Answered step by step

Verified Expert Solution

Question

1 Approved Answer

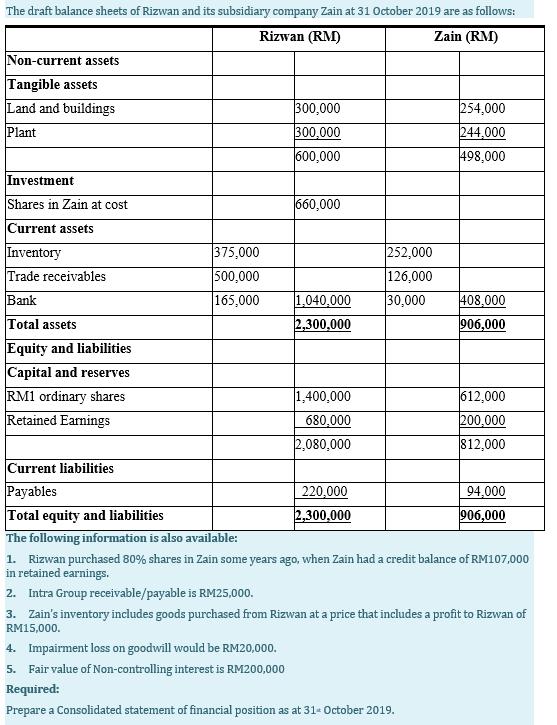

The draft balance sheets of Rizwan and its subsidiary company Zain at 31 October 2019 are as follows: Rizwan (RM) Zain (RM) Non-current assets

The draft balance sheets of Rizwan and its subsidiary company Zain at 31 October 2019 are as follows: Rizwan (RM) Zain (RM) Non-current assets Tangible assets Land and buildings Plant Investment Shares in Zain at cost Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Capital and reserves RM1 ordinary shares Retained Earnings 375,000 500,000 165,000 300,000 300,000 600,000 660,000 1,040,000 2,300,000 1,400,000 680,000 2,080,000 252,000 126,000 30,000 220,000 2,300,000 254,000 244,000 498,000 408,000 906,000 Current liabilities Payables Total equity and liabilities The following information is also available: 1. Rizwan purchased 80% shares in Zain some years ago, when Zain had a credit balance of RM107,000 in retained earnings. 2. Intra Group receivable/payable is RM25,000. 4. Impairment loss on goodwill would be RM20,000. 5. Fair value of Non-controlling interest is RM200,000 Required: Prepare a Consolidated statement of financial position as at 31 - October 2019. 612,000 200,000 812,000 94,000 906,000 3. Zain's inventory includes goods purchased from Rizwan at a price that includes a profit to Rizwan of RM15,000.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

C onsolidated Statement of Financial Position of RIZWAN Ltd as at 31 October 2019 Amount in RM Non Current assets Tangible Assets Land Building 300000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started