Question

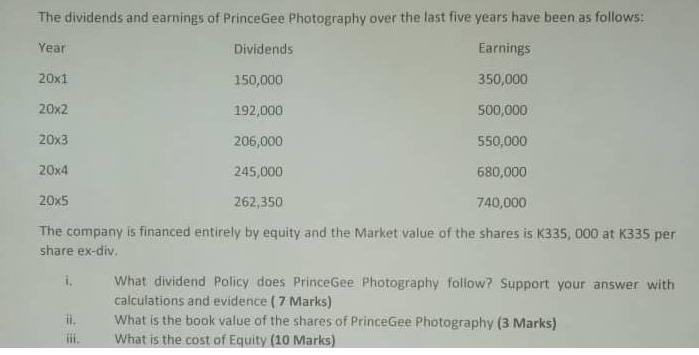

The dividends and earnings of PrinceGee Photography over the last five years have been as follows: Year Dividends Earnings 20x1 150,000 350,000 192,000 500,000

The dividends and earnings of PrinceGee Photography over the last five years have been as follows: Year Dividends Earnings 20x1 150,000 350,000 192,000 500,000 206,000 550,000 20x4 245,000 680,000 20x5 262,350 740,000 The company is financed entirely by equity and the Market value of the shares is K335, 000 at K335 per share ex-div. 20x2 20x3 ii. What dividend Policy does PrinceGee Photography follow? Support your answer with calculations and evidence (7 Marks) What is the book value of the shares of PrinceGee Photography (3 Marks) What is the cost of Equity (10 Marks)

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

i PrinceGee Photography follows a residual dividend policy This is the policy of a company to pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

13th Edition

978-0134083308, 013408330X

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App