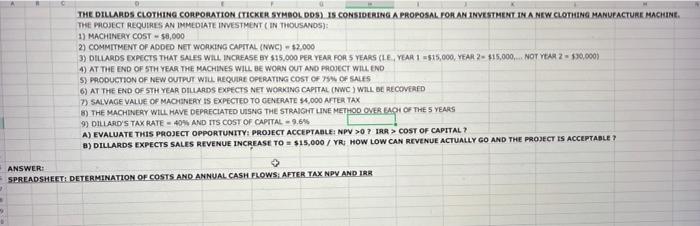

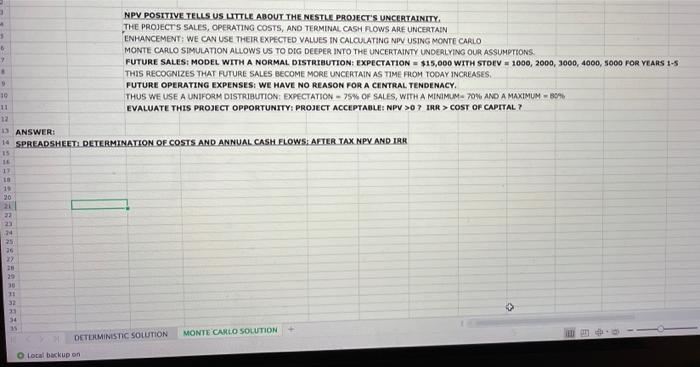

THE DILLARDS CLOTHING CORPORATION (TICKER SYMBOL D05) IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN A NEW CLOTHING MANUFACTURE MACHINE THE PROJECT REQUIRES AN IMMEDIATE INVESTMENT (IN THOUSANDS): 1) MACHINERY COST - 50,000 2) COMMITMENT OF ADDED NETWORKING CAPITAL (WC) - $2,000 3) DILLARDS EXPECTS THAT SALES WILL INCREASE BY $15.000 PER YEAR FOR 5 YEARS (LE YEAR 115.000, YEAR 2- $15.000,..NOT YEAR 2 - 530,000) 4) AT THE END OF STH YEAR THE MACHINES WILL BE WORN OUT AND PROJECT WILL END S) PRODUCTION OF NEW OUTPUT WILL REQUIRE OPERATING COST OF OF SALES 6) AT THE END OF STH YEAR DILLARDS EXPECTS NETWORKING CAPITAL (WC) WILL BE RECOVERED 7) SALVAGE VALUE OF MACHINERY IS EXPECTED TO GENERATE 54,000 AFTER TAX 8) THE MACHINERY WILL HAVE DEPRECIATED UISNG THE STRAIGHT LINE METHOD OVER EACH OF THE 5 YEARS 9) DILLARD'S TAX RATE - 40% AND ITS COST OF CAPITAL -9,6% A) EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >07 IRR > COST OF CAPITAL B) DILLARDS EXPECTS SALES REVENUE INCREASE TO = $15,000 / YR HOW LOW CAN REVENUE ACTUALLY GO AND THE PROJECT IS ACCEPTABLE? ANSWER: SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS: AFTER TAX NPV AND IRR 1 8 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY THE PROJECTS SALES, OPERATING COSTS, AND TERMINAL CASH ROWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION EXPECTATION - 75% OF SALES, WITH A MINIMUM 70% AND A MAXIMUM - 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >07 TRR > COST OF CAPITAL 3 10 12 15 ANSWER: 14 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS: AFTER TAX NPV AND IRR 16 12 19 20 21 22 23 24 21 30 > > 32 33 34 15 DETERMINISTIC SOLUTION MONTE CARLO SOLUTION O Local backup on THE DILLARDS CLOTHING CORPORATION (TICKER SYMBOL D05) IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN A NEW CLOTHING MANUFACTURE MACHINE THE PROJECT REQUIRES AN IMMEDIATE INVESTMENT (IN THOUSANDS): 1) MACHINERY COST - 50,000 2) COMMITMENT OF ADDED NETWORKING CAPITAL (WC) - $2,000 3) DILLARDS EXPECTS THAT SALES WILL INCREASE BY $15.000 PER YEAR FOR 5 YEARS (LE YEAR 115.000, YEAR 2- $15.000,..NOT YEAR 2 - 530,000) 4) AT THE END OF STH YEAR THE MACHINES WILL BE WORN OUT AND PROJECT WILL END S) PRODUCTION OF NEW OUTPUT WILL REQUIRE OPERATING COST OF OF SALES 6) AT THE END OF STH YEAR DILLARDS EXPECTS NETWORKING CAPITAL (WC) WILL BE RECOVERED 7) SALVAGE VALUE OF MACHINERY IS EXPECTED TO GENERATE 54,000 AFTER TAX 8) THE MACHINERY WILL HAVE DEPRECIATED UISNG THE STRAIGHT LINE METHOD OVER EACH OF THE 5 YEARS 9) DILLARD'S TAX RATE - 40% AND ITS COST OF CAPITAL -9,6% A) EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >07 IRR > COST OF CAPITAL B) DILLARDS EXPECTS SALES REVENUE INCREASE TO = $15,000 / YR HOW LOW CAN REVENUE ACTUALLY GO AND THE PROJECT IS ACCEPTABLE? ANSWER: SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS: AFTER TAX NPV AND IRR 1 8 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY THE PROJECTS SALES, OPERATING COSTS, AND TERMINAL CASH ROWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION EXPECTATION - 75% OF SALES, WITH A MINIMUM 70% AND A MAXIMUM - 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >07 TRR > COST OF CAPITAL 3 10 12 15 ANSWER: 14 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS: AFTER TAX NPV AND IRR 16 12 19 20 21 22 23 24 21 30 > > 32 33 34 15 DETERMINISTIC SOLUTION MONTE CARLO SOLUTION O Local backup on