Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Elkton Company is considering a new project that requires an initial investment of $24,000,00... The Elkton Company is considering a new project that

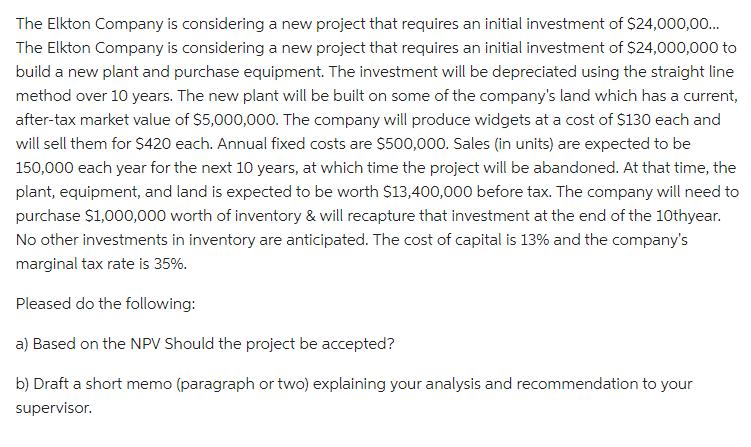

The Elkton Company is considering a new project that requires an initial investment of $24,000,00... The Elkton Company is considering a new project that requires an initial investment of $24,000,000 to build a new plant and purchase equipment. The investment will be depreciated using the straight line method over 10 years. The new plant will be built on some of the company's land which has a current, after-tax market value of $5,000,000. The company will produce widgets at a cost of $130 each and will sell them for $420 each. Annual fixed costs are $500,000. Sales (in units) are expected to be 150,000 each year for the next 10 years, at which time the project will be abandoned. At that time, the plant, equipment, and land is expected to be worth $13,400,000 before tax. The company will need to purchase $1,000,000 worth of inventory & will recapture that investment at the end of the 10thyear. No other investments in inventory are anticipated. The cost of capital is 13% and the company's marginal tax rate is 35%. Pleased do the following: a) Based on the NPV Should the project be accepted? b) Draft a short memo (paragraph or two) explaining your analysis and recommendation to your supervisor.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started