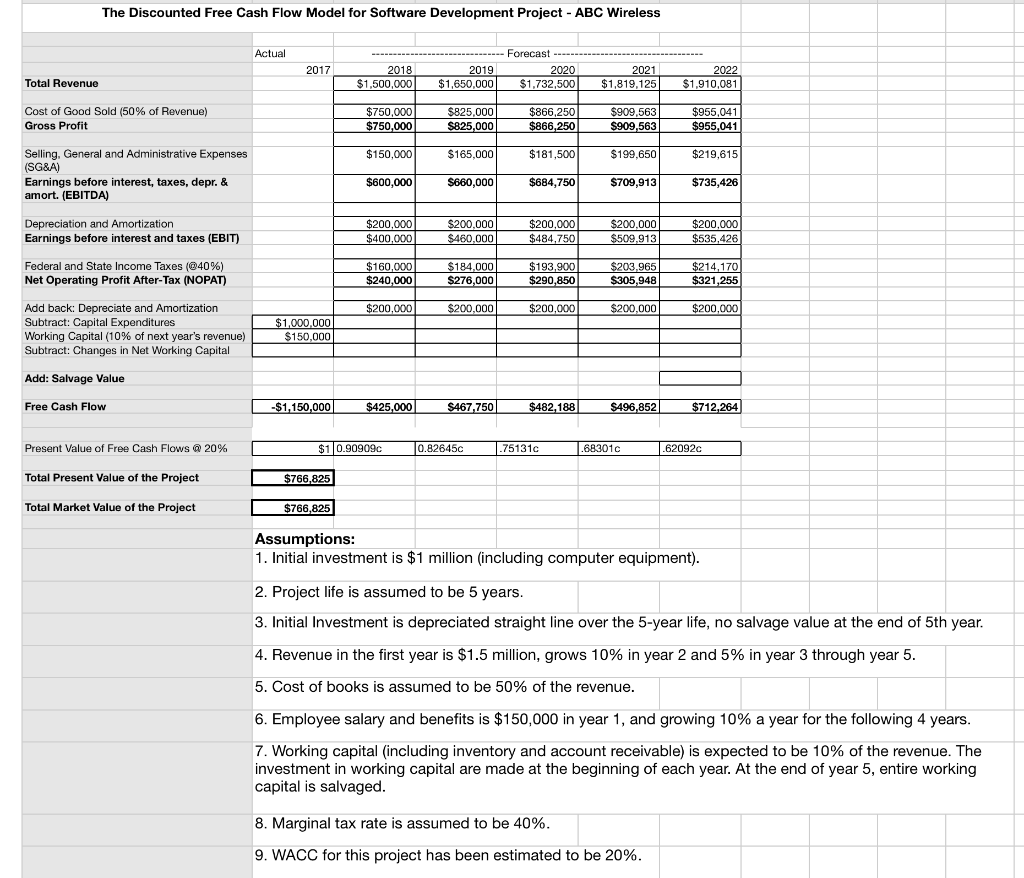

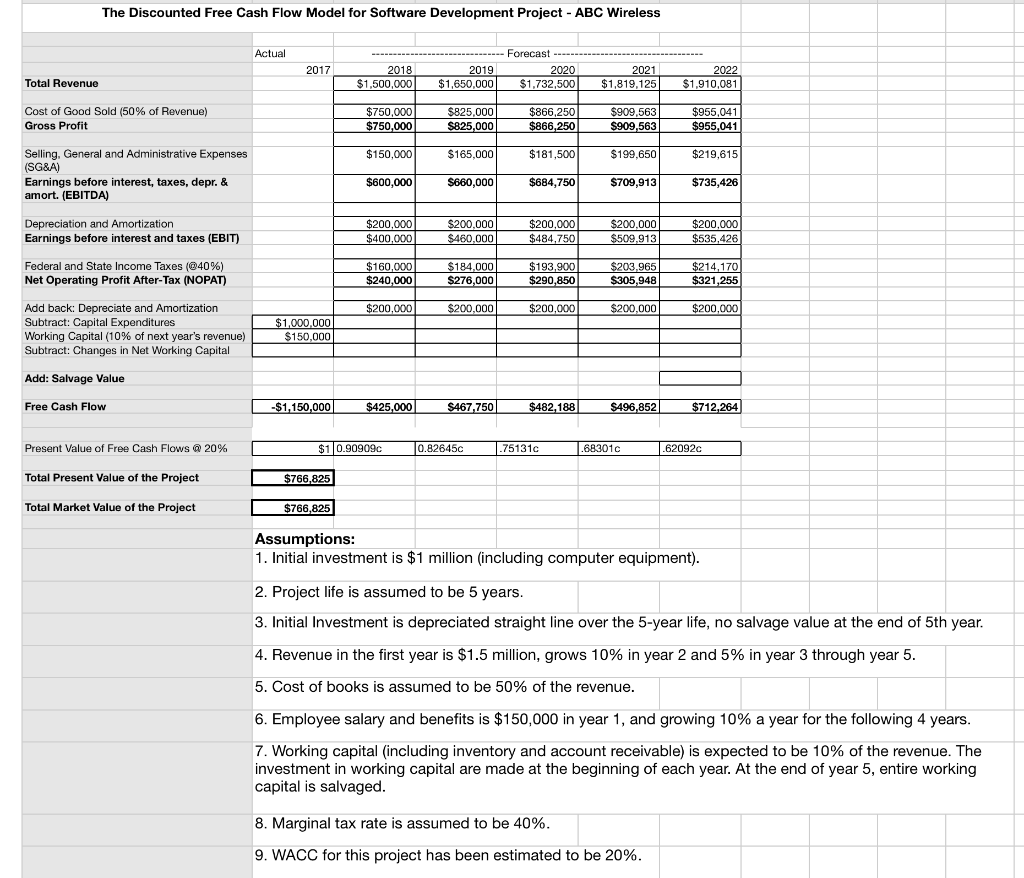

The Discounted Free Cash Flow Model for Software Development Project ABC Wireless Actual Forecast 2017 022 $1,500,000$1,650,000 $1,732,500$1,819,125$1,910,081 2018 2019 2020 Total Revenue Cost of Good Sold (50% of Revenue) Gross Profit $750,000 $825,000 Selling, General and Administrative Expenses (SG&A) Earnings before interest, taxes, depr. & amort. (EBITDA) 750,000 $150,000 $600,000 563 $199,650 $709,913 955,041 $219,615 $735,426 $165,000 $181,500 S660,000 $684,750 Depreciation and Amortization Earnings before interest and taxes (EBIT) $200,000 60,000 $200,000 535,426 $200,000 400,000 484,750 Federal and State Income Taxes (@40%) Net Operating Profit After-Tax (NOPAT) 160,000 $240,000 184,000 $276,000 193,900 $290,850 03,965 $305,948 214,170 $321 Add back: Depreciate and Amortization Subtract: Capital Expenditures Working Capital (10% of next year's revenue) Subtract: Changes in Net Working Capital $200,000 $200,000 $200,000 $200,000 $200,000 $150,000 Add: Salvage Value Free Cash Flow 1.150,000 425,000 750 96,852 Present Value of Free Cash Flows @ 20% $10.90909c 0.82645c 75131c Total Present Value of the Project 766,825 Total Market Value of the Project $766,825 Assumptions 1. Initial investment is $1 million (including computer equipment) 2. Project life is assumed to be 5 years 3. Initial Investment is depreciated straight line over the 5-year life, no