Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Entson Company Believes that its monthly sales during the period from November of the current year to July of next year are normally distributed

The Entson Company Believes that its monthly sales during the period from November of the current year to July of next year are normally distributed with the mean and standard deviation given in the table.

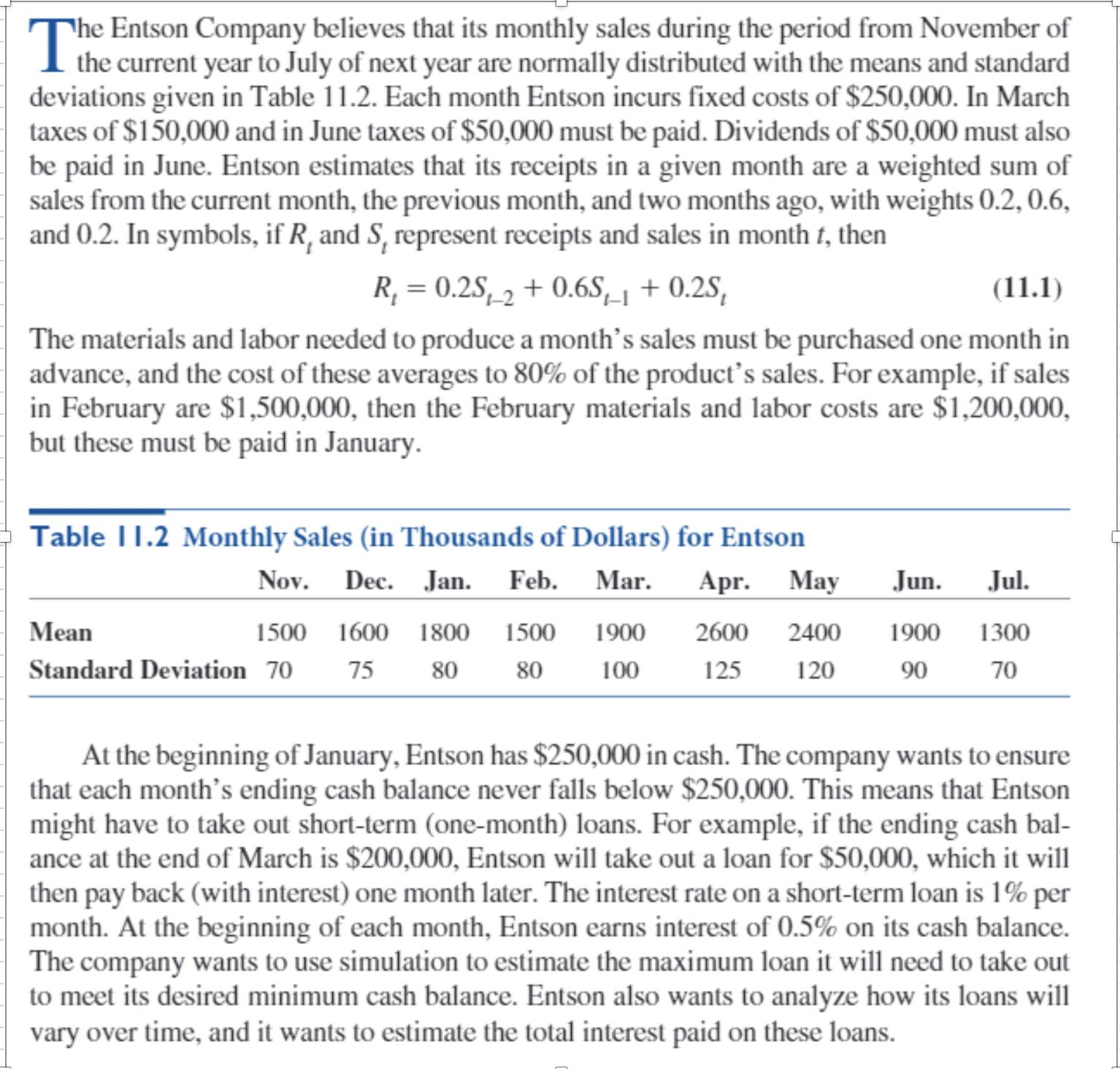

The Entson Company believes that its monthly sales during the period from November of the current year to July of next year are normally distributed with the means and standard deviations given in Table 11.2. Each month Entson incurs fixed costs of $250,000. In March taxes of $150,000 and in June taxes of $50,000 must be paid. Dividends of $50,000 must also be paid in June. Entson estimates that its receipts in a given month are a weighted sum of sales from the current month, the previous month, and two months ago, with weights 0.2, 0.6, and 0.2. In symbols, if R, and S, represent receipts and sales in month t, then R, = 0.2S, 2 + 0.6S, + 0.2S, (11.1) The materials and labor needed to produce a month's sales must be purchased one month in advance, and the cost of these averages to 80% of the products sales. For example, if sales in February are $1,500,000, then the February materials and labor costs are $1,200,000, but these must be paid in January. Table I1.2 Monthly Sales (in Thousands of Dollars) for Entson Nov. Dec. Jan. Feb. Mar. Apr. May Jun. Jul. Mean 1500 1600 1800 1500 1900 2600 2400 1900 1300 Standard Deviation 70 75 80 80 100 125 120 90 70 At the beginning of January, Entson has $250,000 in cash. The company wants to ensure that each month's ending cash balance never falls below $250,000. This means that Entson might have to take out short-term (one-month) loans. For example, if the ending cash bal- ance at the end of March is $200,000, Entson will take out a loan for $50,000, which it will then pay back (with interest) one month later. The interest rate on a short-term loan is 1% per month. At the beginning of each month, Entson earns interest of 0.5% on its cash balance. The company wants to use simulation to estimate the maximum loan it will need to take out to meet its desired minimum cash balance. Entson also wants to analyze how its loans will vary over time, and it wants to estimate the total interest paid on these loans.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Beginning from the spreadsheet created by following the steps in example 116 the fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started