Answered step by step

Verified Expert Solution

Question

1 Approved Answer

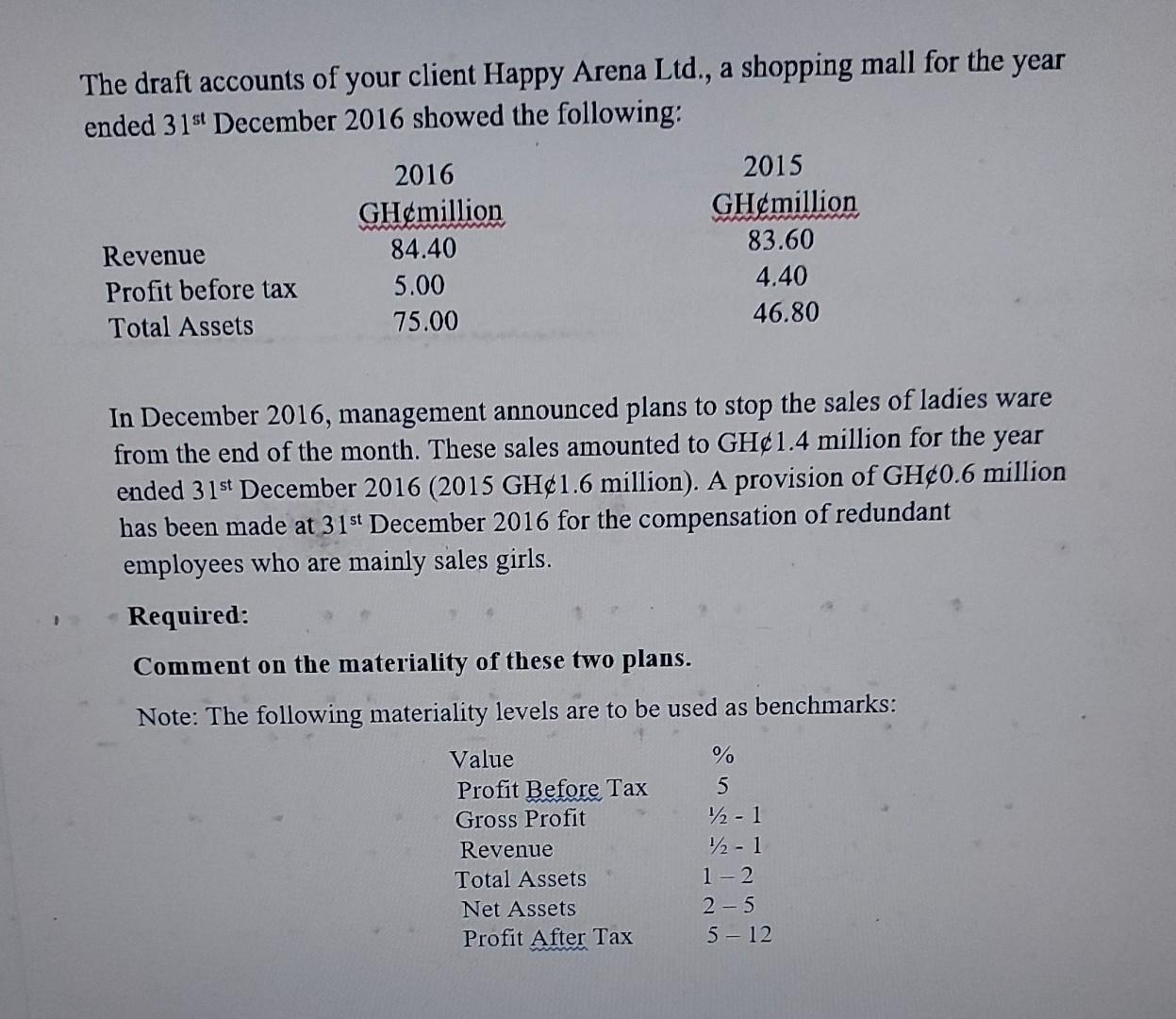

The draft accounts of your client Happy Arena Ltd., a shopping mall for the year ended 31st December 2016 showed the following: 2016 2015

The draft accounts of your client Happy Arena Ltd., a shopping mall for the year ended 31st December 2016 showed the following: 2016 2015 GHemillion GHemillion 84.40 83.60 Revenue Profit before tax 5.00 4.40 Total Assets 75.00 46.80 In December 2016, management announced plans to stop the sales of ladies ware from the end of the month. These sales amounted to GH1.4 million for the year ended 31st December 2016 (2015 GH1.6 million). A provision of GH0.6 million has been made at 31st December 2016 for the compensation of redundant employees who are mainly sales girls. Required: Comment on the materiality of these two plans. Note: The following materiality levels are to be used as benchmarks: Value % Profit Before Tax Gross Profit 2 - 1 2 - 1 1- 2 2- 5 5 - 12 Revenue Total Assets Net Assets Profit After Tax

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Particulars 2016 million 2015 million Revenue 8440 8360 Profit before tax 5 440 Total assets 75 4680 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started