Question

Provide the following analyses pertaining to a portfolio comprised of common stock issued by Microsoft Corporation and common stock issued by The Coca-Cola Company (you

Provide the following analyses pertaining to a portfolio comprised of common stock issued by Microsoft Corporation and common stock issued by The Coca-Cola Company (you will need additional data provided on finance.yahoo.com—in the "Get Quotes" box, type in "MSFT" and "KO"). Be sure to state any additional assumptions upfront, and to print out, highlight, and hand in all relevant information that you use to calculate your answers so that I can quickly follow where your numbers are coming from. In your calculations below, assume that the annual risk-free rate is rf=2%.

Part 1: Estimate the Market Risk Premium

Estimate the (annual) market risk premium using the five-year time series of monthly pricing data from October 2012 through October 2017 (inclusive). Use the S&P500 Composite Index as your proxy for the "market" (in the "Get Quotes" box type "^GSPC").

The monthly closing prices are provided under the "historical prices" tab. From here, you can calculate monthly stock returns. The prices reported here are adjusted prices—which means stock splits and dividend payments have already been factored in such that you need only to calculate the percentage change in these 'adjusted' prices to derive the stock returns.

Part 2: Calculate Portfolio Expected Return and Historical Volatility

Suppose you invest half of your wealth in MSFT and the other half in KO.

1. Assuming that CAPM holds, what is the annual expected return on your portfolio?

Based on the five‐year period spanning October 2012 through October 2017.

2. What is the annualized historical volatility of your portfolio returns?

3. What is the annualized average return?

4. What is the realized return on your investment if you purchased this portfolio on the first trading day of October 2012 and sold it on the last trading day of October 2017?

Part 3: Calculate Betas

Try estimating beta yourself (for both MSFT and KO) using the five-year time series of monthly stock returns from October 2012 through October 2017 (inclusive).

Recall that a stock's beta is calculated as: the covariance between its excess returns and excess market returns (for simplicity, you can just use S&P 500 index returns), divided by the variance of excess market returns.

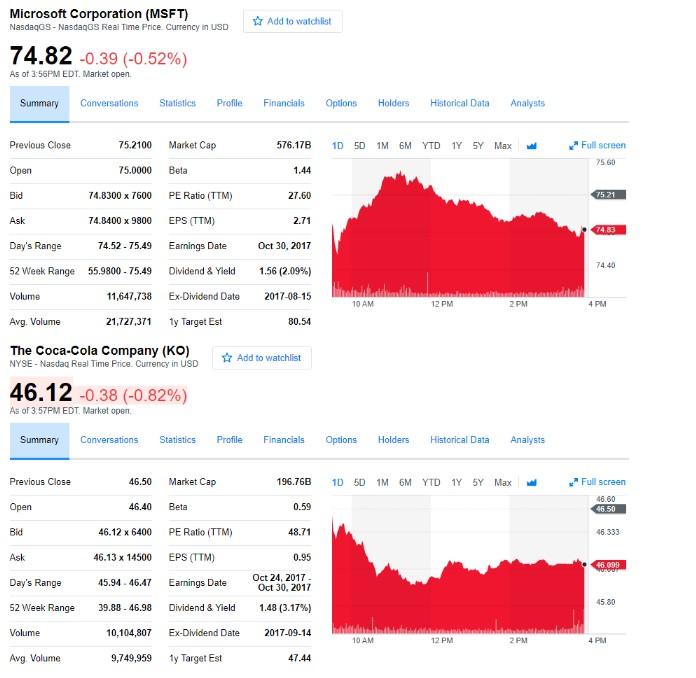

Microsoft Corporation (MSFT) NasdaqGS- NasdaqGS Real Time Price Currency in USD 74.82 -0.39 (-0.52%) As of 3:56PM EDT. Market open Summary Conversations Previous Close Open Bid Ask Summary Previous Close Open Bid Ask Day's Range 52 Week Range 75.2100 Volume 75.0000 74.8300 x 7600 Avg Volume 74.8400 x 9800 Day's Range 52 Week Range Volume Avg. Volume The Coca-Cola Company (KO) NYSE - Nasdaq Real Time Price. Currency in USD 74.52-75.49 55.9800-75.49 11,647,738 21,727,371 46.12 -0.38 (-0.82%) As of 3.57PM EDT. Market open Conversations 46.40 46.12 x 6400 Statistics Profile 46.13 x 14500 Market Cap 45.94-46.47 Beta 46.50 Market Cap PE Ratio (TTM) EPS (TTM) Earnings Date Dividend & Yield Ex-Dividend Date 1y Target Est 39.88-46.98 Statistics Profile Beta PE Ratio (TTM) EPS (TTM) Earnings Date Dividend & Yield 10,104,807 Ex-Dividend Date 9,749,959 1y Target Est Add to watchlist Financials Options Holders 1.44 576.17B 1D 50 1M 6M YTD 1Y SY Max w 27.60 2.71 Oct 30, 2017 1.56 (2.09%) 2017-08-15 Add to watchlist 80.54 Financials 196.76B 0.59 48.71 0.95 Oct 24, 2017 - Oct 30, 2017 1.48 (3.17%) 2017-09-14 47.44 10 AM Options Holders Historical Data 10 AM 12 PM Historical Data Analysts 12 PM 2PM 1D 5D 1M 6M YTD 1Y 5Y Max val Analysts 2PM Full screen 75.60 75.21 74.83 74.40 4 PM Full screen 46.60 46.50 46.333 46.099 40:00P 45.80 4 PM

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Part 1 Estimate the Market Risk Premium To estimate the market risk premium we need to calculate the excess return of the market over the riskfree rate and then calculate the standard deviation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started