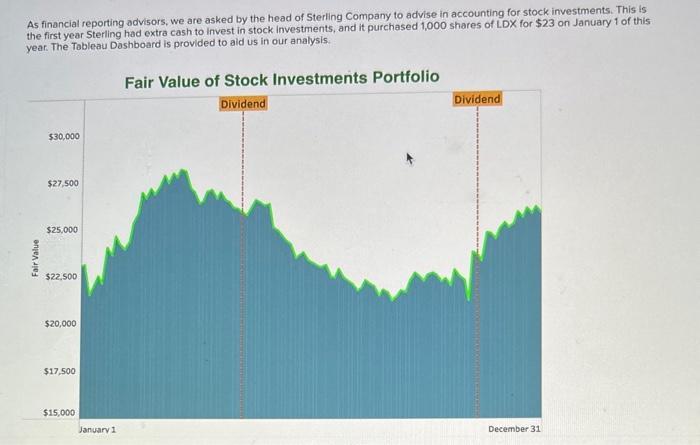

The dividends are at $1.00 and $1.15, respectively. As financial reporting advisors, we are asked by the head of Sterling Company to advise in accounting

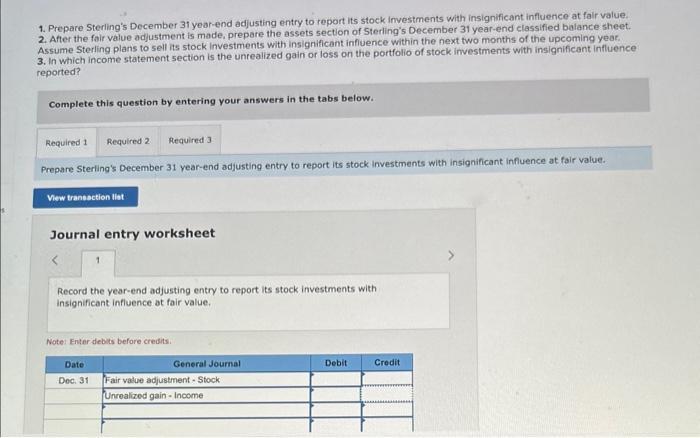

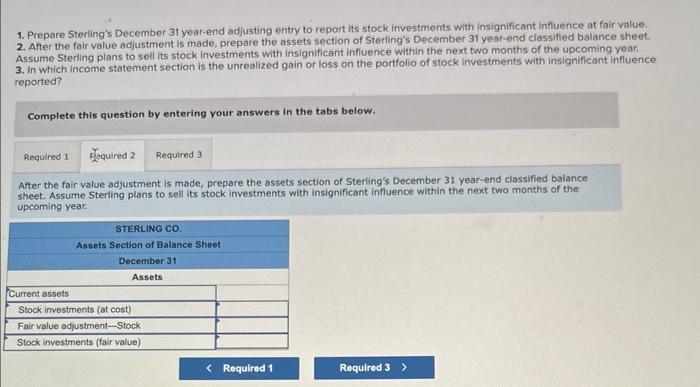

As financial reporting advisors, we are asked by the head of Sterling Company to advise in accounting for stock investments. This is the first year Sterling had extra cash to invest in stock investments, and it purchased 1,000 shares of LDX for $23 on January 1 of this year. The Tableau Dashboard is provided to aid us in our analysis. Fair Value $30,000 $27,500 $25,000 $22,500 $20,000 $17,500 $15,000 January 1 Fair Value of Stock Investments Portfolio Dividend Dividend December 31

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started