Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The estimated tax payable, investment tax allowance and exempt income for each of the year of assessment from 2021 to 2025? Sinar Harapan Sdn Bhd

The estimated tax payable, investment tax allowance and exempt income for each of the year of assessment from 2021 to 2025?

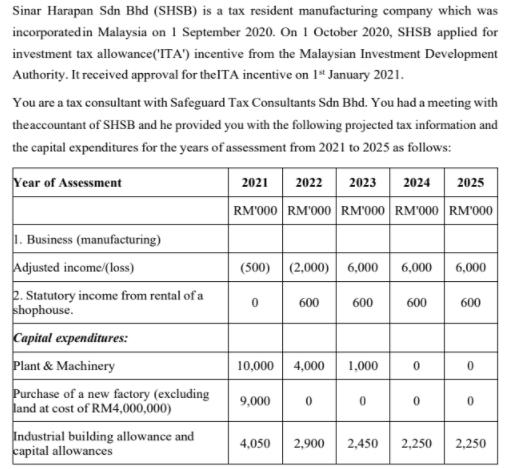

Sinar Harapan Sdn Bhd (SHSB) is a tax resident manufacturing company which was incorporated in Malaysia on 1 September 2020. On 1 October 2020, SHSB applied for investment tax allowance('ITA') incentive from the Malaysian Investment Development Authority. It received approval for the ITA incentive on 1st January 2021. You are a tax consultant with Safeguard Tax Consultants Sdn Bhd. You had a meeting with the accountant of SHSB and he provided you with the following projected tax information and the capital expenditures for the years of assessment from 2021 to 2025 as follows: Year of Assessment 1. Business (manufacturing) Adjusted income/(loss) 2. Statutory income from rental of a shophouse. Capital expenditures: Plant & Machinery Purchase of a new factory (excluding land at cost of RM4,000,000) Industrial building allowance and capital allowances 2021 2022 2023 2024 2025 RM'000 RM'000 RM'000 RM'000 RM'000 (500) (2,000) 6,000 6,000 6,000 600 0 10,000 4,000 9,000 0 4,050 2,900 600 1,000 0 2,450 600 0 0 2,250 600 0 0 2,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the estimated tax payable investment tax allowance ITA and exempt income for each year of assessment from 2021 to 2025 for Sinar Harapan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started