Question

The EH Logistics CFO advises you that MS Incorporated have pledged to only use the services of suppliers and distributors that meet its sustainability guidelines,

The EH Logistics CFO advises you that MS Incorporated have pledged to only use the services of suppliers and distributors that meet its sustainability guidelines, which includes a requirement that packaging be comprised of at least 90% recycled materials. EH Logistics currently uses packaging that is comprised of 50% recycled materials. The date from which MS plan this change to take effect is exactly five years after the planned commencement of the investment. The CFO asks you to reconsider the two investment options and determine how this new requirement would impact your recommendation.

? To meet the requirements, for the labour intensive option there will be an increased in fixed cost $100,000 each year from year 5 to source suitable packaging materials.

?To meet the requirements for the capital intensive option, the old machinery will be traded in and there would be an additional cost of $2, 000,000 to accommodate the purchase of a different model of machinery that can operate with the alternative packaging materials. There would also be the increased cost of $200,000 each year from year 5 to source suitable packaging materials. The new machine will be evenly depreciated over the next 10 years. There will be no salvage value. Assume the production will start from year 6.

In your team, calculate the differences to the NPV for each of two options and prepare a supplementary recommendation that includes the following details:

A) A summary of the impact of MS?s sustainability pledge on this investment decision and your revised recommendation on which option to follow.

B) Any additional sustainability factors* that have the potential to impact the investment that the CFO has not asked you to consider and what this impact might look like.

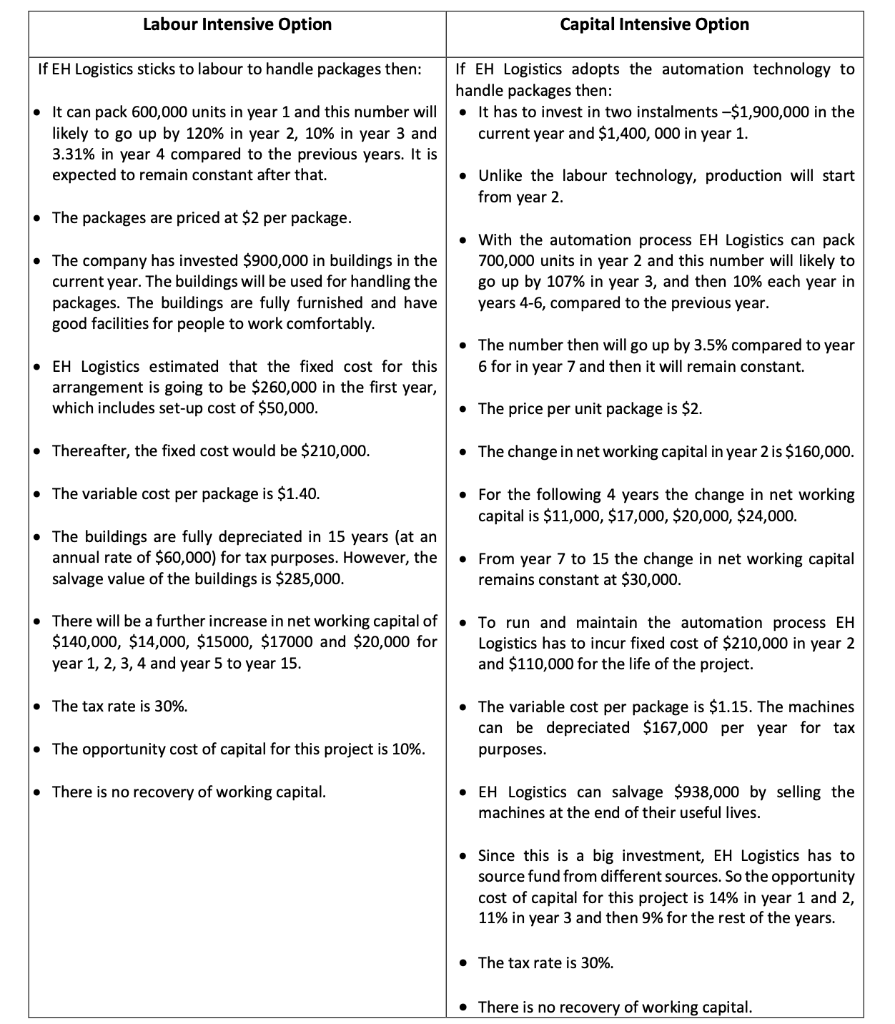

Labour Intensive Option If EH Logistics sticks to labour to handle packages then: It can pack 600,000 units in year 1 and this number will likely to go up by 120% in year 2, 10% in year 3 and 3.31% in year 4 compared to the previous years. It is expected to remain constant after that. The packages are priced at $2 per package. The company has invested $900,000 in buildings in the current year. The buildings will be used for handling the packages. The buildings are fully furnished and have good facilities for people to work comfortably. EH Logistics estimated that the fixed cost for this arrangement is going to be $260,000 in the first year, which includes set-up cost of $50,000. Thereafter, the fixed cost would be $210,000. The variable cost per package is $1.40. The buildings are fully depreciated in 15 years (at an annual rate of $60,000) for tax purposes. However, the salvage value of the buildings is $285,000. There will be a further increase in net working capital of $140,000, $14,000, $15000, $17000 and $20,000 for year 1, 2, 3, 4 and year 5 to year 15. The tax rate is 30%. The opportunity cost of capital for this project is 10%. There is no recovery of working capital. Capital Intensive Option If EH Logistics adopts the automation technology to handle packages then: It has to invest in two instalments -$1,900,000 in the current year and $1,400, 000 in year 1. Unlike the labour technology, production will start from year 2. With the automation process EH Logistics can pack 700,000 units in year 2 and this number will likely to go up by 107% in year 3, and then 10% each year in years 4-6, compared to the previous year. The number then will go up by 3.5% compared to year 6 for in year 7 and then it will remain constant. The price per unit package is $2. The change in net working capital in year 2 is $160,000. For the following 4 years the change in net working capital is $11,000, $17,000, $20,000, $24,000. From year 7 to 15 the change in net working capital remains constant at $30,000. To run and maintain the automation process EH Logistics has to incur fixed cost of $210,000 in year 2 and $110,000 for the life of the project. The variable cost per package is $1.15. The machines can be depreciated $167,000 per year for tax purposes. EH Logistics can salvage $938,000 by selling the machines at the end of their useful lives. Since this is a big investment, EH Logistics has to source fund from different sources. So the opportunity cost of capital for this project is 14% in year 1 and 2, 11% in year 3 and then 9% for the rest of the years. The tax rate is 30%. There is no recovery of working capital.

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A A summary of the impact of MSs sustainability pledge on this investment decision and your revised recommendation on which option to follow The sustainability pledge of MS Incorporated has an impact ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started