Question

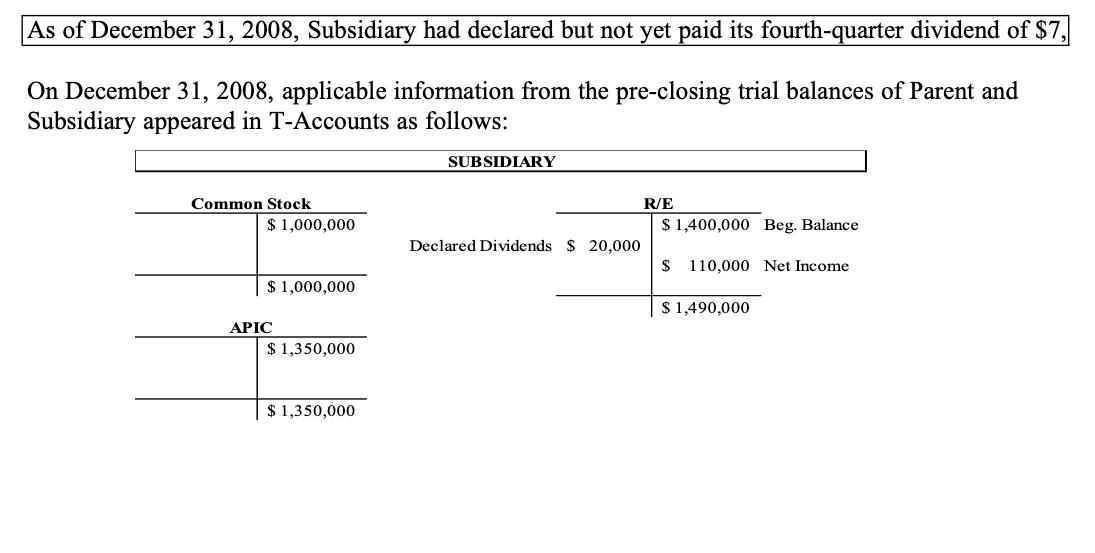

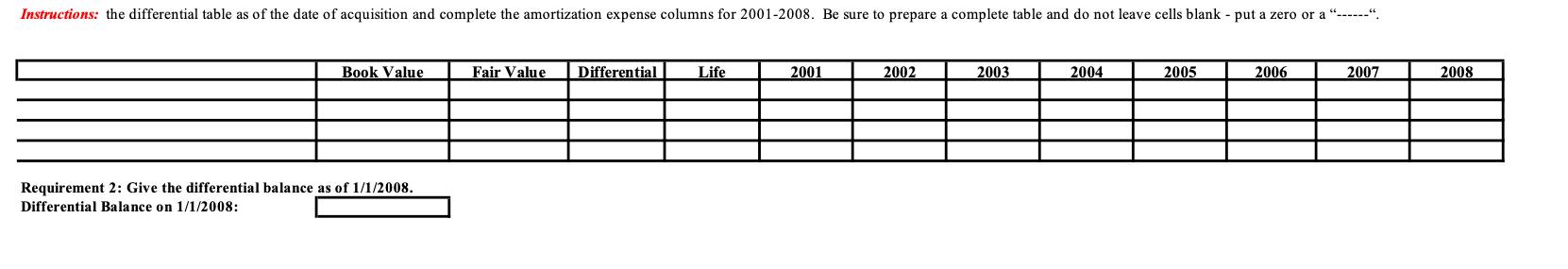

THE DIVIDEND THAT IS CUT OFF IS $7,000.00 AND THE DIFFERENTIAL TABLE CAN BE SEEN IF YOU SOON THE PAGE IN. I COULD NOT GET.

THE DIVIDEND THAT IS CUT OFF IS $7,000.00 AND THE DIFFERENTIAL TABLE CAN BE SEEN IF YOU SOON THE PAGE IN. I COULD NOT GET. LARGER FONT TO FIT WITHOUT CUTTING THE GRAPH IN HALF. IT WANTS THE DIFFERENTIAL OF 1/1/08.

THE LAST TABLES ARE FOR THE EQUITY AND ELIMINATING ENTIRES AS OF DECEMBER 31ST, 2008. ACCOUNT NAMES NOT PROVIDED.

Requirements:

1.) The differential table as of the date of acquisition and complete the amortization expense columns for 2001-2008.

2.) The differential balance as of 1/1/2008.

3.) All applicable equity method entries for the year ended, December 31, 2008.

4.) The elimination entries as of December 31, 2008.

