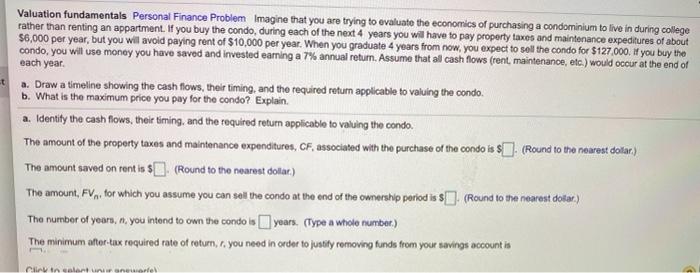

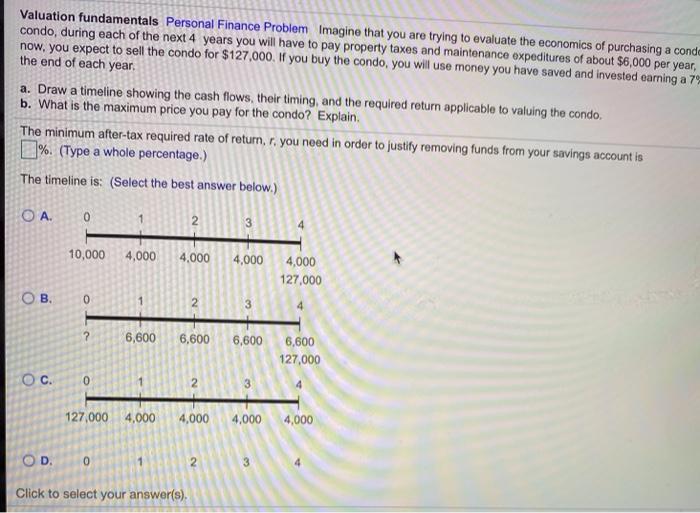

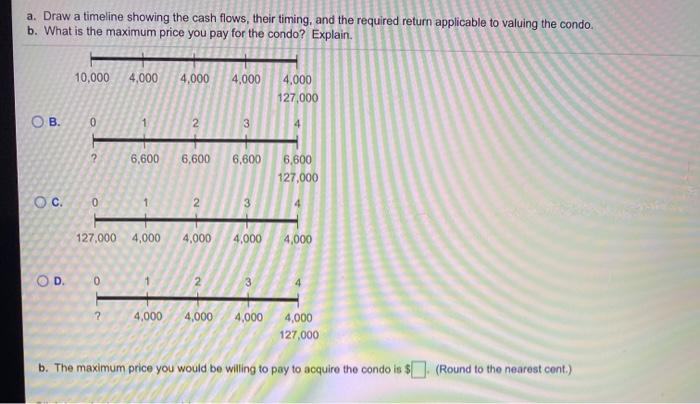

the end of t Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during college rather than renting an appartment. If you buy the condo, during each of the next 4 years you will have to pay property taxes and maintenance expeditures of about $6,000 per year, but you will avoid paying rent of $10,000 per year. When you graduate 4 years from now, you expect to sell the condo for $127.000. you buy the condo, you will use money you have saved and invested earning a 7% annual return. Assume that all cash flows (rent, maintenance, etc.) would occur each year a. Draw a timeline showing the cash flows, their timing, and the required retur applicable to valuing the condo b. What is the maximum price you pay for the condo? Explain a. Identity the cash flows, their timing, and the required return applicable to valuing the condo. The amount of the property taxes and maintenance expenditures, CF, associated with the purchase of the condo is $. (Round to the nearest dollar) The amount saved on rent is $. (Round to the nearest dolar.) The amount, FV,, for which you assume you can sell the condo at the end of the ownership period is $. (Round to the nearest dolar) The number of years, . you intend to own the condo is years. (Type a whole number.) The minimum after-tax required rate of return, r, you need in order to justify removing funds from your savings account is Clin in colante Valuation fundamentals Personal Finance Problem Imagine that you are trying to evaluate the economics of purchasing a conde condo, during each of the next 4 years you will have to pay property taxes and maintenance expeditures of about $6,000 per year, now, you expect to sell the condo for $127,000. If you buy the condo, you will use money you have saved and invested earning a 7 the end of each year. a. Draw a timeline showing the cash flows, their timing, and the required return applicable to valuing the condo. b. What is the maximum price you pay for the condo? Explain. The minimum after-tax required rate of return, r, you need in order to justify removing funds from your savings account is %. (Type a whole percentage.) The timeline is: (Select the best answer below.) OA. 0 2 3 10,000 4,000 4,000 4,000 4,000 127,000 , 0 3 ? 6,600 6,600 6,600 6,600 127,000 O c. 0 3 127,000 4,000 4,000 4,000 4,000 D. 0 2 3 Click to select your answer(s) a. Draw a timeline showing the cash flows, their timing, and the required return applicable to valuing the condo b. What is the maximum price you pay for the condo? Explain. 10,000 4,000 4,000 4,000 4.000 127,000 OB. 0 2 3 4 ? 6,600 6,600 6,600 6,600 127,000 OC. 0 2 3 127,000 4,000 4,000 4,000 4,000 OD 0 2 3 4,000 4,000 4,000 4,000 127,000 b. The maximum price you would be willing to pay to acquire the condo in $(Round to the nearest cont.)