salvage value at the end of 5th year 4. Revenue in the first year is $1.5 million, grows 10% in year 2 and 5% in year 3 through year 5 5. Cost of books is assumed to be 50% of the revenue 6. Employee salary and benefits is $150,000 in year 1, and growing 10% a year for the following 4 years Working capital (including inventory and account receivable) is expected to be 10% of the revenue. The investment in working capital are made at the beginning of each year. At the end of year 5, entire working capital is salvaged 8, Marginal tax rate is assumed to be 40% 9. WACC for this project has been estimated to be 20% Problem 2: Discounted Cash Flow Analysis with a Growing Perpetuity In Problem 1, suppose the software development project grows at a steady growth rate of 2% after year 5. Assume SG&A is 10% of revenue in each year. Assume Initial Investment is depreciated straight line over 6 years, no salvage value at the end of the 6tlh year. In order to calculate the working capital in year 6, you may calculate the revenue in year 7, and assume working capital in year 6 is 10% of the revenue in year 7, (Note that in this case, there is no need to assume a salvage value of working capital because the project life is perpetuity.) Modify your spreadsheet in Problem 1 and print a new report. 1) What is the free cash flow in year 6? 2) What is the present value of the growing perpetuity? ARE171B Page 2 of 2 3) What is the fair market value of the project