Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The equity beta of Hubbard Plc. is 1.5. Investors expect that Hubbard Plc. will pay all of its earnings out as a cash dividend

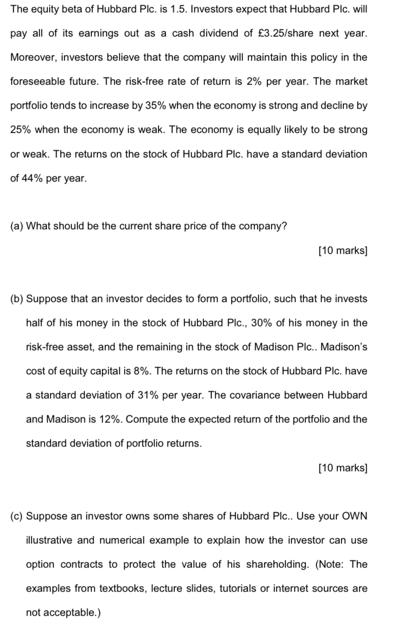

The equity beta of Hubbard Plc. is 1.5. Investors expect that Hubbard Plc. will pay all of its earnings out as a cash dividend of 3.25/share next year. Moreover, investors believe that the company will maintain this policy in the foreseeable future. The risk-free rate of return is 2% per year. The market portfolio tends to increase by 35% when the economy is strong and decline by 25% when the economy is weak. The economy is equally likely to be strong or weak. The returns on the stock of Hubbard Plc. have a standard deviation of 44% per year. (a) What should be the current share price of the company? [10 marks] (b) Suppose that an investor decides to form a portfolio, such that he invests half of his money in the stock of Hubbard Plc., 30% of his money in the risk-free asset, and the remaining in the stock of Madison Plc.. Madison's cost of equity capital is 8%. The returns on the stock of Hubbard Plc. have a standard deviation of 31% per year. The covariance between Hubbard and Madison is 12%. Compute the expected return of the portfolio and the standard deviation of portfolio returns. [10 marks] (c) Suppose an investor owns some shares of Hubbard Plc.. Use your OWN illustrative and numerical example to explain how the investor can use option contracts to protect the value of his shareholding. (Note: The examples from textbooks, lecture slides, tutorials or internet sources are not acceptable.)

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the current share price of Hubbard Plc we need to use the dividend discount model which is given by P0 D1 r g Where P0 is the current share price D1 is the expected dividend per share n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started