Answered step by step

Verified Expert Solution

Question

1 Approved Answer

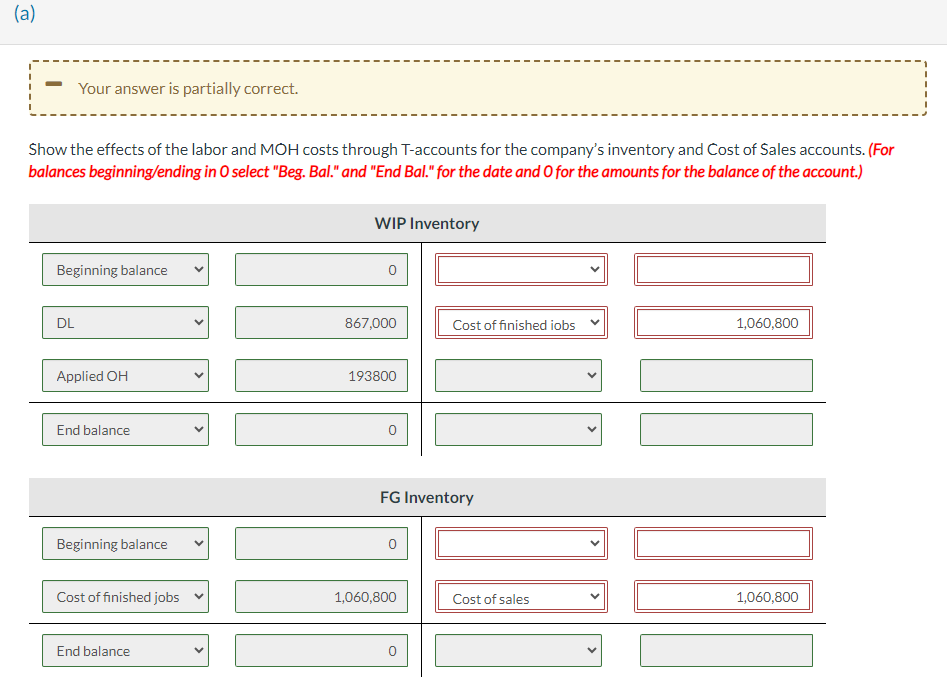

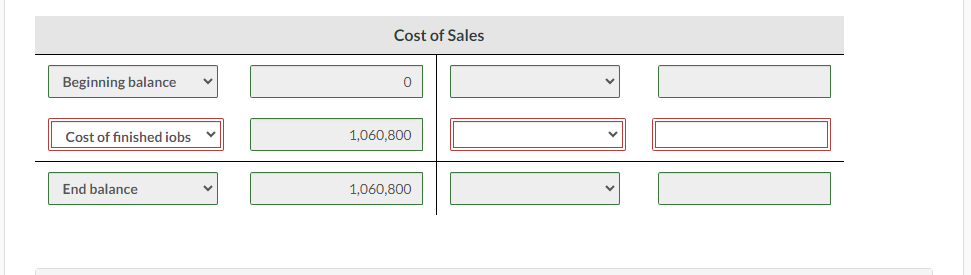

THE DROP DOWN OPTIONS FOR A) ARE APPLIED OH, BEGINNING BALANCE, COST OF FINISHED JOBS, COST OF SALES, DEPRECIATION, DL, DM USED, END BALANCE, PURCHASES

THE DROP DOWN OPTIONS FOR A) ARE APPLIED OH, BEGINNING BALANCE, COST OF FINISHED JOBS, COST OF SALES, DEPRECIATION, DL, DM USED, END BALANCE, PURCHASES

