Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Dow Jones Industrial Average is an index of 30 of the largest stocks in America. The object of this problem is to find mean-variance

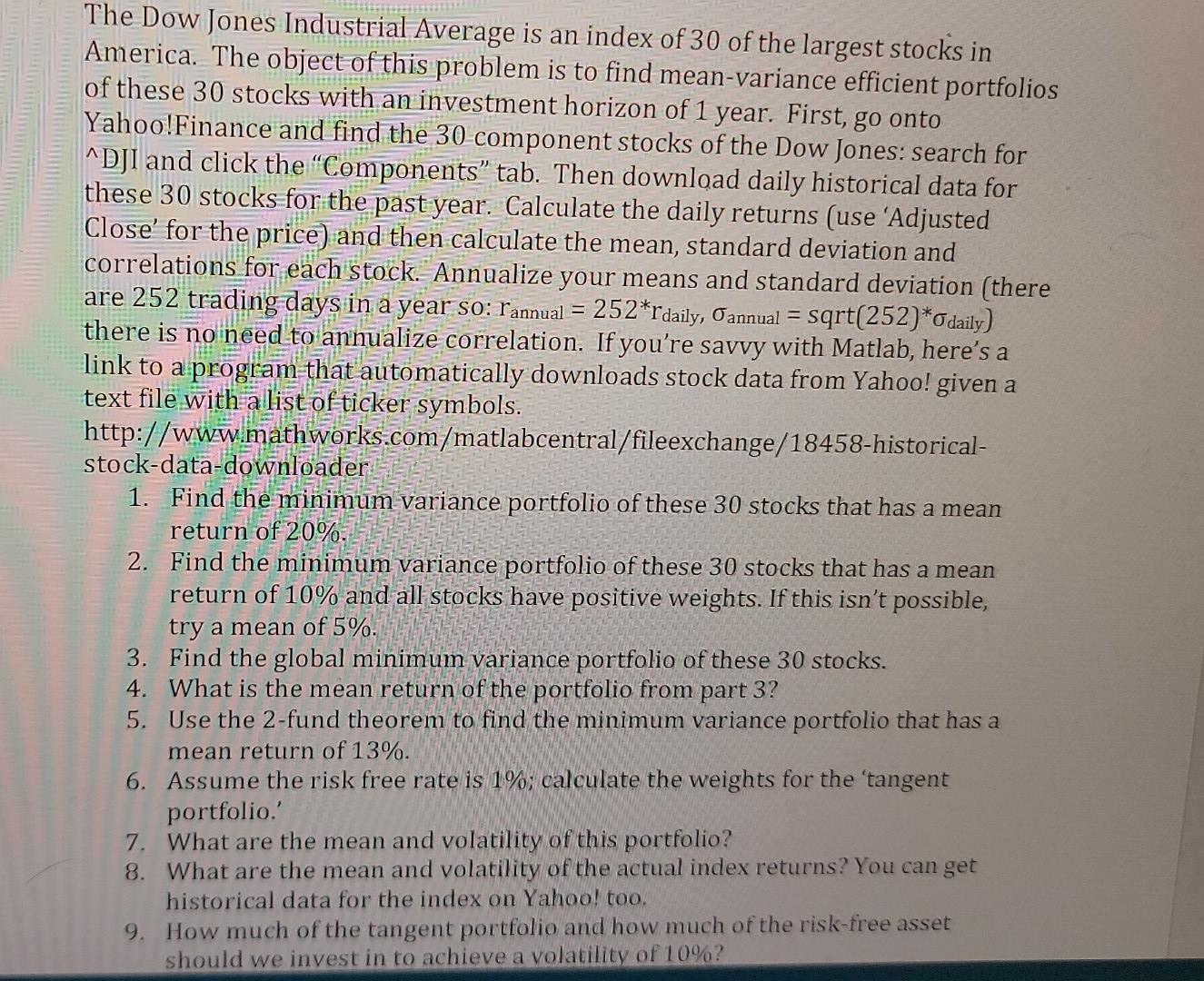

The Dow Jones Industrial Average is an index of 30 of the largest stocks in America. The object of this problem is to find mean-variance efficient portfolios of these 30 stocks with an investment horizon of 1 year. First, go onto Yahoo!Finance and find the 30 component stocks of the Dow Jones: search for ^DJI and click the "Components tab. Then download daily historical data for these 30 stocks for the past year. Calculate the daily returns (use 'Adjusted Close' for the price) and then calculate the mean, standard deviation and correlations for each stock. Annualize your means and standard deviation (there are 252 trading days in a year so: rannual = 252*rdaily, annual = sqrt(252) *Odaily) a there is no need to annualize correlation. If you're savvy with Matlab, here's a link to a program that automatically downloads stock data from Yahoo! given a text file with a list of ticker symbols. http://www.mathworks.com/matlabcentral/fileexchange/18458-historical- stock-data-downloader 1. Find the minimum variance portfolio of these 30 stocks that has a mean return of 20%. 2. Find the minimum variance portfolio of these 30 stocks that has a mean return of 10% and all stocks have positive weights. If this isn't possible, try a mean of 5%. 3. Find the global minimum variance portfolio of these 30 stocks. 4. What is the mean return of the portfolio from part 3? 5. Use the 2-fund theorem to find the minimum variance portfolio that has a mean return of 13%. 6. Assume the risk free rate is 1%; calculate the weights for the 'tangent portfolio.' 7. What are the mean and volatility of this portfolio? 8. What are the mean and volatility of the actual index returns? You can get historical data for the index on Yahoo! too. 9. How much of the tangent portfolio and how much of the risk-free asset should we invest in to achieve a volatility of 10%? The Dow Jones Industrial Average is an index of 30 of the largest stocks in America. The object of this problem is to find mean-variance efficient portfolios of these 30 stocks with an investment horizon of 1 year. First, go onto Yahoo!Finance and find the 30 component stocks of the Dow Jones: search for ^DJI and click the "Components tab. Then download daily historical data for these 30 stocks for the past year. Calculate the daily returns (use 'Adjusted Close' for the price) and then calculate the mean, standard deviation and correlations for each stock. Annualize your means and standard deviation (there are 252 trading days in a year so: rannual = 252*rdaily, annual = sqrt(252) *Odaily) a there is no need to annualize correlation. If you're savvy with Matlab, here's a link to a program that automatically downloads stock data from Yahoo! given a text file with a list of ticker symbols. http://www.mathworks.com/matlabcentral/fileexchange/18458-historical- stock-data-downloader 1. Find the minimum variance portfolio of these 30 stocks that has a mean return of 20%. 2. Find the minimum variance portfolio of these 30 stocks that has a mean return of 10% and all stocks have positive weights. If this isn't possible, try a mean of 5%. 3. Find the global minimum variance portfolio of these 30 stocks. 4. What is the mean return of the portfolio from part 3? 5. Use the 2-fund theorem to find the minimum variance portfolio that has a mean return of 13%. 6. Assume the risk free rate is 1%; calculate the weights for the 'tangent portfolio.' 7. What are the mean and volatility of this portfolio? 8. What are the mean and volatility of the actual index returns? You can get historical data for the index on Yahoo! too. 9. How much of the tangent portfolio and how much of the risk-free asset should we invest in to achieve a volatility of 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started