Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The excel workbook photos must be completed in order to properly answer the multiple choice questions. Need done asap, thank you for your help! Which

The excel workbook photos must be completed in order to properly answer the multiple choice questions. Need done asap, thank you for your help!

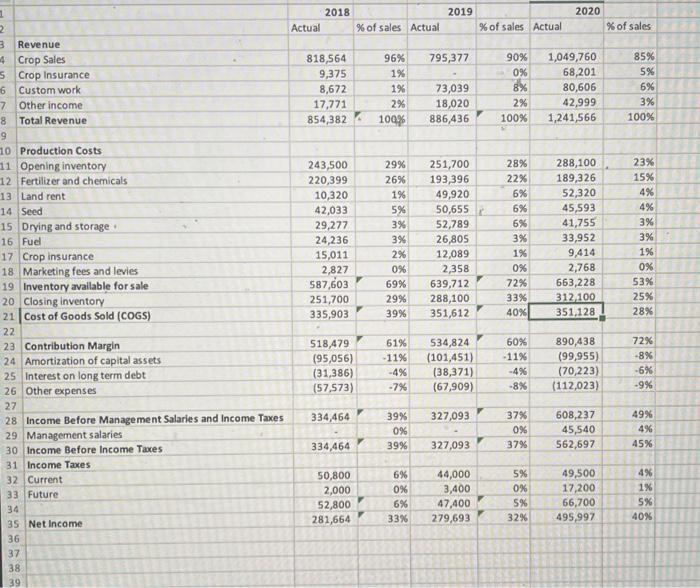

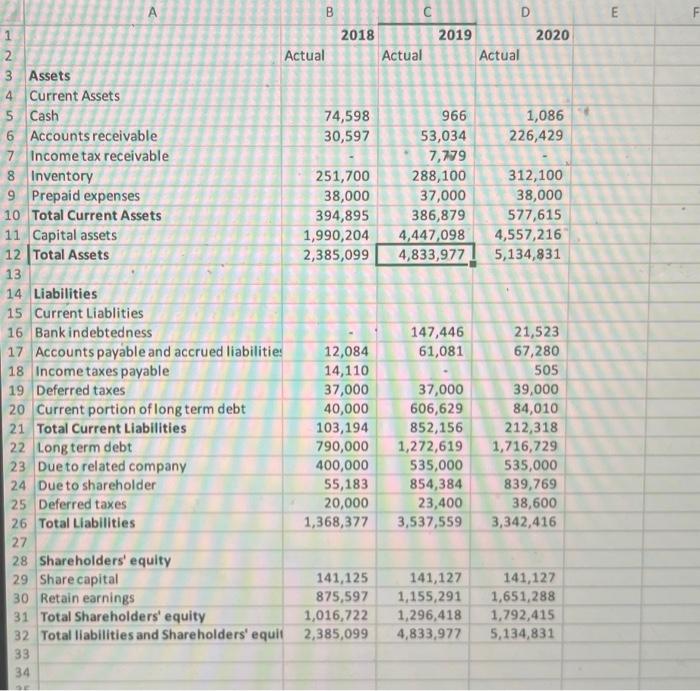

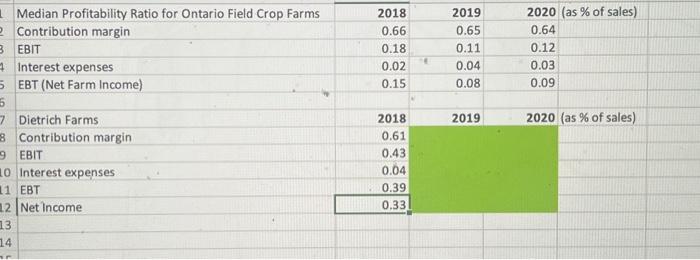

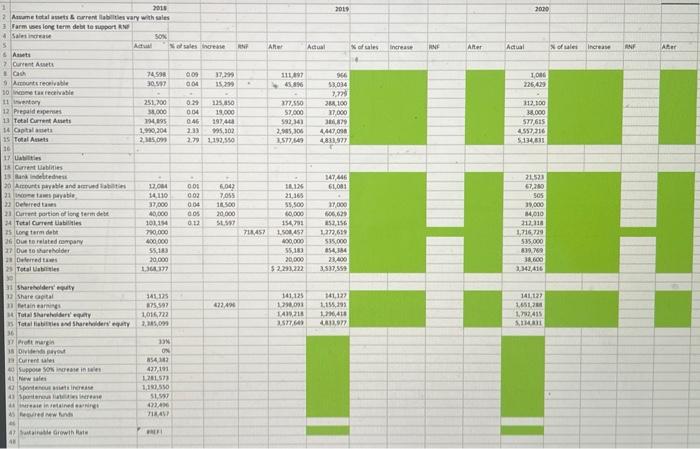

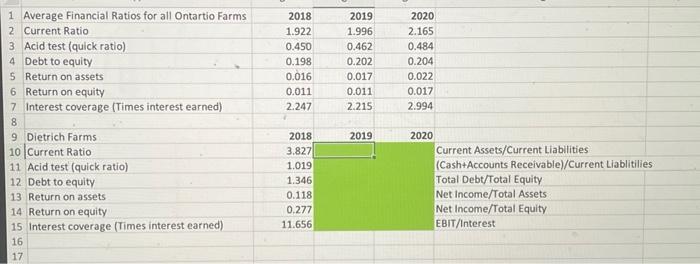

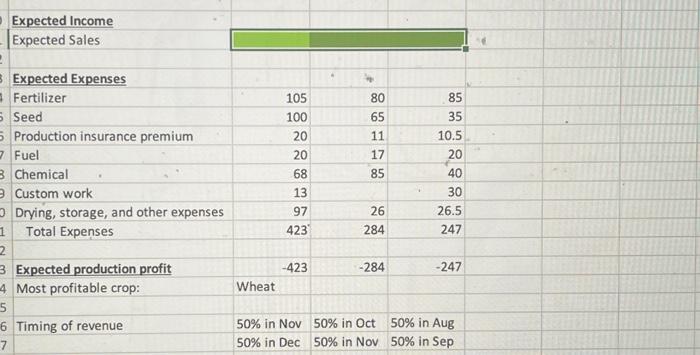

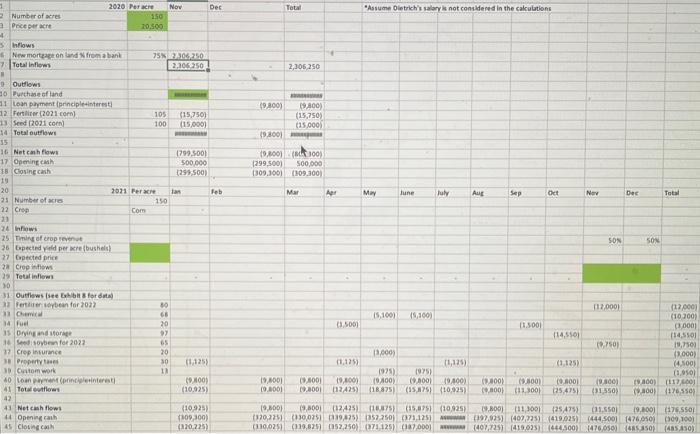

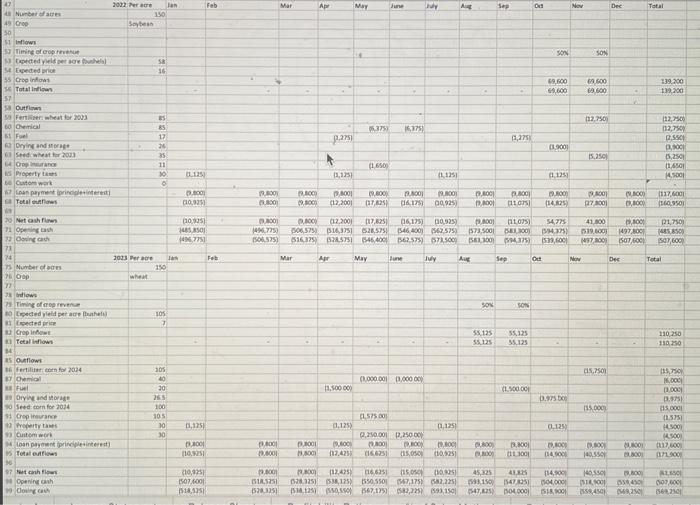

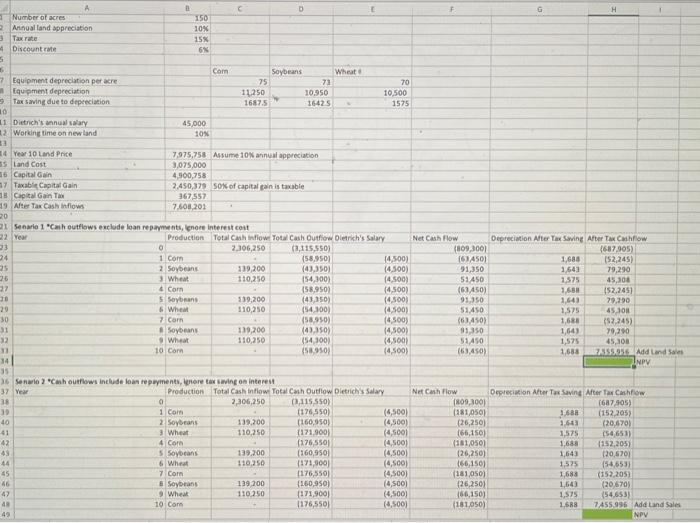

