Question

The Directors Board of a bank wants to study the relationship between the percentage change of performing loans (Y), the rate of economic growth (X),

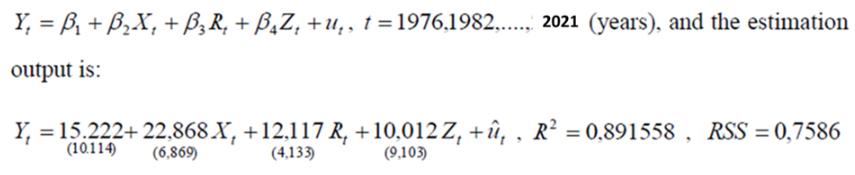

The Directors Board of a bank wants to study the relationship between the percentage change of performing loans (Y), the rate of economic growth (X), the lending interest rates (R) and the percentage change of banking products promotion funds (Z), annually. The Board uses the linear regression model

where the standard errors (standard errors) are given in parentheses.

By using the p-value approach, examine the null hypothesis that the percentage change of banking products promotion funds has no effect (positive or negative) on the percentage of performing loans of the bank

Examine whether the rate of economic growth has a positive impact on the percentage of performing loans

Y =B + BX + B R + BZ +u, t=1976,1982. 2021 (years), and the estimation output is: Y = 15.222+22,868 X, +12,117 R, +10,012 Z, +,, R = 0,891558, RSS = 0,7586 (10.114) (4,133) (9,103) (6,869)

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Sure here is an examination of the null hypothesis that the percentage change of banking products pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started