Question

The director of finance has asked you the managerial economist to analyze proposed projects. Each project has a cost of Ksh 10,000 and a

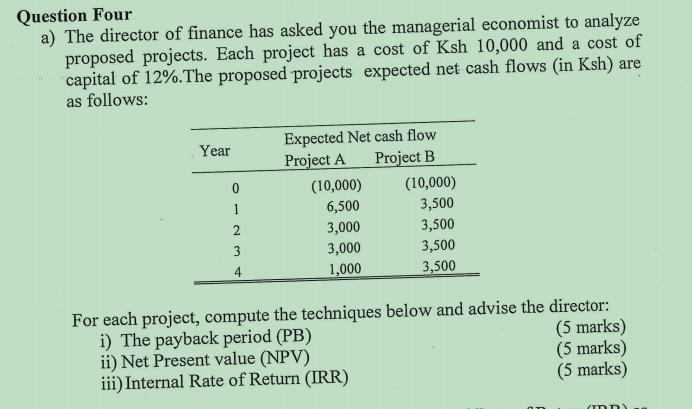

The director of finance has asked you the managerial economist to analyze proposed projects. Each project has a cost of Ksh 10,000 and a cost of capital of 12%. The proposed projects expected net cash flows (in Ksh) are as follows: Year 0 1 2 3 4 Expected Net cash flow Project A Project B (10,000) 6,500 3,000 3,000 1,000 (10,000) 3,500 3,500 3,500 3,500 For each project, compute the techniques below and advise the director: i) The payback period (PB) ii) Net Present value (NPV) iii) Internal Rate of Return (IRR) (5 marks) (5 marks) (5 marks) (nn)

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below i The payback period for Project A is 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App