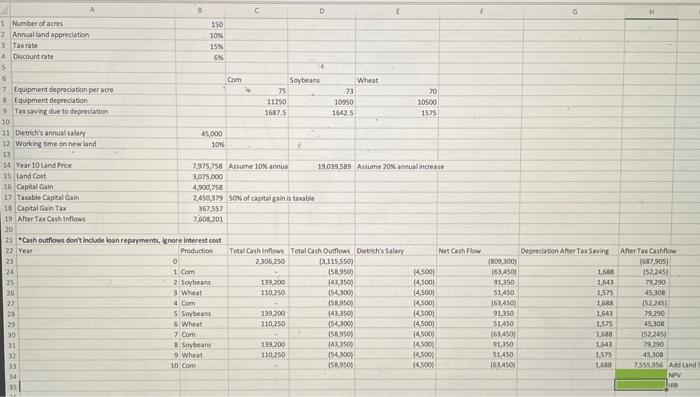

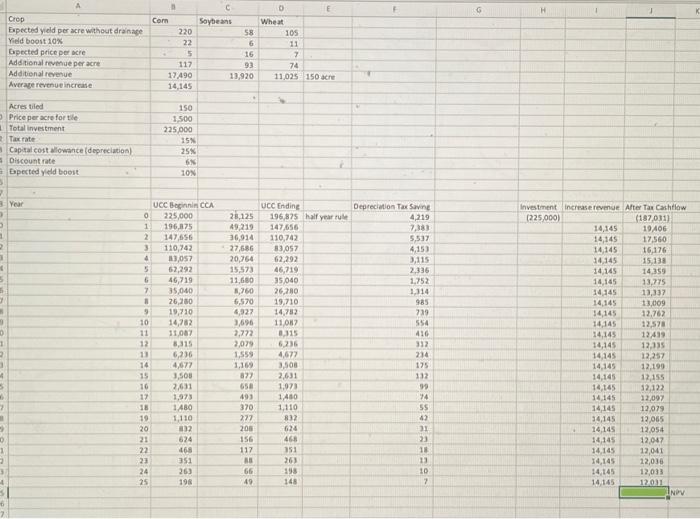

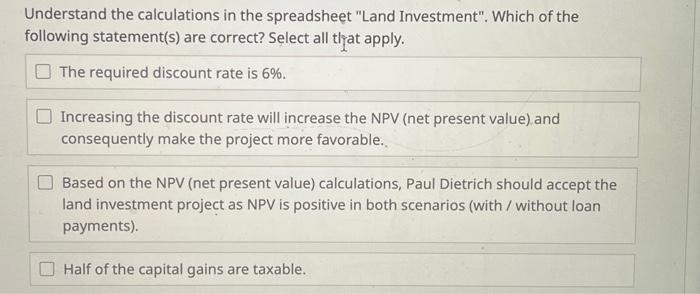

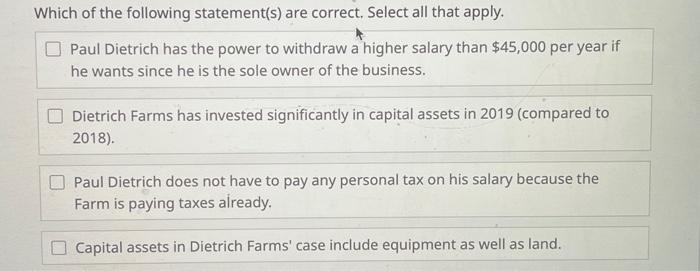

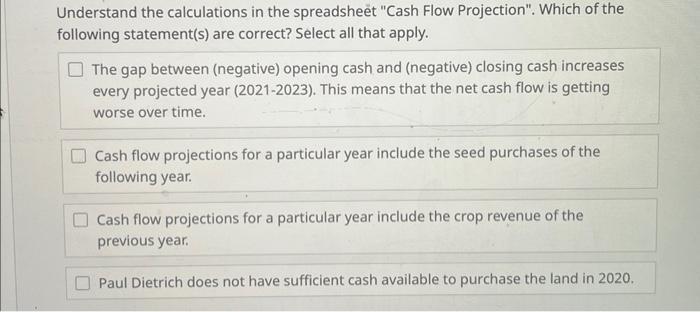

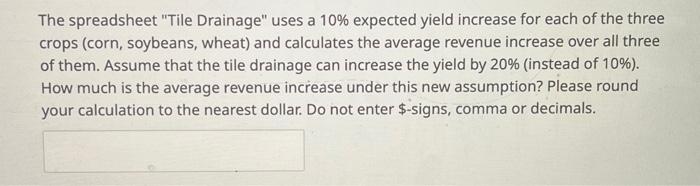

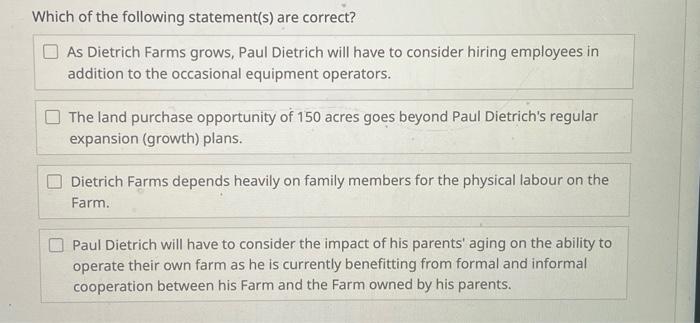

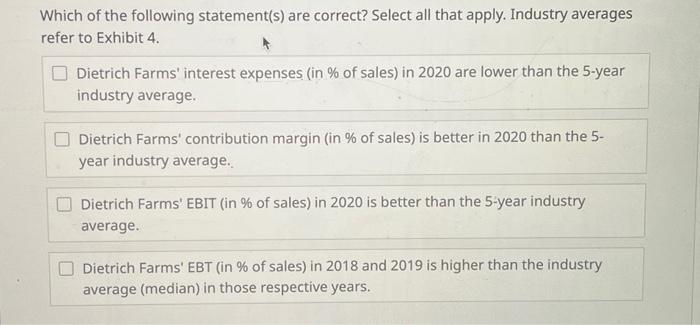

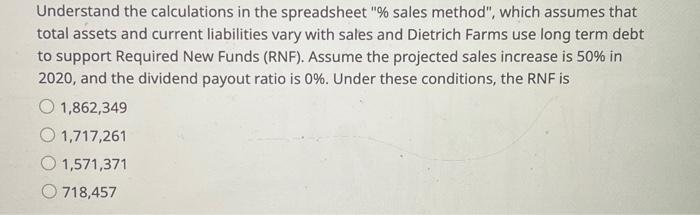

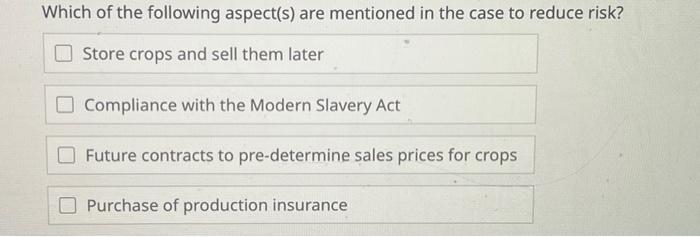

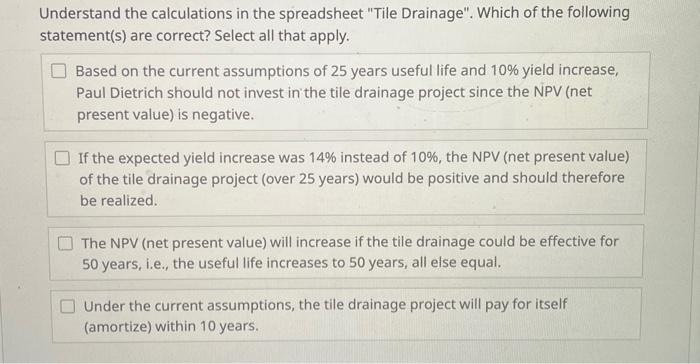

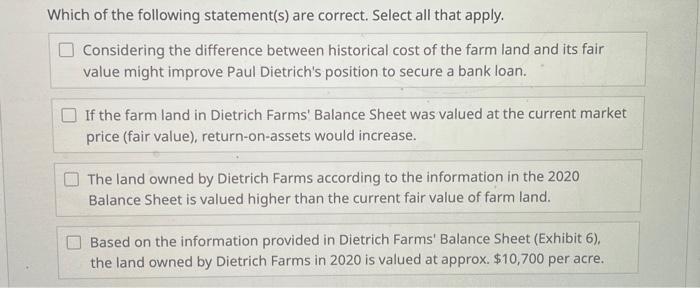

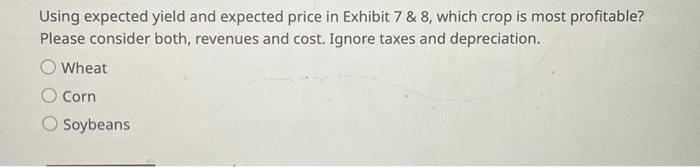

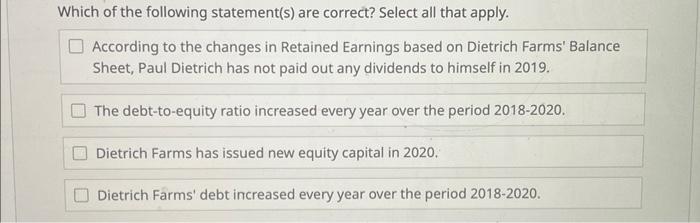

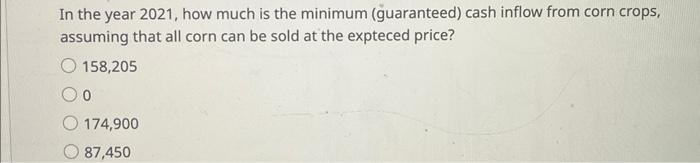

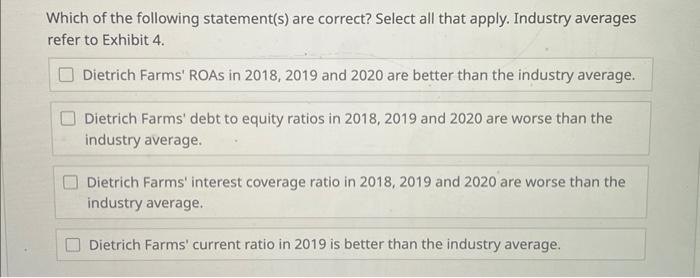

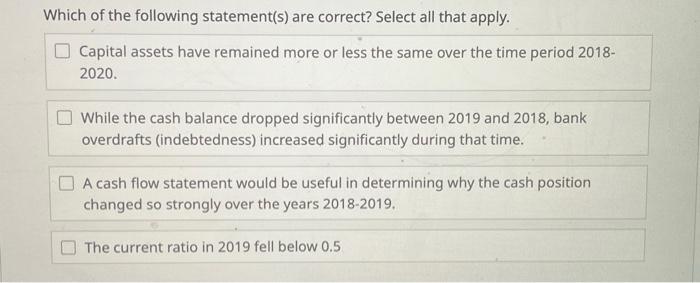

