Question

Brown Ltd is a company which has in inventory some materials oftype XY which cost $150,000 but which are now obsolete and have a scrapvalue

Brown Ltd is a company which has in inventory some materials oftype XY which cost $150,000 but which are now obsolete and have a scrapvalue of only $42,000. Other than selling the material for scrap thereare only two alternative uses for them.

Alternative 1

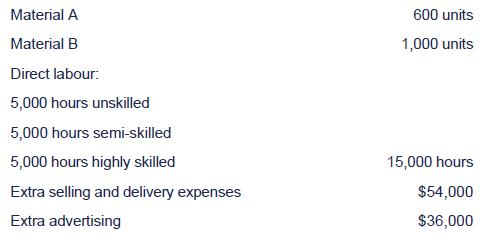

Converting the obsolete materials into a specialized product which would require the following additional work and materials

The conversion would produce 900 units of saleable product and these could be sold for $600 per unit.

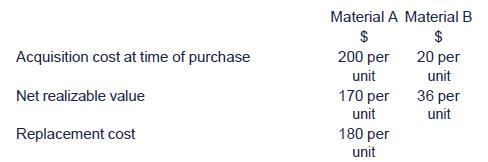

Material A is already in inventory and is widely used within thefirm. Although present inventories together with orders already plannedwill be sufficient to facilitate normal activity, any extra materialused by adopting this alternative will necessitate such materials beingreplaced immediately. Material B is also in inventory but it is unlikelythat any additional supplies can be obtained for some considerable timebecause of an industrial dispute. At the present time material B isnormally used in the production of product Z which sells at $780 perunit and incurs total variable cost (excluding material B) of $420 perunit. Each unit of product Z uses four units of material B.

The details of materials A and B are as follows:

Alternative 2

Adapting the obsolete materials for use as a substitute for asub-assembly which is regularly used within the firm. Details of theextra work and materials required are:

1,200 units of the sub-assembly are regularly used per quarter at acost of $1,800 per unit. The adaptation of material XY would reduce thequantity of the subassembly purchased from outside the firm to 900units for the next quarter only. However, as the volume purchased wouldbe reduced some discount would be lost, and the price of those purchasedfrom outside would increase to $2,100 per unit for that quarter.

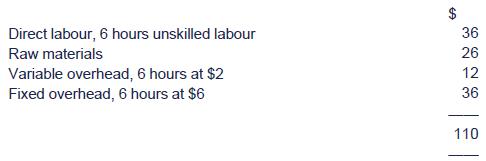

Material C is not available externally but is manufactured by BrownLtd. The 1,000 units required would be available from inventories butwould be produced as extra production. The standard cost per unit ofmaterial C would be as follows:

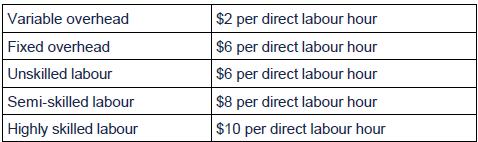

The wage rates and overhead recovery rates for Brown Ltd are:

The unskilled labour is employed on a casual basis and sufficientlabour can be acquired to exactly meet the production requirements.Semi-skilled labour is part of the permanent labour force but thecompany has temporary excess supply of this type of labour at thepresent time. Highly skilled labour is in short supply and cannot beincreased significantly in the short term; this labour is presentlyengaged in meeting the demand for product L which requires 4 hours ofhighly skilled labour. The contribution from the sale of one unit ofproduct L is $48.

Required:

For each of the alternatives 1 and 2, prepare a cost-benefitanalysis based on a schedule of relevant costs. Your answer shouldinclude a conclusion as to whether the inventories of material XY shouldbe sold, converted into a specialized product (alternative 1) oradapted for use as a substitute for a sub-assembly (alternative 2).

Material A Material B Direct labour: 5,000 hours unskilled 5,000 hours semi-skilled 600 units 1,000 units 5,000 hours highly skilled 15,000 hours Extra selling and delivery expenses Extra advertising $54,000 $36,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the percentage of total pharmaceutical sales for each subcategory Immunology Infectious D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started