Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When a firm decides that a plant wide overhead rate is not sufficient (perhaps it makes multiple products and the various products go through

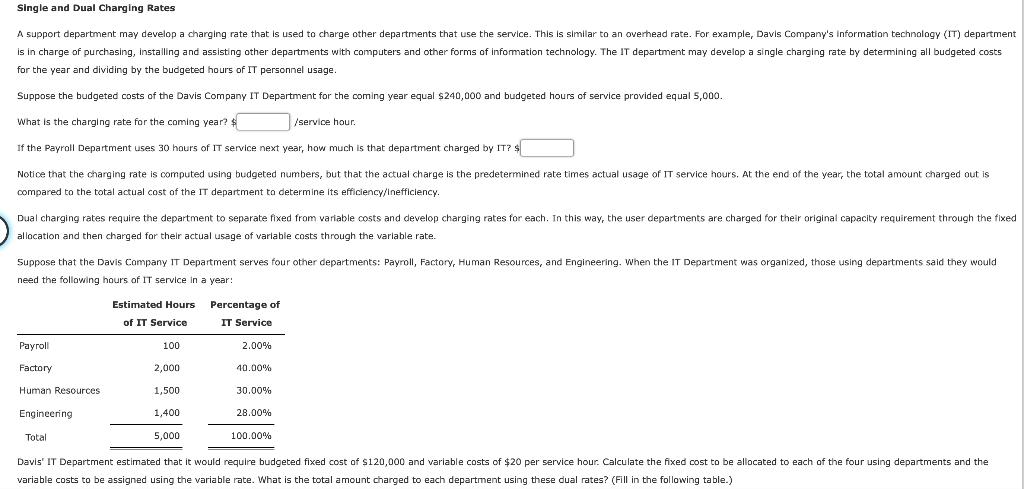

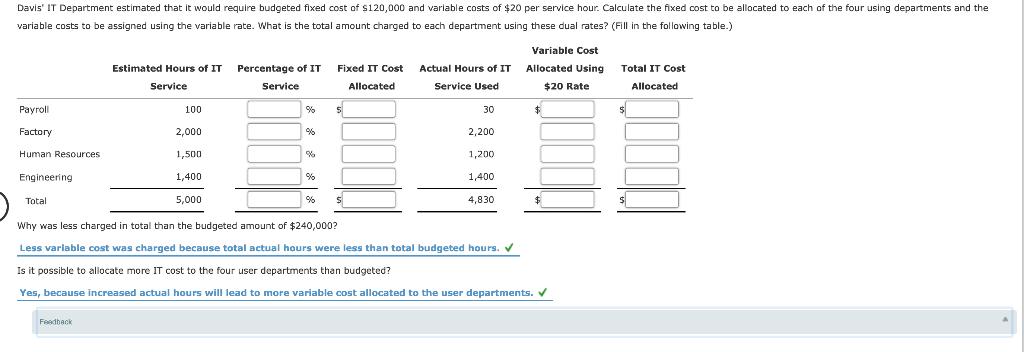

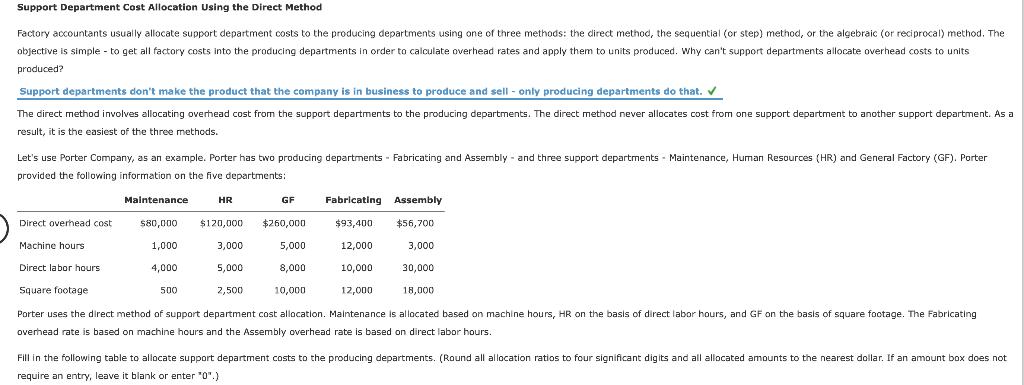

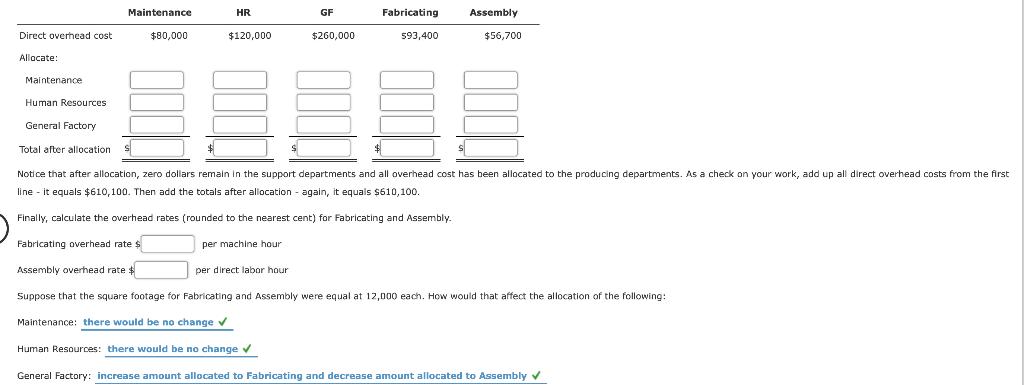

When a firm decides that a plant wide overhead rate is not sufficient (perhaps it makes multiple products and the various products go through some processes but not all), it may decide to departmentalise. The factory is divided into departments and costs are accumulated within the departments. When that is done, there are basically two types of departments: producing departments that actually make units of product, and support departments that do not make the product but assist or support the producing departments. Costs of support departments are allocated to producing departments for the following reasons: inventory valuation, product- line profitability, pricing, and planning and control.. From the list below, determine which of the following are producing departments: Departments Is it a producing department? Yes Assembly Human Resources Industrial engineering (in a bread factory) Baking (in a bread factory) Packaging Accounting (in a paint factory) Welding (in a auto manufacture) No No Yes Yes No Yes No Yes Maintenance Mixing (in a food factory) Some costs are hard to associate with a single department, so a final catch-all department may be created called General Factory. This department includes all overhead costs that could not be traced to the other departments. For example, the salary of the plant superintendent and the cost of landscaping and grounds keeping may be included in General Factory. Once the factory is departmentalized, the costs of each department are traced to that department. All costs in the support departments are overhead costs. Costs in the producing departments can include direct overhead. For example, overhead cost directly traced to a producing department may include depreciation on machinery and the salary of the departmental supervisor. Single and Dual Charging Rates A support department may develop a charging rate that is used to charge other departments that use the service. This is similar to an overhead rate. For example, Davis Company's Information technology (IT) department is in charge of purchasing, installing and assisting other departments with computers and other forms of information technology. The IT department may develop a single charging rate by determining all budgeted costs for the year and dividing by the budgeted hours of IT personnel usage. Suppose the budgeted costs of the Davis Company IT Department for the coming year equal $240,000 and budgeted hours of service provided equal 5,000. What is the charging rate for the coming year? $ /service hour. If the Payroll Department uses 30 hours of IT service next year, how much is that department charged by IT? $ Notice that the charging rate is computed using budgeted numbers, but that the actual charge is the predetermined rate times actual usage of IT service hours. At the end of the year, the total amount charged out is compared to the total actual cost of the IT department to determine its efficiency/Inefficiency. Dual charging rates require the department to separate fixed from variable costs and develop charging rates for each. In this way, the user departments are charged for their original capacity requirement through the fixed. allocation and then charged for their actual usage of variable costs through the variable rate. Suppose that the Davis Company IT Department serves four other departments: Payroll, Factory, Human Resources, and Engineering. When the IT Department was organized, those using departments said they would need the following hours of IT service in a year: Payroll Factory Human Resources. Engineering. Estimated Hours of IT Service 100 2,000 1,500 1,400 Total Percentage of IT Service 2.00% 40.00% 30.00% 28.00% 5,000 Davis' IT Department estimated that it would require budgeted fixed cost of $120,000 and variable costs of $20 per service hour. Calculate the fixed cost to be allocated to each of the four using departments and the variable costs to be assigned using the variable rate. What is the total amount charged to each department using these dual rates? (Fill in the following table.) 100.00% Davis' IT Department estimated that it would require budgeted fixed cost of $120,000 and variable costs of $20 per service hour. Calculate the fixed cost to be allocated to each of the four using departments and the variable costs to be assigned using the variable rate. What is the total amount charged to each department using these dual rates? (Fill in the following table.) Payroll Factory Human Resources Engineering Total Estimated Hours of IT Service Feedback 100 2,000 1,500 1,400 5,000 Percentage of IT Service % % % % % Fixed IT Cost Allocated 5 Actual Hours of IT Service Used 30 2,200 1,200 1,400 4,830 Variable Cost Allocated Using $20 Rate $ Why was less charged in total than the budgeted amount of $240,000? Less variable cost was charged because total actual hours were less than total budgeted hours. Is it possible to allocate more IT cost to the four user departments than budgeted? Yes, because increased actual hours will lead to more variable cost allocated to the user departments. Total IT Cost Allocated Support Department Cost Allocation Using the Direct Method Factory accountants usually allocate support department costs to the producing departments using one of three methods: the direct method, the sequential (or step) method, or the algebraic (or reciprocal) method. The objective is simple to get all