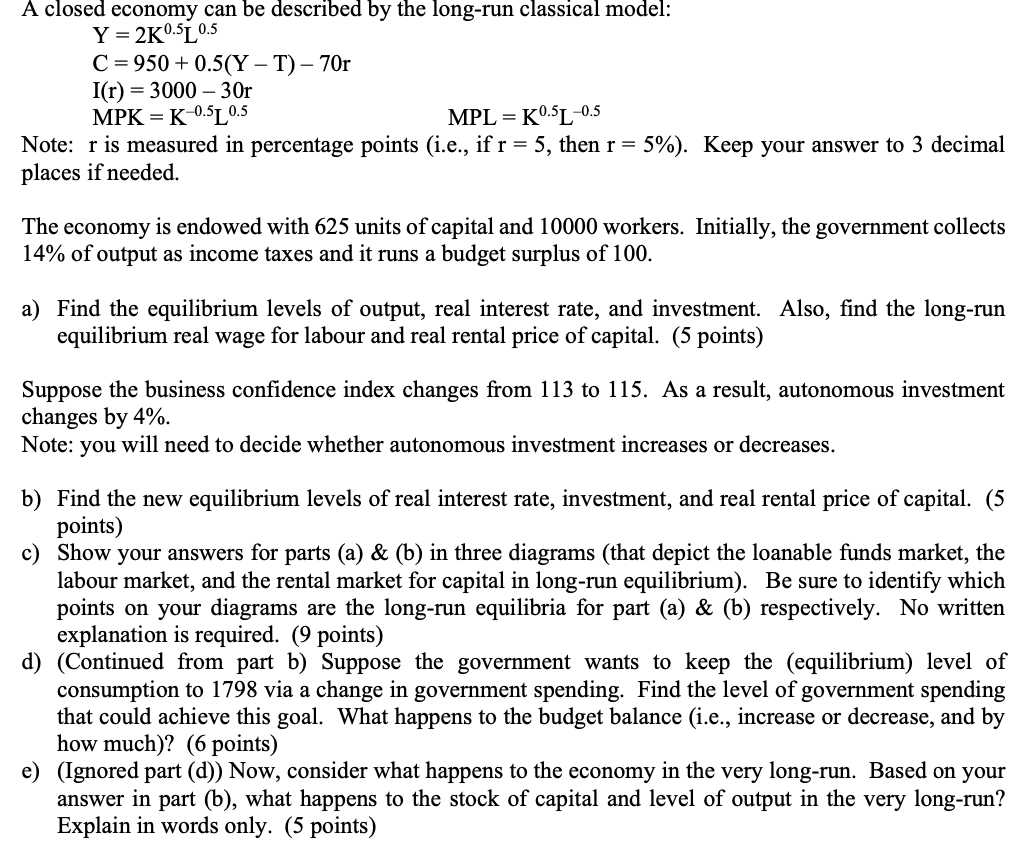

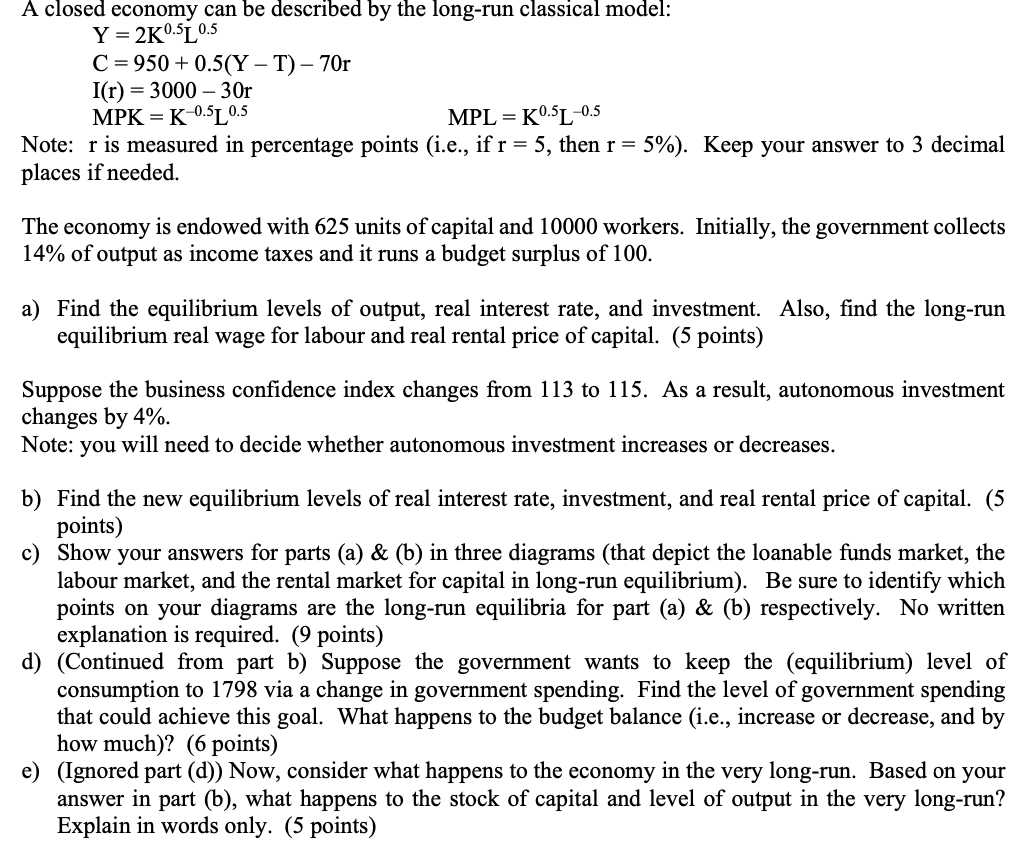

The diagram! thank you!

The diagram! thank you!

Y=2K0.5L0.5 C=950+0.5(YT)70r I(r)=300030r MPK =K0.5L0.5 MPL =K0.5L0.5 Note: r is measured in percentage points (i.e., if r=5, then r=5% ). Keep your answer to 3 decimal places if needed. The economy is endowed with 625 units of capital and 10000 workers. Initially, the government collects 14% of output as income taxes and it runs a budget surplus of 100 . a) Find the equilibrium levels of output, real interest rate, and investment. Also, find the long-run equilibrium real wage for labour and real rental price of capital. (5 points) Suppose the business confidence index changes from 113 to 115 . As a result, autonomous investment changes by 4%. Note: you will need to decide whether autonomous investment increases or decreases. b) Find the new equilibrium levels of real interest rate, investment, and real rental price of capital. (5 points) c) Show your answers for parts (a) \& (b) in three diagrams (that depict the loanable funds market, the labour market, and the rental market for capital in long-run equilibrium). Be sure to identify which points on your diagrams are the long-run equilibria for part (a) \& (b) respectively. No written explanation is required. (9 points) d) (Continued from part b) Suppose the government wants to keep the (equilibrium) level of consumption to 1798 via a change in government spending. Find the level of government spending that could achieve this goal. What happens to the budget balance (i.e., increase or decrease, and by how much)? (6 points) e) (Ignored part (d)) Now, consider what happens to the economy in the very long-run. Based on your answer in part (b), what happens to the stock of capital and level of output in the very