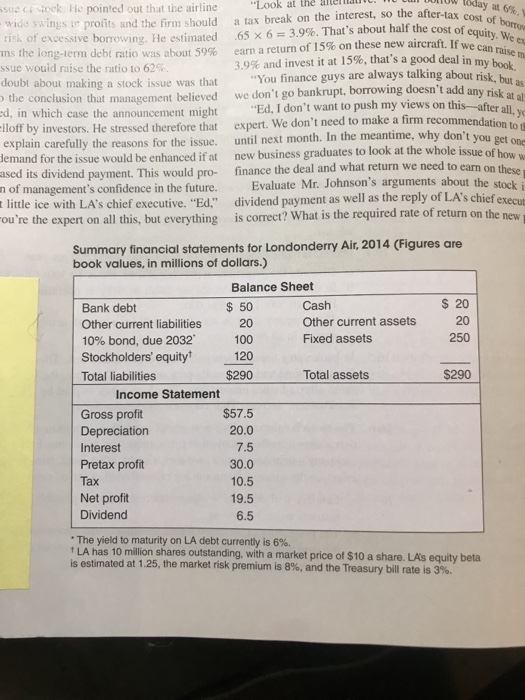

The electric utility has the most stable assets that would not be impaired by software firm has the least dependence value only if the firm continues as an dictable cash flows. It should have the 16.8 MINICASE In March 2015 the management team of Londonderry Air (LA) met to discuss a proposal to purchase five shorthaul aircraft at a total you say flie to sell more 5 million. There was general enthusiasm for the invest- by nearly a of 6.5%, w ment, and the new aircraft were expected to generate an annual cash flow of $4 million for 20 years Increasing he focus of the meeting was on how to finance the purchase. LA had $20 million in cash and marketable securities (see table), but Ed Johnson, the chief financial officer, pointed out that the company needed at least $10 million in cash to meet normal out- flow and as a contingency reserve. This meant that there would be a What's mor the stockho If we hike t stock issue the shareho cash deficiency of $15 million, which the firm would need to cover dilution. O While admitting that the arguments were finely balanced, Mr. John- for around either by the sale of common stock or by additional borrowing. not playing son recommended an issue of stock. He pointed out that the airline industry was subject to wide swings in profits and the firm should be careful to avoid the risk of excessive borrowing. He estimated that in market value terms the long-term debt ratio was about 59% "Look a a tax break .65 x 6 earn a retur 3.9% and 11 You fi we don't g "Ed, I d rt. We ntil next r new busine finance the Evaluat and that a further debt issue would raise the ratio to 62% Mr. Johnson's only doubt about making a stock issue was that investors might jump to the conclusion that management believed the stock was overpriced, in which case the announcement might prompt an unjustified selloff by investors. He stressed therefore that the company needed to explain carefully the reasons for the issue. Also, he suggested that demand for the issue would be enhanced if at the same time LA increased its dividend payment. This would pro- vide a tangible indication of management's confidence in the future These arguments cut little ice with LA's chief executive. "Ed," she said, "I know that you're the expert on all this, but everything expe u dividend is correct? Summary financial statements for Lonc book values, in millions of dollars.)