Answered step by step

Verified Expert Solution

Question

1 Approved Answer

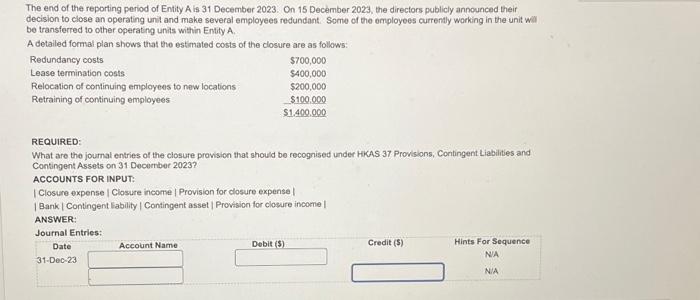

The end of the reporting period of Entity A is 31 December 2023. On 15 December 2023, the directors publicly announced their decision to

The end of the reporting period of Entity A is 31 December 2023. On 15 December 2023, the directors publicly announced their decision to close an operating unit and make several employees redundant. Some of the employees currently working in the unit will be transferred to other operating units within Entity A. A detailed formal plan shows that the estimated costs of the closure are as follows: Redundancy costs Lease termination costs Relocation of continuing employees to new locations Retraining of continuing employees REQUIRED: What are the journal entries of the closure provision that should be recognised under HKAS 37 Provisions, Contingent Liabilities and Contingent Assets on 31 December 20237 ACCOUNTS FOR INPUT: Date 31-Dec-23 $700,000 $400,000 $200,000 $100.000 $1,400,000 | Closure expense | Closure income | Provision for closure expense | | Bank | Contingent liability | Contingent asset | Provision for closure income | ANSWER: Journal Entries: Account Name Debit (5) Credit ($) Hints For Sequence N/A N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a question which is to do with accounting for a closure provision The scenario perta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started