Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Evil Queen Souvenir Corporation completed its first year of operations in 2019. During 2019 capital assets totalling $780,000 were purchased with none for

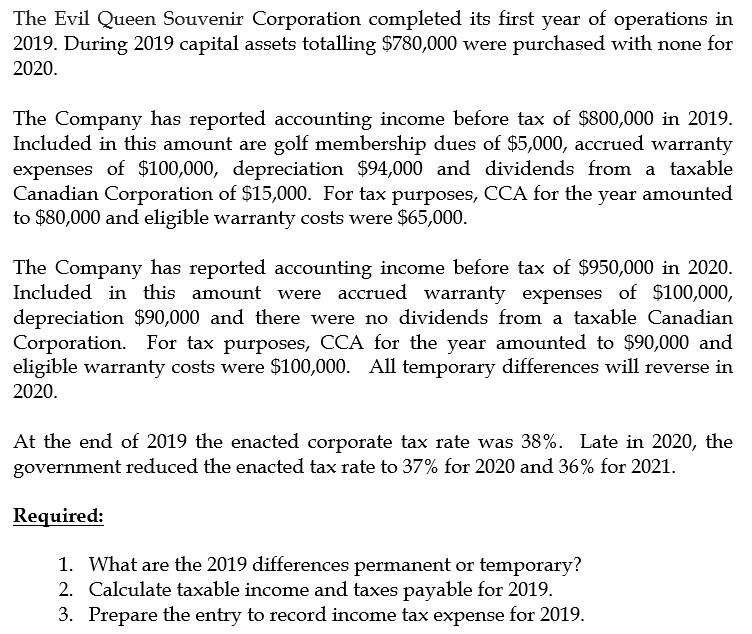

The Evil Queen Souvenir Corporation completed its first year of operations in 2019. During 2019 capital assets totalling $780,000 were purchased with none for 2020. The Company has reported accounting income before tax of $800,000 in 2019. Included in this amount are golf membership dues of $5,000, accrued warranty expenses of $100,000, depreciation $94,000 and dividends from a taxable Canadian Corporation of $15,000. For tax purposes, CCA for the year amounted to $80,000 and eligible warranty costs were $65,000. The Company has reported accounting income before tax of $950,000 in 2020. Included in this amount were accrued warranty expenses of $100,000, depreciation $90,000 and there were no dividends from a taxable Canadian Corporation. For tax purposes, CCA for the year amounted to $90,000 and eligible warranty costs were $100,000. All temporary differences will reverse in 2020. At the end of 2019 the enacted corporate tax rate was 38%. Late in 2020, the government reduced the enacted tax rate to 37% for 2020 and 36% for 2021. Required: 1. What are the 2019 differences permanent or temporary? 2. Calculate taxable income and taxes payable for 2019. 3. Prepare the entry to record income tax expense for 2019.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Golf membership dues Accrued warranty expenses Depreciation difference Dividend from a taxable Canad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started