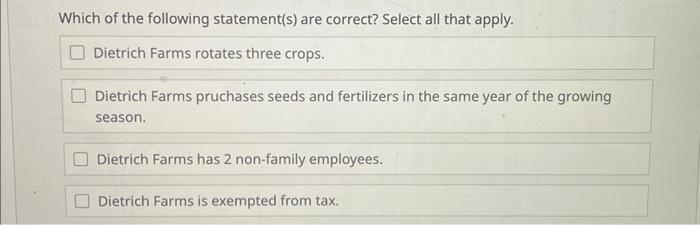

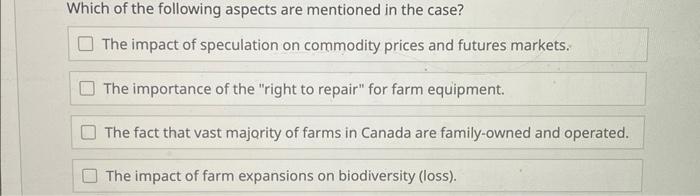

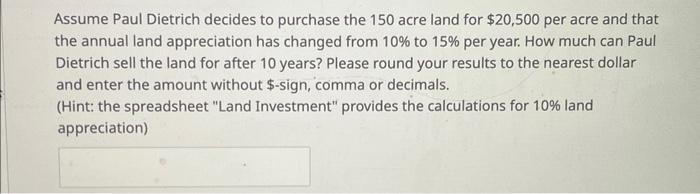

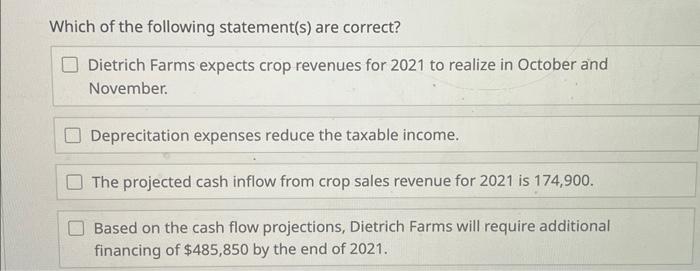

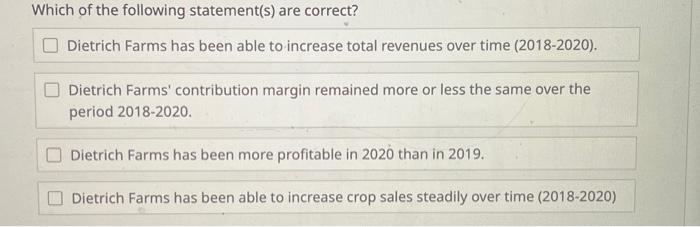

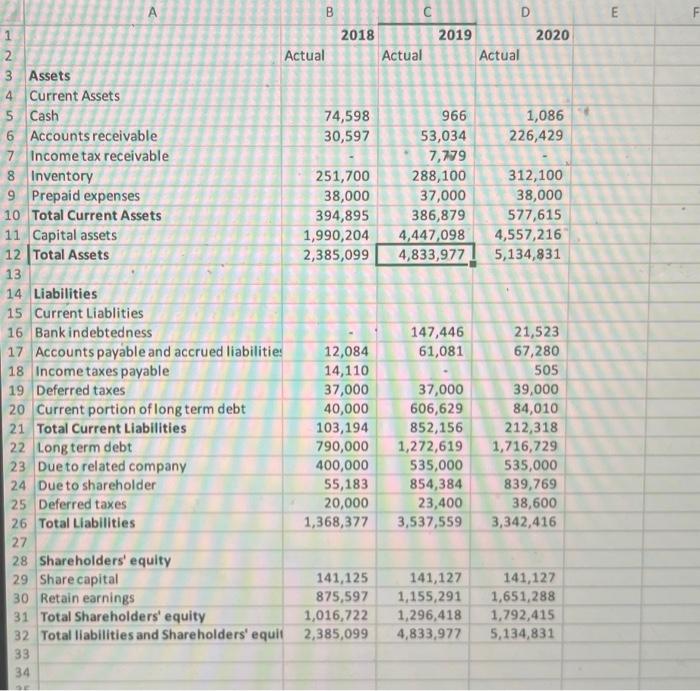

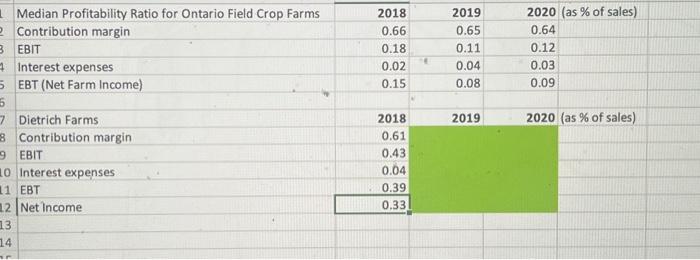

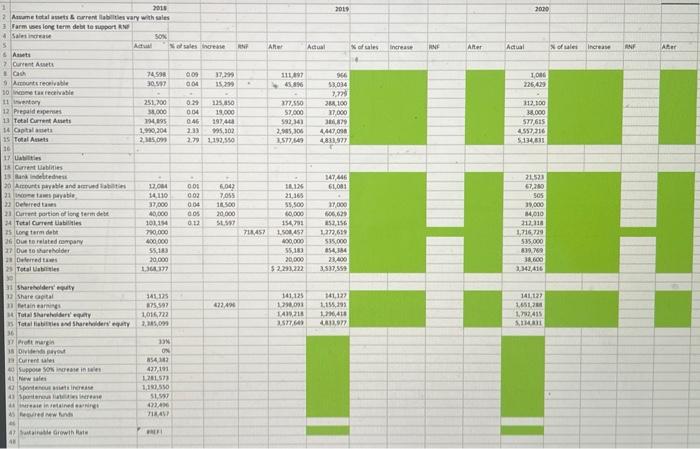

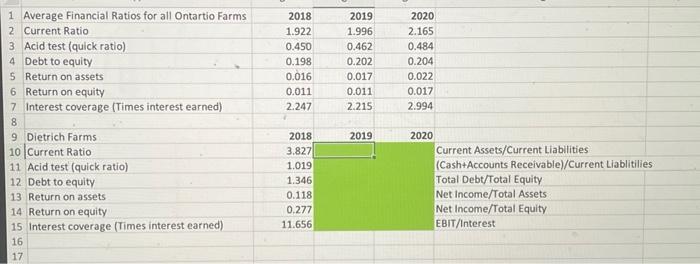

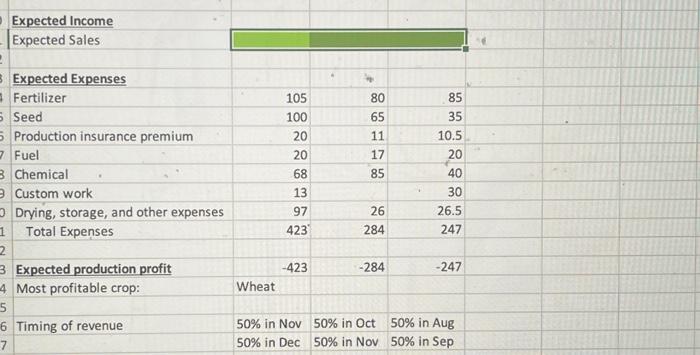

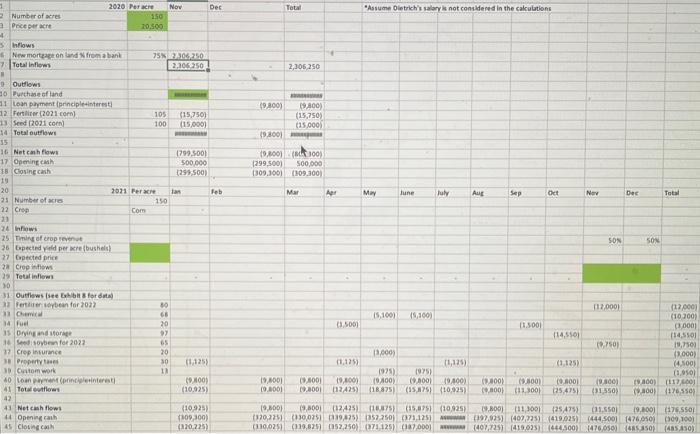

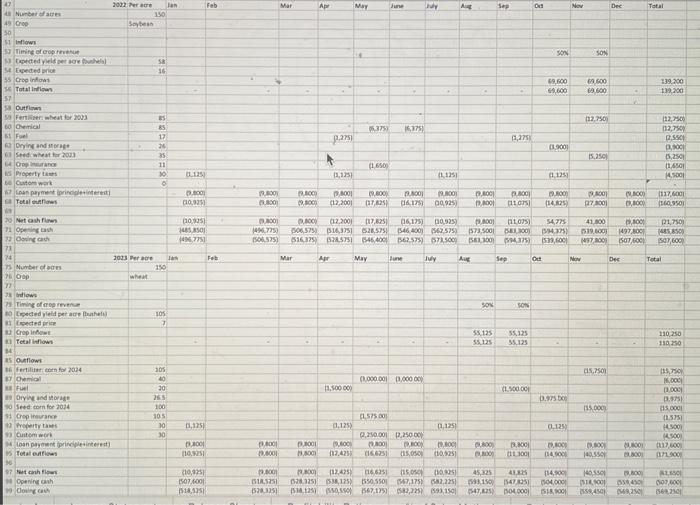

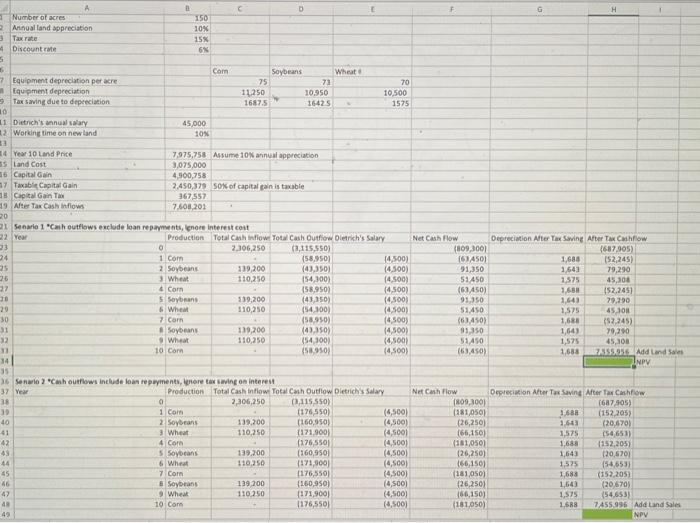

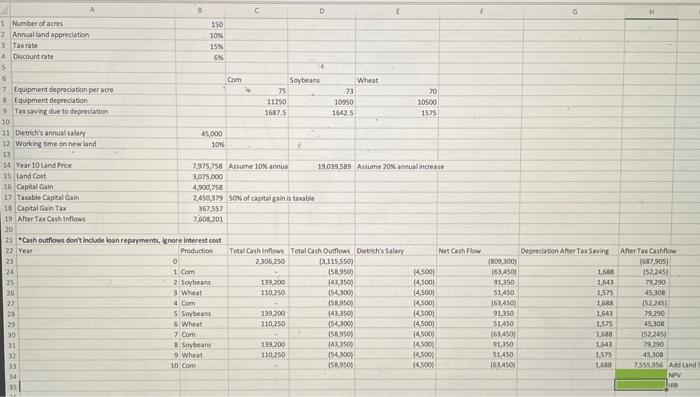

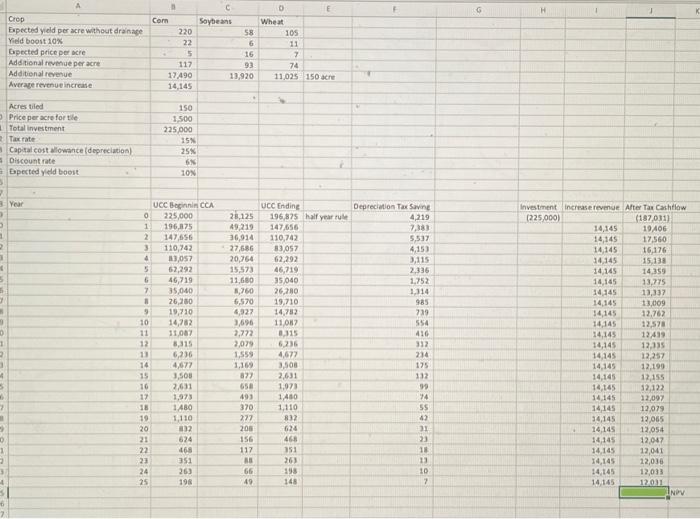

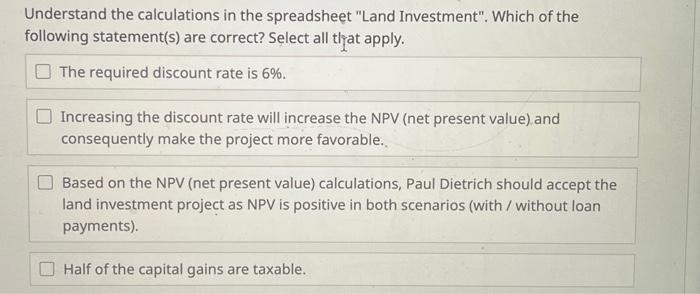

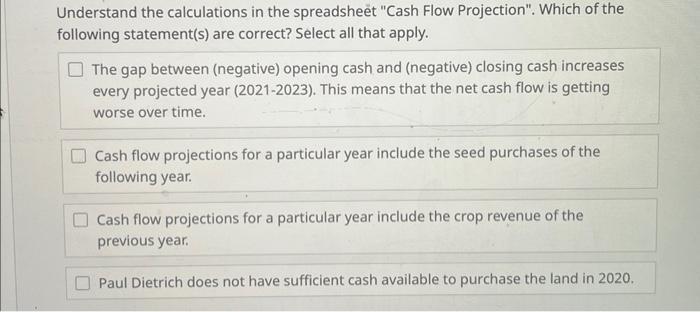

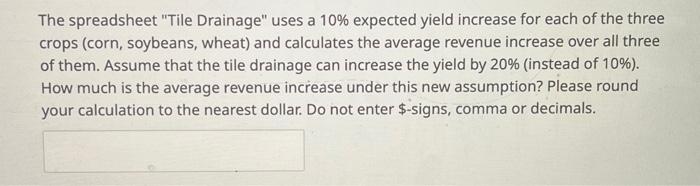

