Answered step by step

Verified Expert Solution

Question

1 Approved Answer

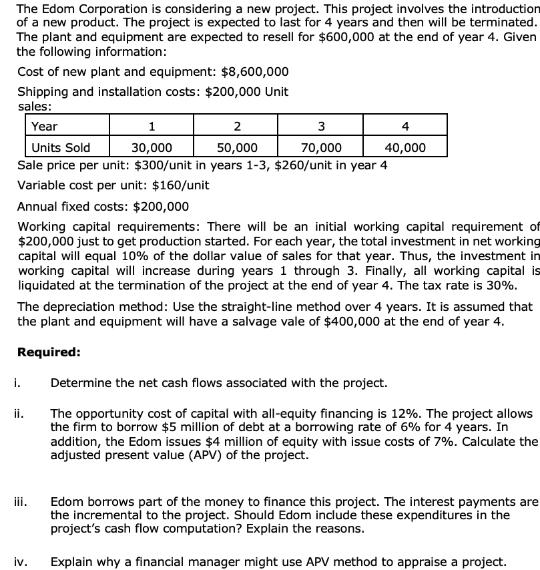

The Edom Corporation is considering a new project. This project involves the introduction of a new product. The project is expected to last for

![4. A company decided to manufacture computer accessories at their production facilities. They [10] have well](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/6452242aadc6e_1683104808480.jpg)

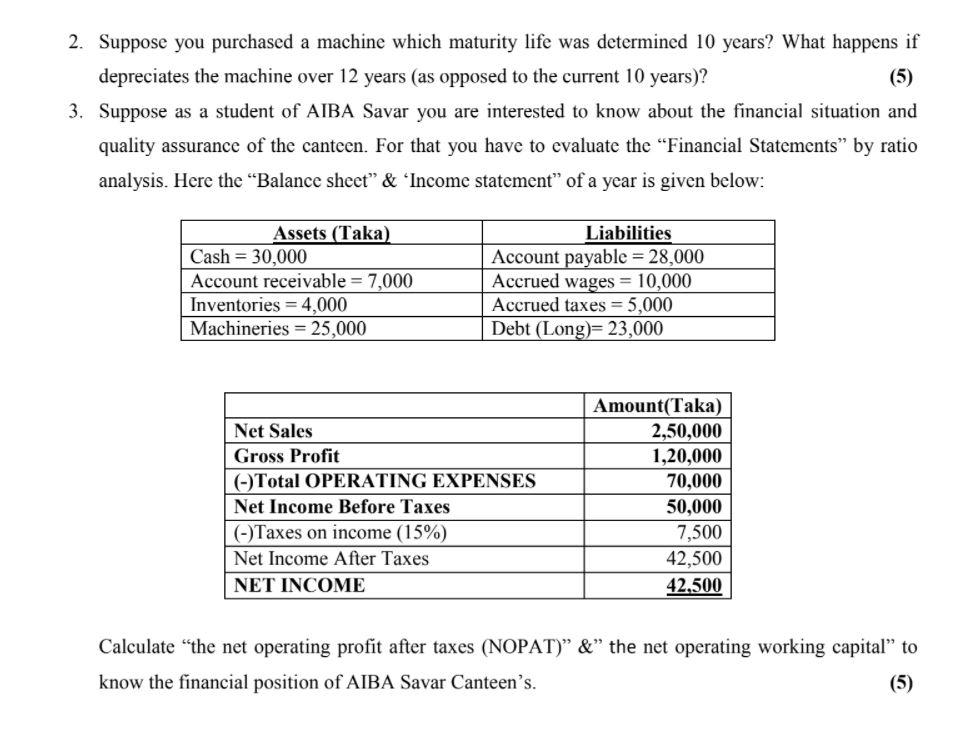

The Edom Corporation is considering a new project. This project involves the introduction of a new product. The project is expected to last for 4 years and then will be terminated. The plant and equipment are expected to resell for $600,000 at the end of year 4. Given the following information: Cost of new plant and equipment: $8,600,000 Shipping and installation costs: $200,000 Unit sales: Year 1 2 Units Sold 30,000 50,000 Sale price per unit: $300/unit in years 1-3, $260/unit in year 4 Variable cost per unit: $160/unit Annual fixed costs: $200,000 Working capital requirements: There will be an initial working capital requirement of $200,000 just to get production started. For each year, the total investment in net working capital will equal 10% of the dollar value of sales for that year. Thus, the investment in working capital will increase during years 1 through 3. Finally, all working capital is liquidated at the termination of the project at the end of year 4. The tax rate is 30%. 1. The depreciation method: Use the straight-line method over 4 years. It is assumed that the plant and equipment will have a salvage vale of $400,000 at the end of year 4. Required: ii. 3 70,000 iii. 4 40,000 iv. Determine the net cash flows associated with the project. The opportunity cost of capital with all-equity financing is 12%. The project allows the firm to borrow $5 million of debt at a borrowing rate of 6% for 4 years. In addition, the Edom issues $4 million of equity with issue costs of 7%. Calculate the adjusted present value (APV) of the project. Edom borrows part of the money to finance this project. The interest payments are the incremental to the project. Should Edom include these expenditures in the project's cash flow computation? Explain the reasons. Explain why a financial manager might use APV method to appraise a project. 2. Suppose you purchased a machine which maturity life was determined 10 years? What happens if depreciates the machine over 12 years (as opposed to the current 10 years)? (5) 3. Suppose as a student of AIBA Savar you are interested to know about the financial situation and quality assurance of the canteen. For that you have to evaluate the "Financial Statements" by ratio analysis. Here the "Balance sheet" & "Income statement" of a year is given below: Assets (Taka) Cash = 30,000 Account receivable = 7,000 Inventories = 4,000 Machineries = 25,000 Liabilities Account payable = 28,000 Accrued wages = 10,000 Accrued taxes = 5,000 Debt (Long)= 23,000 Net Sales Gross Profit (-)Total OPERATING EXPENSES Net Income Before Taxes (-)Taxes on income (15%) Net Income After Taxes NET INCOME Amount(Taka) 2,50,000 1,20,000 70,000 50,000 7,500 42,500 42,500 Calculate "the net operating profit after taxes (NOPAT)" &" the net operating working capital" to know the financial position of AIBA Savar Canteen's. (5) 4. A company decided to manufacture computer accessories at their production facilities. They [10] have well facilitated and equipped production plant in 3 areas. They want to analyze meticulously where there production cost will reach the break-even point fast. Thus, they write down detail cost structure of three different areas, are as follows: location Dhaka Chottogram Khulna Fixed cost 4,00,000 3,00,000 2,00,000 Variable cost (Unit) 300 250 250 Now, they have hired you to calculate the BEP for each location. For your clarity, they provide you hypothetical production unit of 5,000 unit and 20,000. These two value will help you to compare the cost pattern. Instructions: Which range of production volume is more suitable for each location? Which one of the three is the best location at a production of 9,000 units?

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

i Net Cash Flows Calculation Initial Investment Cost of new plant and equipment 8600000 Shipping and installation costs 200000 Initial working capital requirement 200000 Initial Investment 86000002000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started