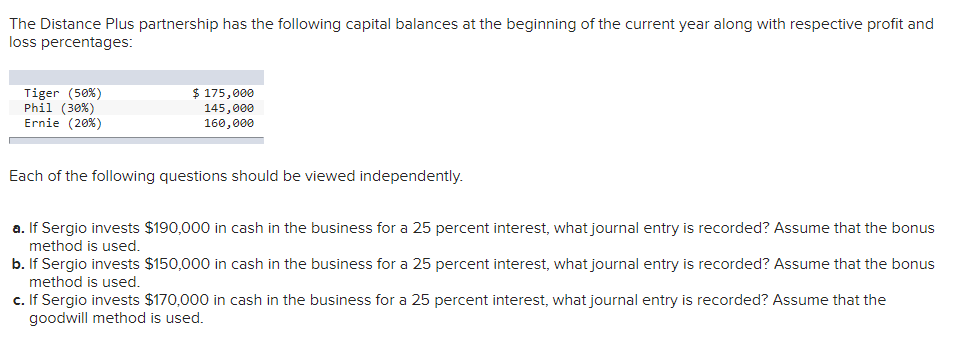

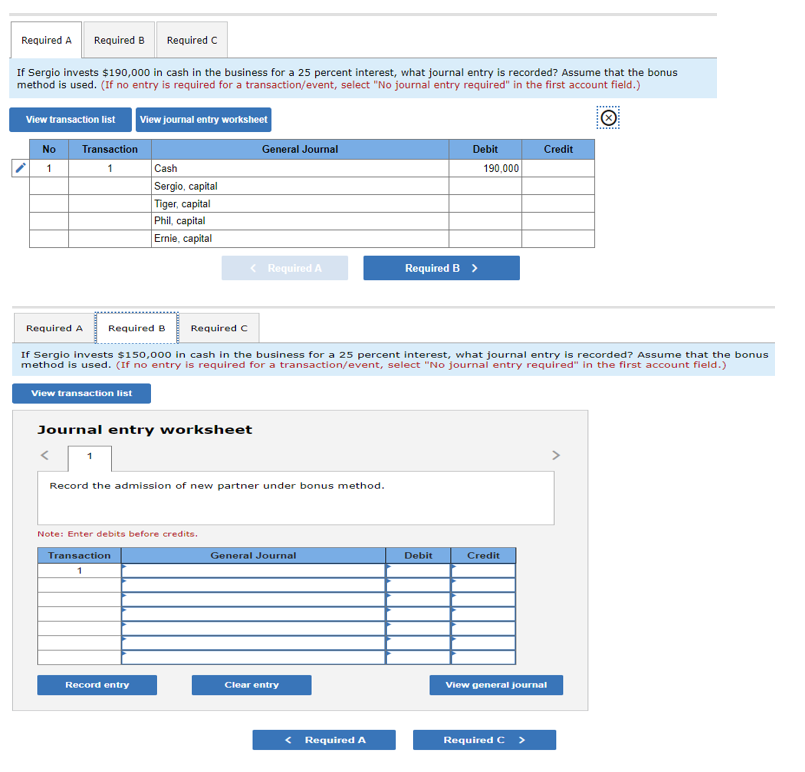

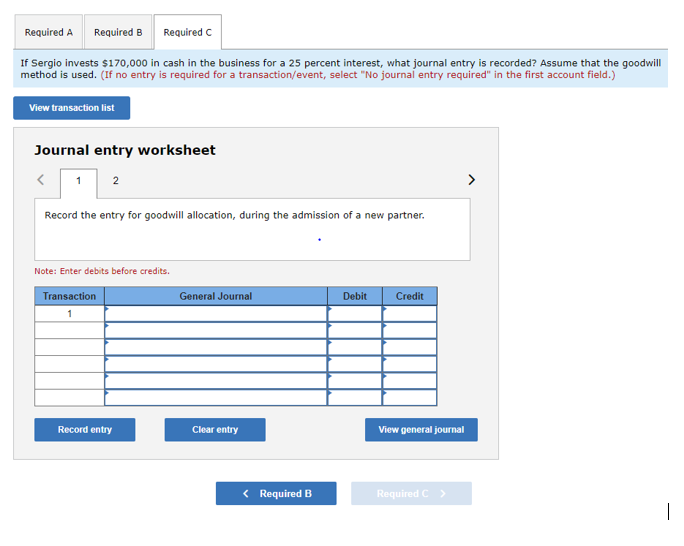

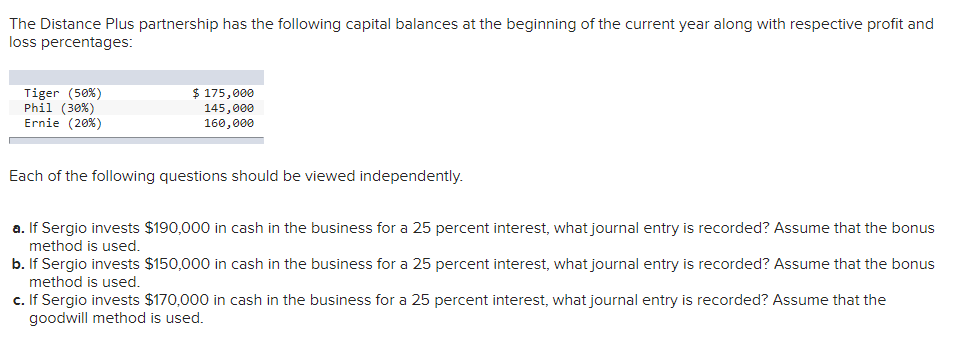

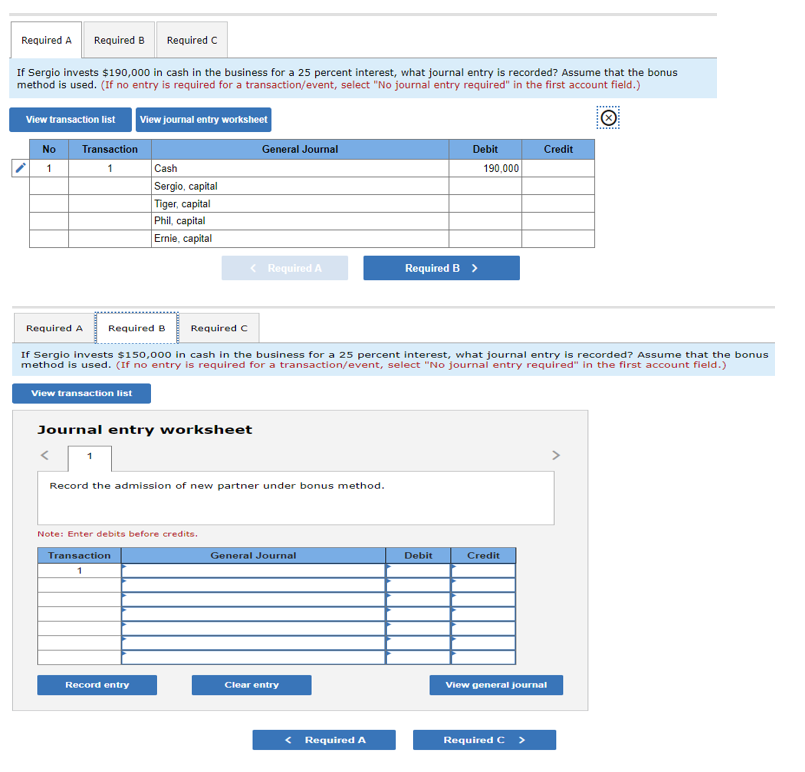

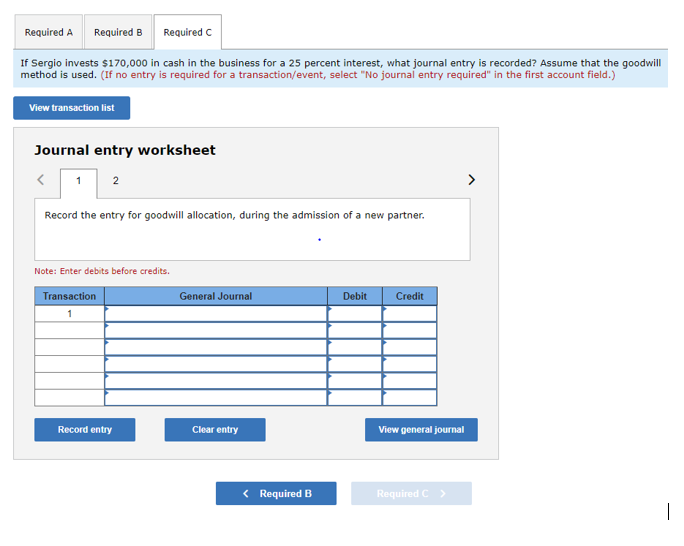

The Distance Plus partnership has the following capital balances at the beginning of the current year along with respective profit and loss percentages: Tiger (50%) Phil (30%) Ernie (20%) $ 175,000 145,000 160,000 Each of the following questions should be viewed independently. a. If Sergio invests $190,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the bonus method is used. b. If Sergio invests $150,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the bonus method is used. c. If Sergio invests $170,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the goodwill method is used. Required A Required B Required If Sergio invests $190,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the bonus method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Debit Credit 190,000 View transaction list View journal entry worksheet No Transaction General Journal 1 1 Cash Sergio, capital Tiger, capital Phil, capital Ernie, capital Required A Required B Required c If Sergio invests $150,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the bonus method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet > Record the admission of new partner under bonus method. Note: Enter debits before credits General Journal Debit Credit Transaction 1 Record entry Clear entry View general journal Required A Required B Required If Sergio invests $170,000 in cash in the business for a 25 percent interest, what journal entry is recorded? Assume that the goodwill method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for goodwill allocation, during the admission of a new partner. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal