Answered step by step

Verified Expert Solution

Question

1 Approved Answer

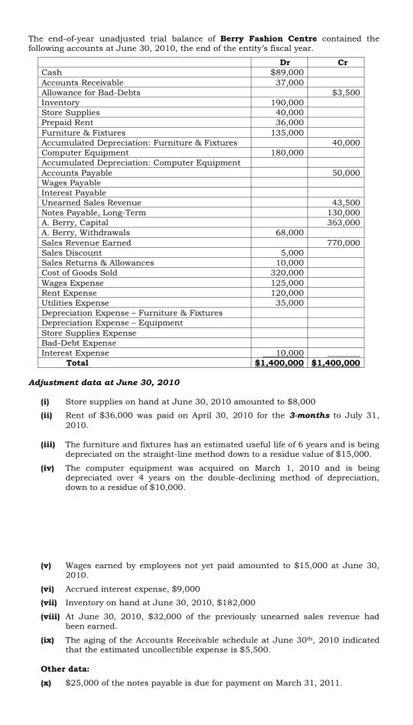

The end-of-year unadjusted trial balance of Berry Fashion Centre contained the following accounts at June 30, 2010, the end of the entity's fiscal year.

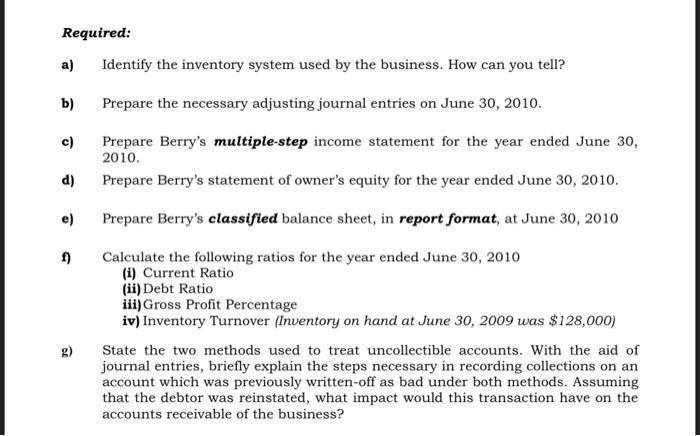

The end-of-year unadjusted trial balance of Berry Fashion Centre contained the following accounts at June 30, 2010, the end of the entity's fiscal year. Cash Accounts Receivable Allowance for Bad-Debts Inventory Store Supplies Prepaid Rent Furniture & Fixtures Accumulated Depreciation: Furniture & Fixtures Computer Equipment Accumulated Depreciation: Computer Equipment Accounts Payable Wages Payable Interest Payable Unearned Sales Revenue Notes Payable, Long-Term A. Berry, Capital A. Berry, Withdrawals Sales Revenue Earned Sales Discount Sales Returns & Allowances Cost of Goods Sold Wages Expense Rent Expense Utilities Expense Depreciation Expense - Furniture & Fixtures Depreciation Expense-Equipment Store Supplies Expense Bad-Debt Expense Interest Expense Total Adjustment data at June 30, 2010 Dr $89,000 37,000 190,000 40,000 36,000 135,000 180,000 68,000 5,000 10,000 320,000 125,000 120,000 35,000 (vi) Accrued interest expense, $9,000 (vii) Inventory on hand at June 30, 2010, $182,000 Cr $3,500 40,000 50,000 43,500 130,000 363,000 770,000 10.000 $1,400,000 $1,400,000 Store supplies on hand at June 30, 2010 amounted to $8,000 Rent of $36,000 was paid on April 30, 2010 for the 3-months to July 31, 2010. (iii) The furniture and fixtures has an estimated useful life of 6 years and is being depreciated on the straight-line method down to a residue value of $15,000. (iv) The computer equipment was acquired on March 1, 2010 and is being depreciated over 4 years on the double-declining method of depreciation, down to a residue of $10,000. (v) Wages earned by employees not yet paid amounted to $15,000 at June 30, 2010. (viii) At June 30, 2010, $32,000 of the previously unearned sales revenue had been earned. (ix) The aging of the Accounts Receivable schedule at June 30, 2010 indicated that the estimated uncollectible expense is $5,500. Other data: (x) $25,000 of the notes payable is due for payment on March 31, 2011. Required: a) b) c) d) e) f) g) Identify the inventory system used by the business. How can you tell? Prepare the necessary adjusting journal entries on June 30, 2010. Prepare Berry's multiple-step income statement for the year ended June 30, 2010. Prepare Berry's statement of owner's equity for the year ended June 30, 2010. Prepare Berry's classified balance sheet, in report format, at June 30, 2010 Calculate the following ratios for the year ended June 30, 2010 (i) Current Ratio (ii) Debt Ratio iii) Gross Profit Percentage iv) Inventory Turnover (Inventory on hand at June 30, 2009 was $128,000) State the two methods used to treat uncollectible accounts. With the aid of journal entries, briefly explain the steps necessary in recording collections on an account which was previously written-off as bad under both methods. Assuming that the debtor was reinstated, what impact would this transaction have on the accounts receivable of the business?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The inventory system used by the business is a perpetual inventory system This can be determined by the presence of the Inventory account on the unadjusted trial balance which indicates that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started