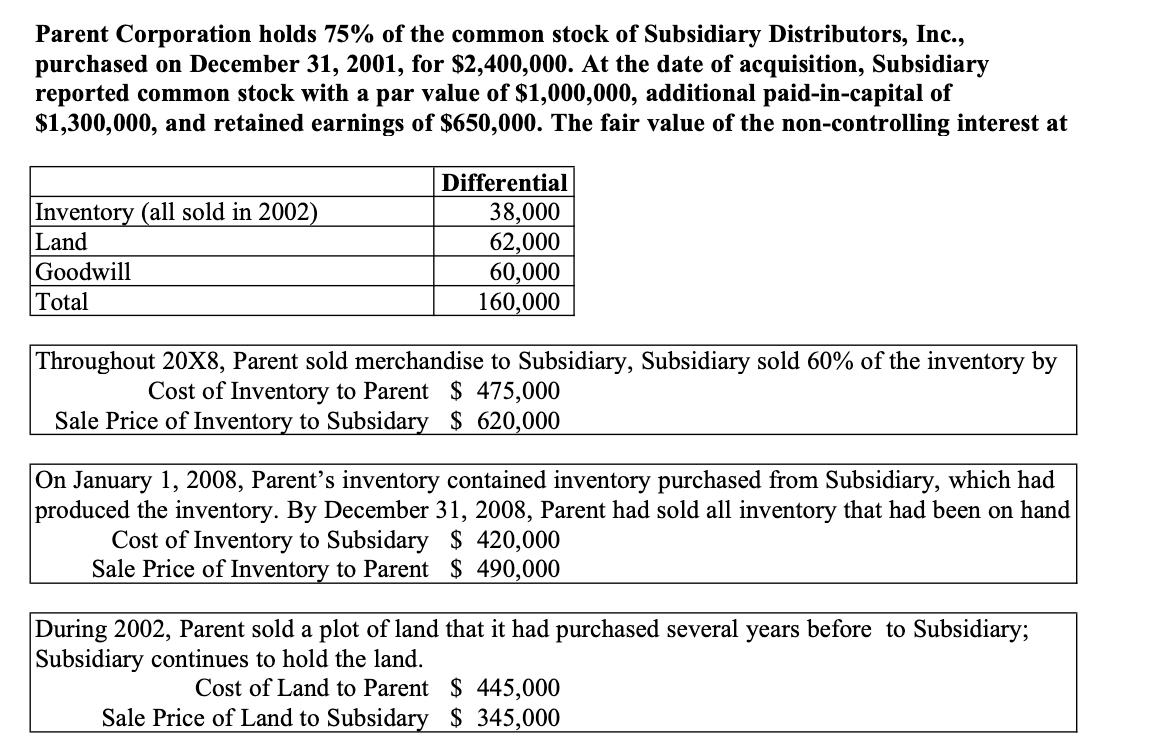

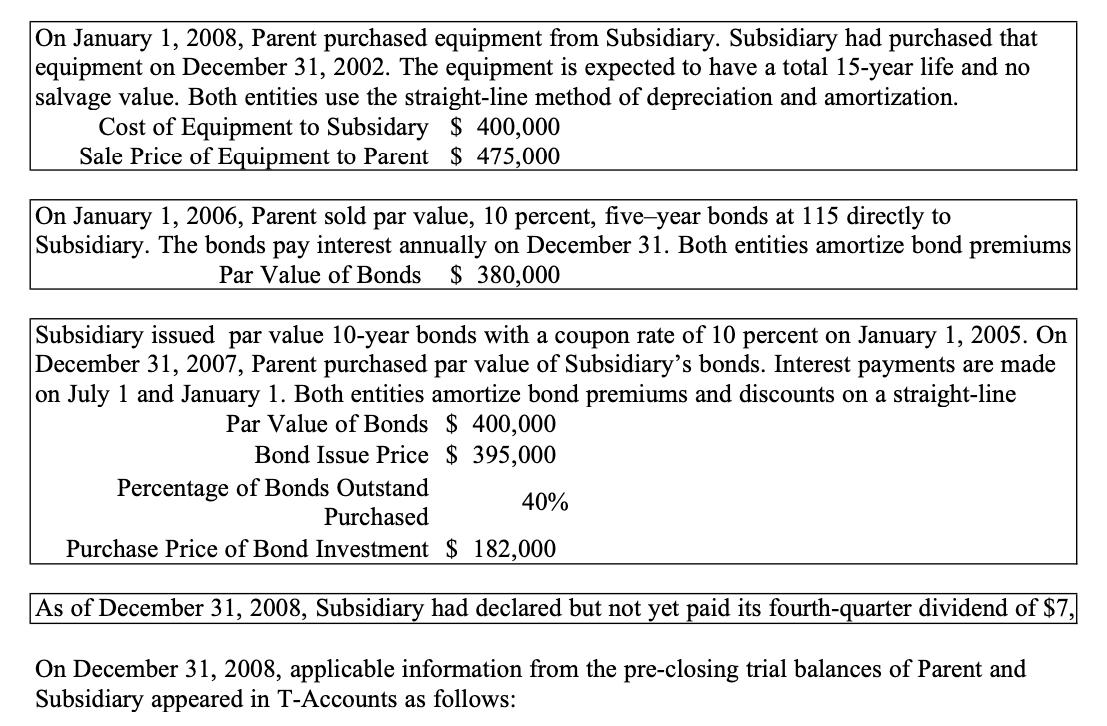

Parent Corporation holds 75% of the common stock of Subsidiary Distributors, Inc., purchased on December 31, 2001, for $2,400,000. At the date of acquisition, Subsidiary reported common stock with a par value of $1,000,000, additional paid-in-capital of $1,300,000, and retained earnings of $650,000. The fair value of the non-controlling interest at Inventory (all sold in 2002) Land Goodwill Total Differential 38,000 62,000 60,000 160,000 Throughout 20X8, Parent sold merchandise to Subsidiary, Subsidiary sold 60% of the inventory by Cost of Inventory to Parent $475,000 Sale Price of Inventory to Subsidary $ 620,000 On January 1, 2008, Parent's inventory contained inventory purchased from Subsidiary, which had produced the inventory. By December 31, 2008, Parent had sold all inventory that had been on hand Cost of Inventory to Subsidary $ 420,000 Sale Price of Inventory to Parent $ 490,000 During 2002, Parent sold a plot of land that it had purchased several years before to Subsidiary; Subsidiary continues to hold the land. Cost of Land to Parent $ 445,000 Sale Price of Land to Subsidary $ 345,000

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Given the provided information lets tackle each requirement step by step Requirement 1 The Differential Table as of the Date of Acquisition and Complete the Amortization Expense Columns for 20012008 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started