Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The draft financial statements for Candelle plc for the year to December 31 2016 are being prepared and the accountant had asked your advice

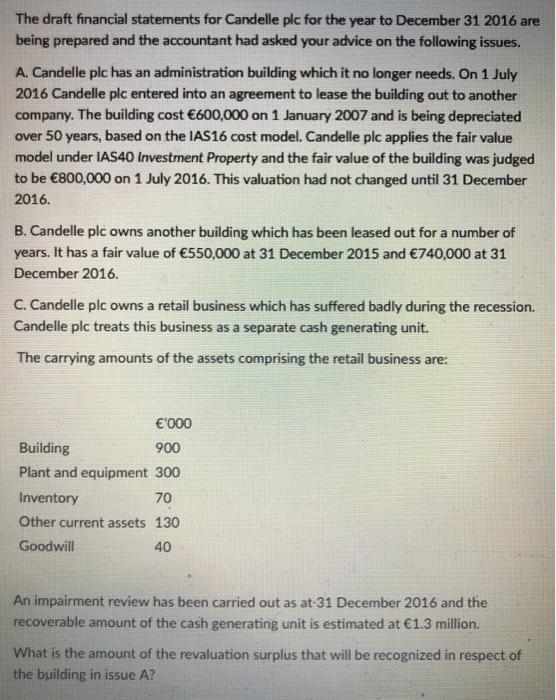

The draft financial statements for Candelle plc for the year to December 31 2016 are being prepared and the accountant had asked your advice on the following issues. A. Candelle plc has an administration building which it no longer needs. On 1 July 2016 Candelle plc entered into an agreement to lease the building out to another company. The building cost 600,000 on 1 January 2007 and is being depreciated over 50 years, based on the IAS16 cost model. Candelle plc applies the fair value model under IAS40 Investment Property and the fair value of the building was judged to be 800,000 on 1 July 2016. This valuation had not changed until 31 December 2016. B. Candelle plc owns another building which has been leased out for a number of years. It has a fair value of 550,000 at 31 December 2015 and 740,000 at 31 December 2016. C. Candelle plc owns a retail business which has suffered badly during the recession. Candelle plc treats this business as a separate cash generating unit. The carrying amounts of the assets comprising the retail business are: '000 Building 900 Plant and equipment 300 Inventory 70 Other current assets 130 Goodwill 40 An impairment review has been carried out as at-31 December 2016 and the recoverable amount of the cash generating unit is estimated at 1.3 million. What is the amount of the revaluation surplus that will be recognized in respect of the building in issue A?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Note All the numbers to be considered as There are three steps to focus on before solving this quest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started