factory costs into the producing departments in order to calculate overhead rates and apply them to units produced. Why can't support departments allocate overhead costs to units produced? Support departments don't make the product that the company is in business to produce and sell only producing departments do that. The direct method involves allocating overhead cost from the support departments to the producing departments. The direct method never allocates cost from one support department another support department. As a result, it is the easiest of the three methods. Let's use Porter Company, as an example. Porter has two producing departments Fabricating and Assembly and three support departments Maintenance, Human Resources (HR) and General Factory (GF). Porter provided the following information on the five departments: Direct overhead cost. Machine hours Maintenance $80,000 1,000 4,000 500 HR GF $120,000 $260,000 3,000 5,000 2,500 5,000 8,000 Fabricating Assembly $93,400. $56,700 12,000 10,000 10,000 3,000 Direct labor hours Square footage 18,000 Porter uses the direct method of support department cost allocation. Maintenance is allocated based on machine hours, HR on the basis of direct labor hours, and GF on the basis of square footage. The Fabricating overhead rate is based on machine hours and the Assembly overhead rate is based on direct labor hours. 12,000 - 30,000 Fill in the following table to allocate support department costs to the producing departments. (Round all allocation ratios to four significant digits and all allocated amounts to the nearest dollar. If an amount box does not require an entry, leave it blank or enter "0".) Direct overhead cost Allocate: Maintenance Human Resources General Factory Maintenance $80,000 $ HR $120,000 GF per machine hour $260,000 $ Fabricating $93,400 Assembly $56,700 Total after allocation Notice that after allocation, zero dollars remain in the support departments and all overhead cost has been allocated to the producing departments. As a check on your work, add up all direct overhead costs from the first line - it equals $610,100. Then add the totals after allocation - again, it equals $610,100. Finally, calculate the overhead rates (rounded to the nearest cent) for Fabricating and Assembly. Fabricating overhead rate $ Assembly overhead rate $ per direct labor hour Suppose that the square footage for Fabricating and Assembly were equal at 12,000 each. How would that affect the allocation of the following: Maintenance: there would be no change Human Resources: there would be no change General Factory: increase amount allocated to Fabricating and decrease amount allocated to Assembly

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Davis Company IT Department charging rate 2400005000 48service hour Payroll Department is charged ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started