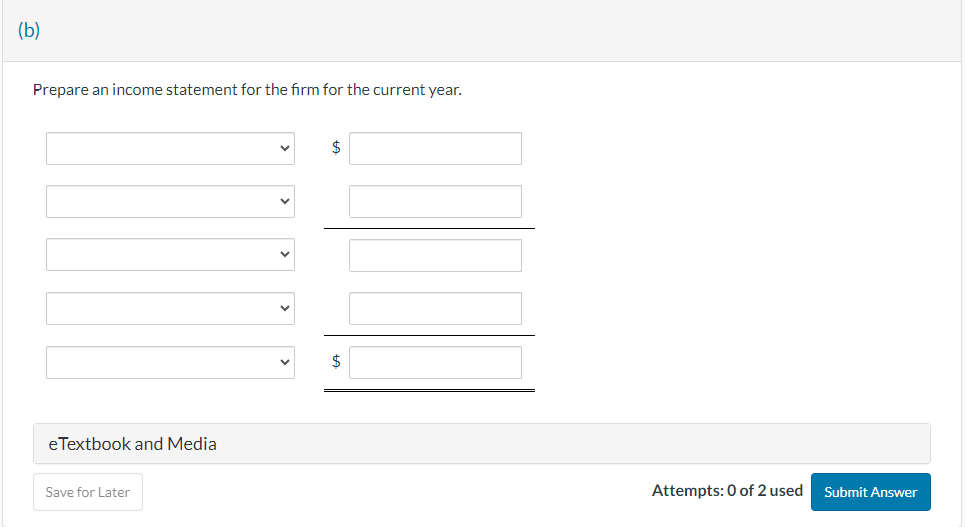

THE DROP DOWN OPTIONS FOR B) ARE DM USED, COST OF SALES, SALES, GROSS PROFIT, SG&A EXPENSES, DL, MOH APPLIED, OPERATING INCOME/LOSS

BOXES HIGHLIGHTED IN RED ARE INCORRECT

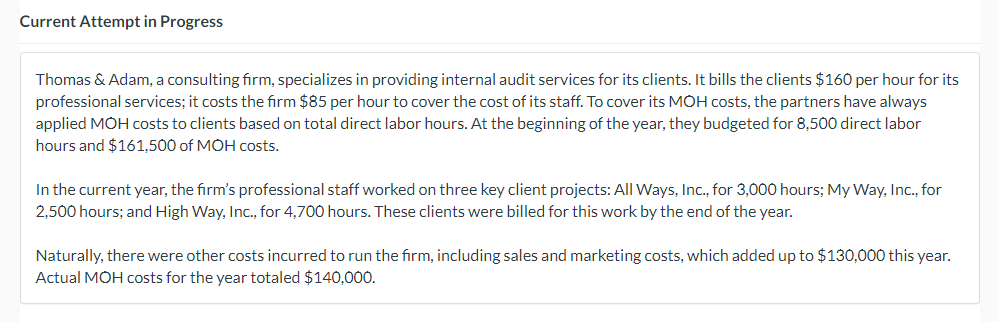

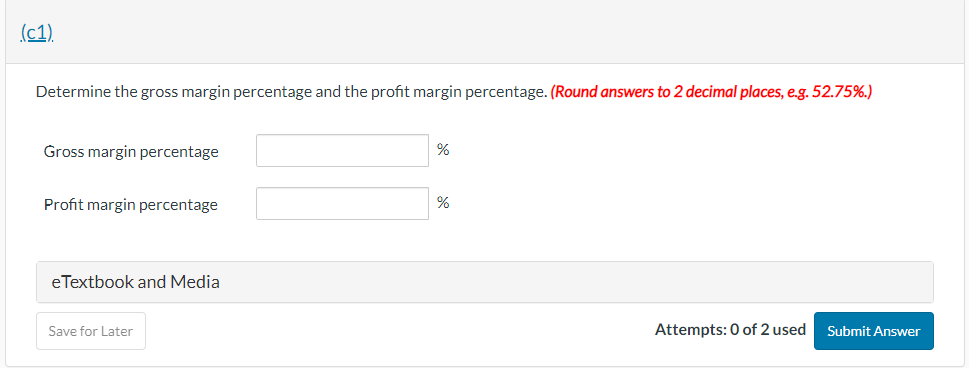

Thomas \& Adam, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $160 per hour for its professional services; it costs the firm $85 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 8,500 direct labor hours and $161,500 of MOH costs. In the current year, the firm's professional staff worked on three key client projects: All Ways, Inc., for 3,000 hours; My Way, Inc., for 2,500 hours; and High Way, Inc., for 4,700 hours. These clients were billed for this work by the end of the year. Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $130,000 this year. Actual MOH costs for the year totaled $140,000. Show the effects of the labor and MOH costs through T-accounts for the company's inventory and Cost of Sales accounts. (For balances beginning/ending in 0 select "Beg. Bal." and "End Bal." for the date and 0 for the amounts for the balance of the account.) Prepare an income statement for the firm for the current year. Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75\%.) Gross margin percentage % Profit margin percentage % Thomas \& Adam, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $160 per hour for its professional services; it costs the firm $85 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 8,500 direct labor hours and $161,500 of MOH costs. In the current year, the firm's professional staff worked on three key client projects: All Ways, Inc., for 3,000 hours; My Way, Inc., for 2,500 hours; and High Way, Inc., for 4,700 hours. These clients were billed for this work by the end of the year. Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $130,000 this year. Actual MOH costs for the year totaled $140,000. Show the effects of the labor and MOH costs through T-accounts for the company's inventory and Cost of Sales accounts. (For balances beginning/ending in 0 select "Beg. Bal." and "End Bal." for the date and 0 for the amounts for the balance of the account.) Prepare an income statement for the firm for the current year. Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75\%.) Gross margin percentage % Profit margin percentage %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started