Question

The effective tax rate is 20% on all items. Ayayai prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock

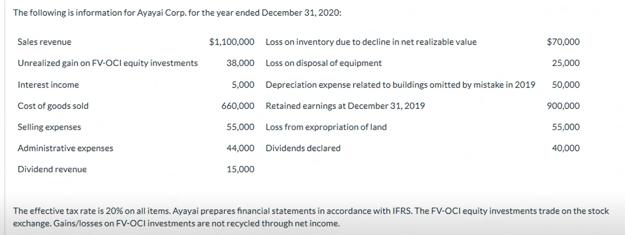

The effective tax rate is 20% on all items. Ayayai prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income.

Prepare a multiple-step statement of financial performance for 2020, showing expenses by function. Ignore calculation of EPS.

Prepare the retained earnings section of the statement of changes in equity for 2020. (List items that increase retained earnings first following the adjustment of prior years.)

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The multiplestep statement of financial performance for 2020 is described at the table below Sales R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting Standards An Introduction

Authors: Belverd E. Needles, Marian Powers

3rd Edition

1133187943, 978-1133187943

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App