Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carlson Inc. is evaluating a project in India that would require a $5.5 million after-tax investment today (t = 0). The after-tax cash flows

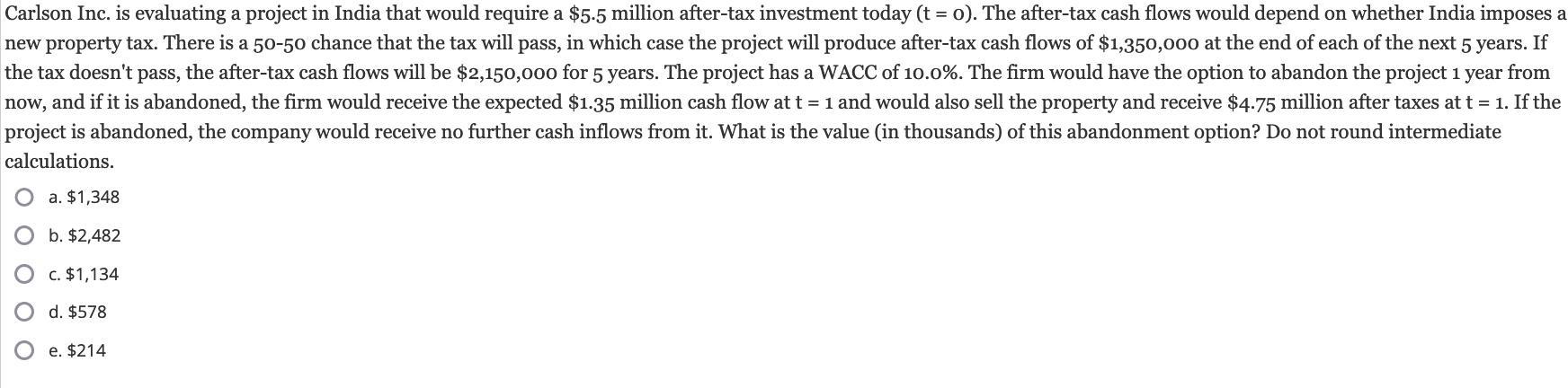

Carlson Inc. is evaluating a project in India that would require a $5.5 million after-tax investment today (t = 0). The after-tax cash flows would depend on whether India imposes a new property tax. There is a 50-50 chance that the tax will pass, in which case the project will produce after-tax cash flows of $1,350,000 at the end of each of the next 5 years. If the tax doesn't pass, the after-tax cash flows will be $2,150,000 for 5 years. The project has a WACC of 10.0%. The firm would have the option to abandon the project 1 year from now, and if it is abandoned, the firm would receive the expected $1.35 million cash flow at t = 1 and would also sell the property and receive $4.75 million after taxes at t = 1. If the project is abandoned, the company would receive no further cash inflows from it. What is the value (in thousands) of this abandonment option? Do not round intermediate calculations. a. $1,348 Ob. $2,482 c. $1,134 d. $578 Oe. $214

Step by Step Solution

★★★★★

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

DL123 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started