Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The example below states that the present value computation above should have been based on a higher interest rate. Why should it be based on

The example below states that "the present value computation above should have been based on a higher interest rate". Why should it be based on a higher interest rate?

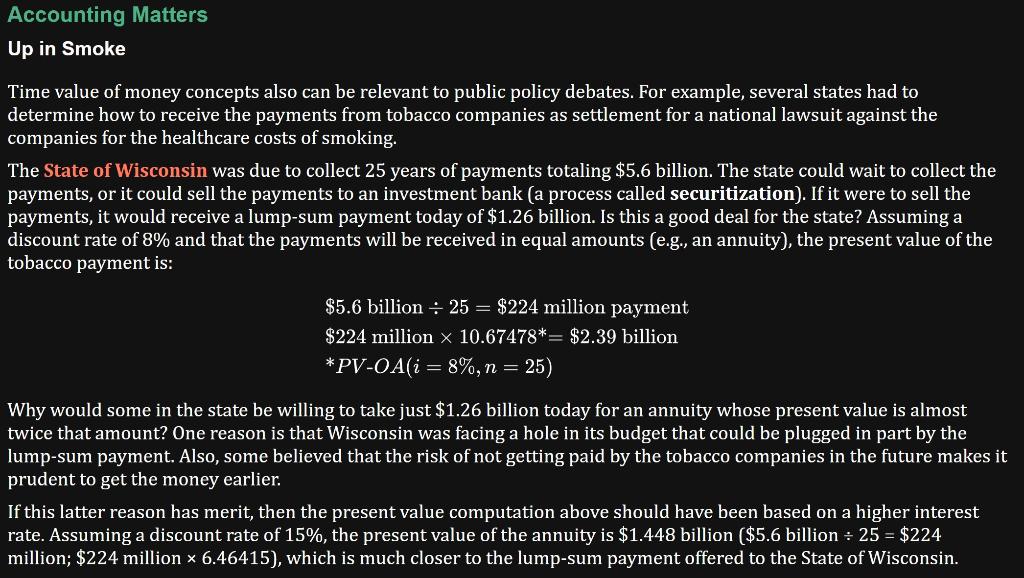

Up in Smoke Time value of money concepts also can be relevant to public policy debates. For example, several states had to determine how to receive the payments from tobacco companies as settlement for a national lawsuit against the companies for the healthcare costs of smoking. The State of Wisconsin was due to collect 25 years of payments totaling $5.6 billion. The state could wait to collect the payments, or it could sell the payments to an investment bank (a process called securitization). If it were to sell the payments, it would receive a lump-sum payment today of $1.26 billion. Is this a good deal for the state? Assuming a discount rate of 8% and that the payments will be received in equal amounts (e.g., an annuity), the present value of the tobacco payment is: $5.6billion25=$224millionpayment$224million10.67478=$2.39billionPVOA(i=8%,n=25) Why would some in the state be willing to take just $1.26 billion today for an annuity whose present value is almost twice that amount? One reason is that Wisconsin was facing a hole in its budget that could be plugged in part by the lump-sum payment. Also, some believed that the risk of not getting paid by the tobacco companies in the future makes it prudent to get the money earlier. If this latter reason has merit, then the present value computation above should have been based on a higher interest rate. Assuming a discount rate of 15%, the present value of the annuity is $1.448 billion ( $5.6 billion 25=$224 million; $224 million 6.46415), which is much closer to the lump-sum payment offered to the State of Wisconsin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started