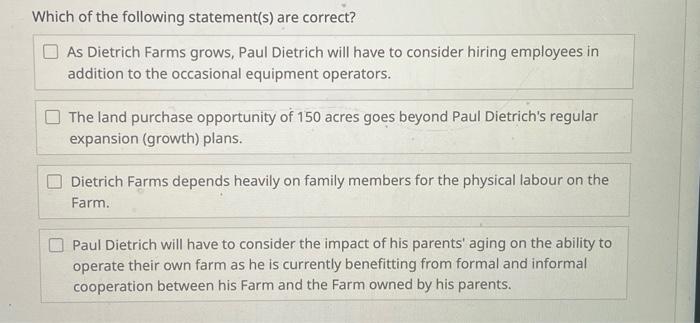

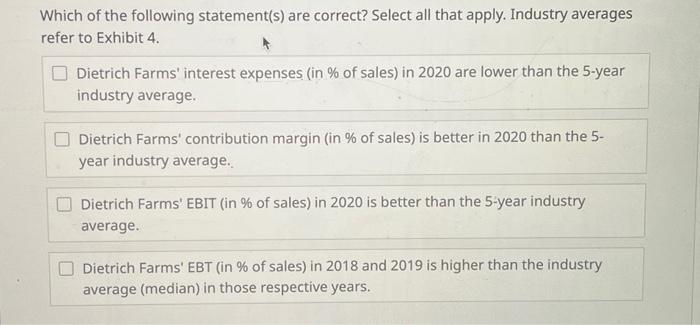

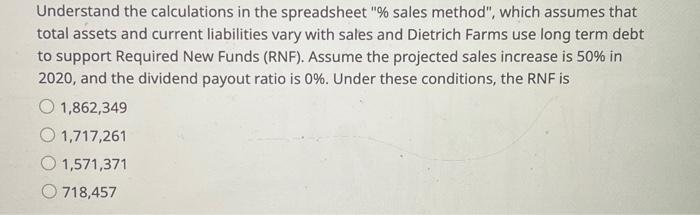

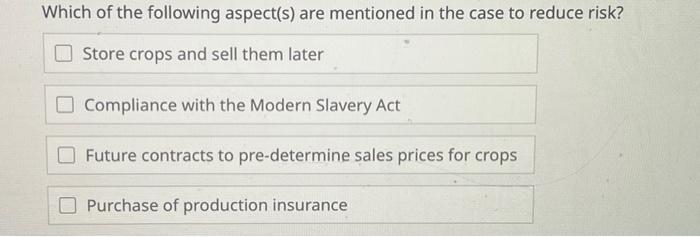

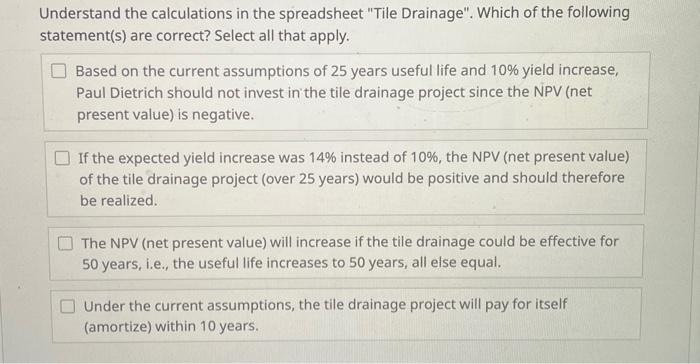

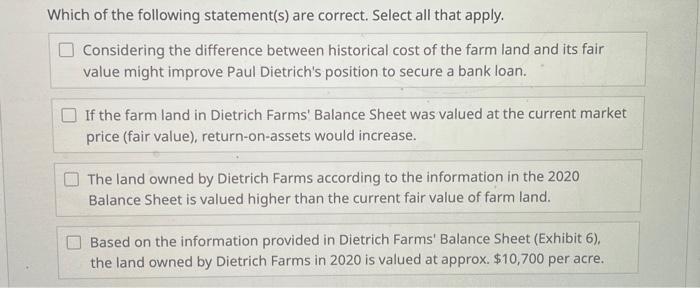

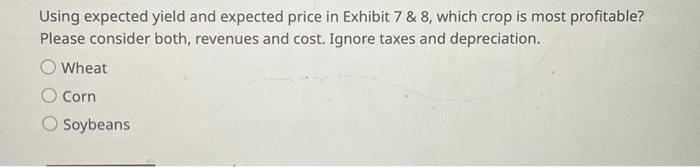

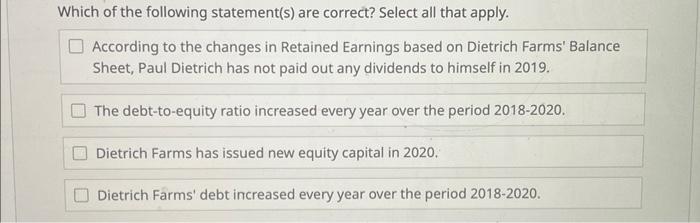

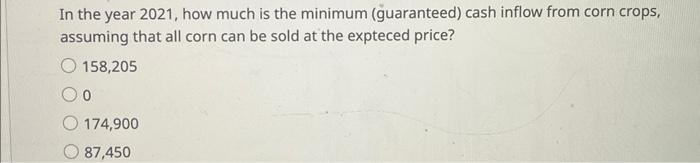

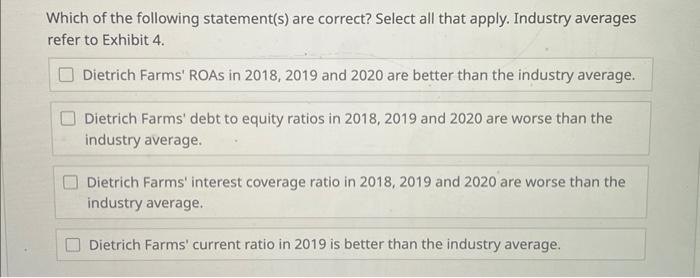

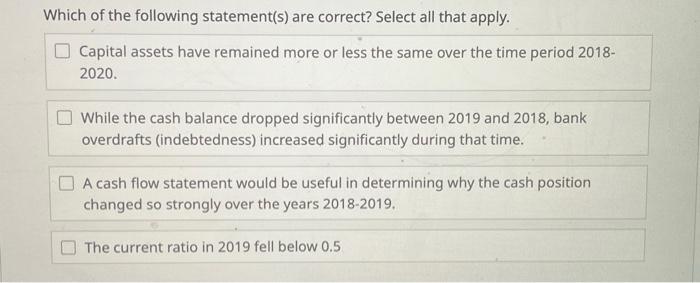

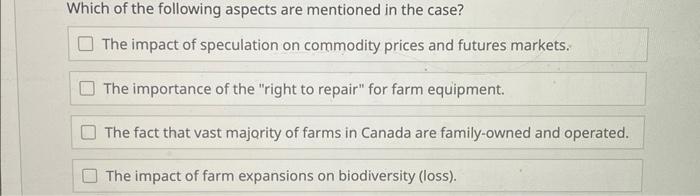

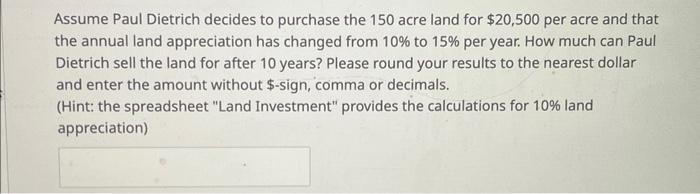

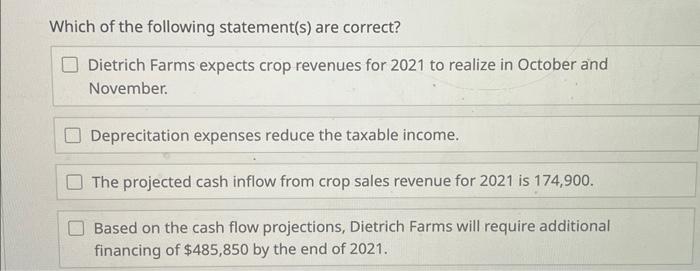

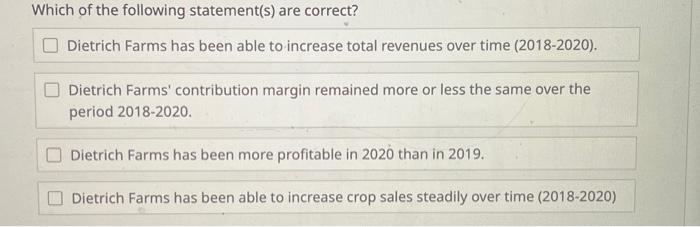

