Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The duration of a bond is defined as the weighted average maturity of its cash flows, with the weights proportional to the present values

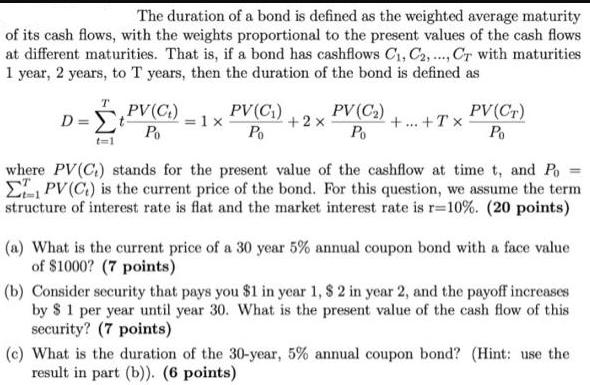

The duration of a bond is defined as the weighted average maturity of its cash flows, with the weights proportional to the present values of the cash flows at different maturities. That is, if a bond has cashflows C1, C2, ..., CT with maturities 1 year, 2 years, to T years, then the duration of the bond is defined as T PV(C) Po D=t t=1 = 1 x PV (C) Po +2x PV (C) Po + ... +Tx PV (CT) Po where PV(C) stands for the present value of the cashflow at time t, and Po EL PV (C) is the current price of the bond. For this question, we assume the term structure of interest rate is flat and the market interest rate is r=10%. (20 points) (a) What is the current price of a 30 year 5% annual coupon bond with a face value of $1000? (7 points) (b) Consider security that pays you $1 in year 1, $ 2 in year 2, and the payoff increases by $1 per year until year 30. What is the present value of the cash flow of this security? (7 points) (c) What is the duration of the 30-year, 5% annual coupon bond? (Hint: use the result in part (b)). (6 points)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started