long-run? Explain in words only. (5 points) Y=2K0.5L0.5 C=950+0.5(YT)70r I(r)=300030r MPK =K0.5L0.5 MPL =K0.5L0.5 Note: r is measured in percentage points (i.e., if r=5, then r=5% ). Keep your answer to 3 decimal places if needed. The economy is endowed with 625 units of capital and 10000 workers. Initially, the government collects 14% of output as income taxes and it runs a budget surplus of 100 . a) Find the equilibrium levels of output, real interest rate, and investment. Also, find the long-run equilibrium real wage for labour and real rental price of capital. (5 points) Suppose the business confidence index changes from 113 to 115 . As a result, autonomous investment changes by 4%. Note: you will need to decide whether autonomous investment increases or decreases. b) Find the new equilibrium levels of real interest rate, investment, and real rental price of capital. (5 points) c) Show your answers for parts (a) \& (b) in three diagrams (that depict the loanable funds market, the labour market, and the rental market for capital in long-run equilibrium). Be sure to identify which points on your diagrams are the long-run equilibria for part (a) \& (b) respectively. No written explanation is required. (9 points) d) (Continued from part b) Suppose the government wants to keep the (equilibrium) level of consumption to 1798 via a change in government spending. Find the level of government spending that could achieve this goal. What happens to the budget balance (i.e., increase or decrease, and by how much)? (6 points) e) (Ignored part (d)) Now, consider what happens to the economy in the very long-run. Based on your answer in part (b), what happens to the stock of capital and level of output in the very long-run? Explain in words only. (5 points)

The diagram! thank you!

The diagram! thank you!