Answered step by step

Verified Expert Solution

Question

1 Approved Answer

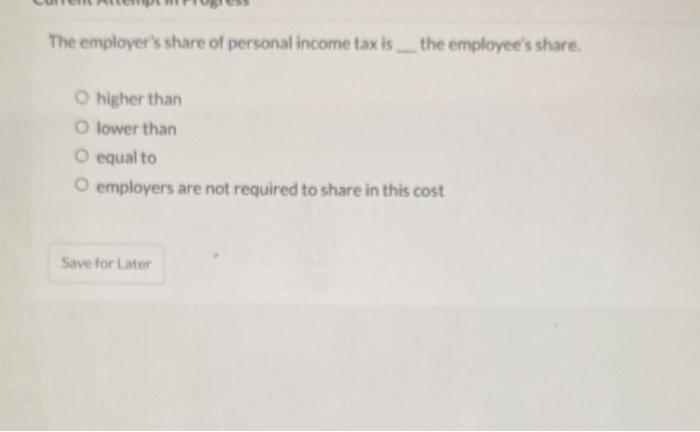

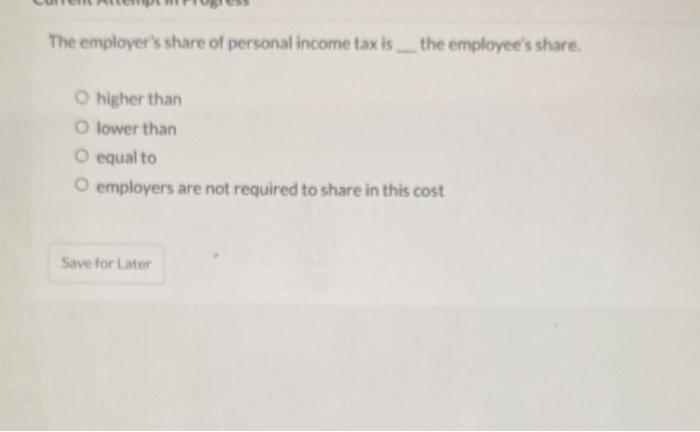

The employer's share of personal income tax is the employee's share. O higher than O lower than O equal to O employers are not required

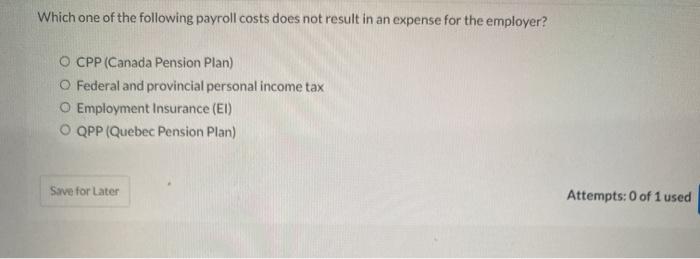

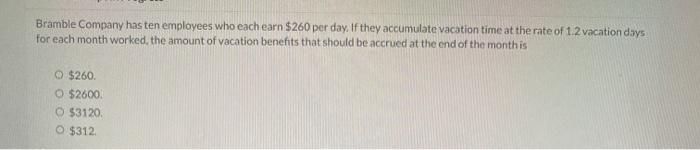

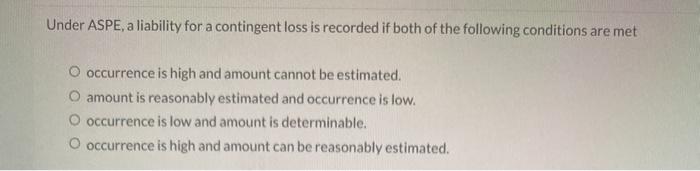

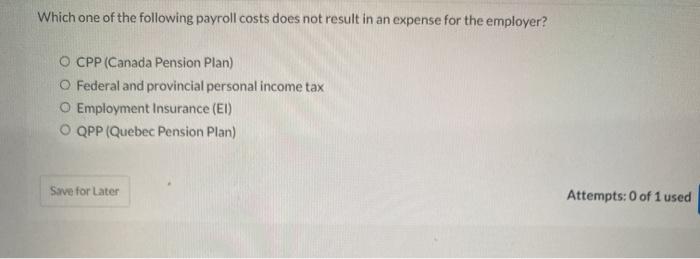

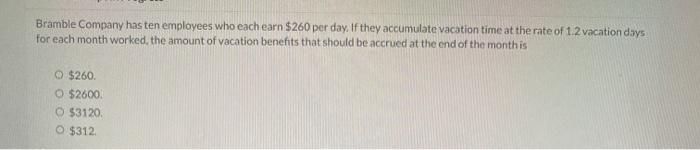

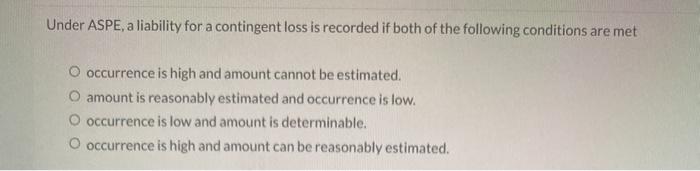

The employer's share of personal income tax is the employee's share. O higher than O lower than O equal to O employers are not required to share in this cost Save for Later Which one of the following payroll costs does not result in an expense for the employer? O CPP (Canada Pension Plan) O Federal and provincial personal income tax O Employment Insurance (EI) O QPP (Quebec Pension Plan) Save for Later Attempts: 0 of 1 used Bramble Company has ten employees who each earn $260 per day. If they accumulate vacation time at the rate of 12 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is $260. O $2600 O $3120 O $312 Under ASPE, a liability for a contingent loss is recorded if both of the following conditions are met O occurrence is high and amount cannot be estimated. O amount is reasonably estimated and occurrence is low. O occurrence is low and amount is determinable. O occurrence is high and amount can be reasonably estimated

The employer's share of personal income tax is the employee's share. O higher than O lower than O equal to O employers are not required to share in this cost Save for Later Which one of the following payroll costs does not result in an expense for the employer? O CPP (Canada Pension Plan) O Federal and provincial personal income tax O Employment Insurance (EI) O QPP (Quebec Pension Plan) Save for Later Attempts: 0 of 1 used Bramble Company has ten employees who each earn $260 per day. If they accumulate vacation time at the rate of 12 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is $260. O $2600 O $3120 O $312 Under ASPE, a liability for a contingent loss is recorded if both of the following conditions are met O occurrence is high and amount cannot be estimated. O amount is reasonably estimated and occurrence is low. O occurrence is low and amount is determinable. O occurrence is high and amount can be reasonably estimated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started