Answered step by step

Verified Expert Solution

Question

1 Approved Answer

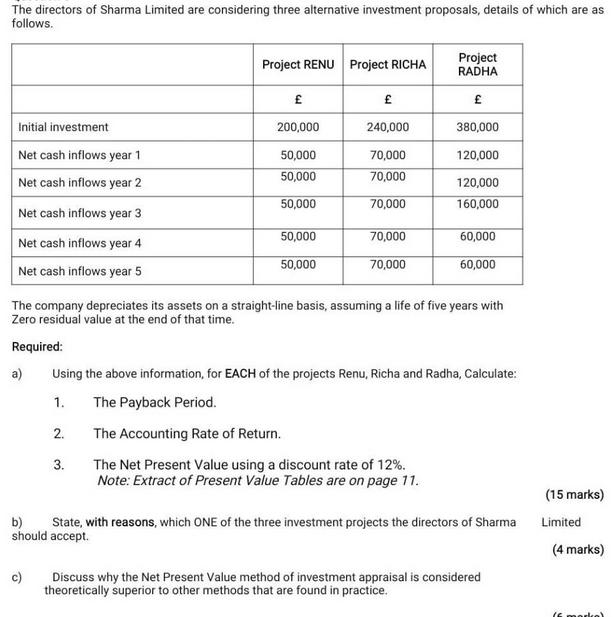

The directors of Sharma Limited are considering three alternative investment proposals, details of which are as follows. Project RENU Project RICHA Project RADHA Initial

The directors of Sharma Limited are considering three alternative investment proposals, details of which are as follows. Project RENU Project RICHA Project RADHA Initial investment 200,000 240,000 380,000 Net cash inflows year 1 50,000 70,000 120,000 Net cash inflows year 2 50,000 70,000 120,000 50,000 70,000 160,000 Net cash inflows year 3 50,000 70,000 60,000 Net cash inflows year 4 50,000 70,000 60,000 Net cash inflows year 5 The company depreciates its assets on a straight-line basis, assuming a life of five years with Zero residual value at the end of that time. Required: a) Using the above information, for EACH of the projects Renu, Richa and Radha, Calculate: 1. The Payback Period. 2. The Accounting Rate of Return. 3. The Net Present Value using a discount rate of 12%. Note: Extract of Present Value Tables are on page 11. (15 marks) b) State, with reasons, which ONE of the three investment projects the directors of Sharma should accept. Limited (4 marks) c) Discuss why the Net Present Value method of investment appraisal is considered theoretically superior to other methods that are found in practice.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay here are the calculations for each project 1 Project Renu Initial investment 200000 Cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started