Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the down payment that is saved up is 50,000 there is no loan amount that was given, i think thats why we had the mortgage

the down payment that is saved up is 50,000

the down payment that is saved up is 50,000 there is no loan amount that was given, i think thats why we had the mortgage calculator to find it out

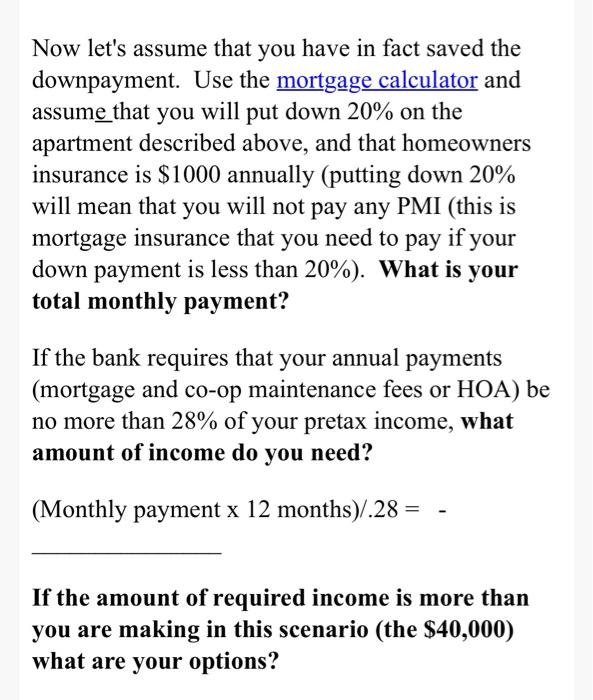

Now let's assume that you have in fact saved the downpayment. Use the mortgage calculator and assume that you will put down 20% on the apartment described above, and that homeowners insurance is $1000 annually (putting down 20% will mean that you will not pay any PMI (this is mortgage insurance that you need to pay if your down payment is less than 20%). What is your total monthly payment? If the bank requires that your annual payments (mortgage and co-op maintenance fees or HOA) be no more than 28% of your pretax income, what amount of income do you need? (Monthly payment x 12 months)/.28 = If the amount of required income is more than you are making in this scenario (the $40,000) what are your options? Now let's assume that you have in fact saved the downpayment. Use the mortgage calculator and assume that you will put down 20% on the apartment described above, and that homeowners insurance is $1000 annually (putting down 20% will mean that you will not pay any PMI (this is mortgage insurance that you need to pay if your down payment is less than 20%). What is your total monthly payment? If the bank requires that your annual payments (mortgage and co-op maintenance fees or HOA) be no more than 28% of your pretax income, what amount of income do you need? (Monthly payment x 12 months)/.28 = If the amount of required income is more than you are making in this scenario (the $40,000) what are your options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started