Which of the following statement(s) are correct? Select all that apply. Capital assets have remained more or less the same over the time period 2018 2020. While the cash balance dropped significantly between 2019 and 2018 , bank overdrafts (indebtedness) increased significantly during that time. A cash flow statement would be useful in determining why the cash position changed so strongly over the years 2018-2019. The current ratio in 2019 fell below 0.5 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & & & 2018 & & 2019 & & 2020 & \\ \hline & & & Actual & % of sales & Actual & \% of sales & Actual & \%of sales \\ \hline & Revenue & A & 7 & & & & & \\ \hline & Crop Sales & . & 818,564 & 96% & 795,377 & 90% & 1,049,760 & 85% \\ \hline & Crop Insurance & & 9,375 & 1% & - & 0% & 68,201 & 5% \\ \hline & Custom work & & 8,672 & 1% & 73,039 & 8% & 80,606 & 6% \\ \hline & Other income & & 17,771 & 2% & 18,020 & 2% & 42,999 & 3% \\ \hline & Total Revenue & & 854,382 & 100% & 886,436 & 100% & 1,241,566 & 100% \\ \hline & & & & & & & & \\ \hline & Production Costs & & & & & & & \\ \hline & Opening inventory & & 243,500 & 29% & 251,700 & 28% & 288,100 & 23% \\ \hline & Fertilizer and chemicals & . & 220,399 & 26% & 193,396 & 22% & 189,326 & 15% \\ \hline & Land rent & & 10,320 & 1% & 49,920 & 6% & 52,320 & 4% \\ \hline & Seed & & 42,033 & 5% & 50,655 & 6% & 45,593 & 4% \\ \hline & Drying and storage . & + & 29,277 & 3% & 52,789 & 6% & 41,755 & 3% \\ \hline & Fuel & & 24,236 & 3% & 26,805 & 3% & 33,952 & 3% \\ \hline & Crop insurance & & 15,011 & 2% & 12,089 & 1% & 9,414 & 1% \\ \hline & Marketing fees and levies & & 2,827 & 0% & 2,358 & 0% & 2,768 & 0% \\ \hline & Inventory available for sale & & 587,603 & 69% & 639,712 & 72% & 663,228 & 53% \\ \hline & Closing inventory & & 251,700 & 29% & 288,100 & 33% & 312,100 & 25% \\ \hline & Cost of Goods Sold (COGS) & & 335,903 & 39% & 351,612 & 40%[ & 351,128 & 28% \\ \hline & & & * & & & & & \\ \hline & Contribution Margin & & 518,479 & 61% & 534,824 & 60% & 890,438 & 72% \\ \hline 24 & Amortization of capital assets & & (95,056) & 11% & (101,451) & 11% & (99,955) & .8% \\ \hline 5 & Interest on long term debt & & (31,386) & 4% & (38,371) & 4% & (70,223) & .6% \\ \hline 26 & Other expenses & & (57,573) & 7% & (67,909) & 8% & (112,023) & 9% \\ \hline 27 & & & & & & & & \\ \hline 28 & Income Before Management Sal & laries and Income Taxes & 334,464 & 39% & 327,093 & 37% & 608,237 & 49% \\ \hline 29 & Management salaries & 4 & . & 0% & - & 0% & 45,540 & 4% \\ \hline 30 & Income Before Income Taxes & & 334,464 & 39% & 327,093 & 37% & 562,697 & 45% \\ \hline 31 & Income Taxes & & & 8 & & & & \\ \hline 32 & Current & & 50,800 & 6% & 44,000 & 5% & 49,500 & 4% \\ \hline 33 & Future & & 2,000 & 0% & 3,400 & 0% & 17,200 & 1% \\ \hline 34 & & & 52,800 & 6% & 47,400 & 5% & 66,700 & 5% \\ \hline 15 & Net income & & 281,664 & 33% & 279,693 & 32% & 495,997 & 40% \\ \hline 36 & & & 21 & & & & & \\ \hline 37 & & & = & & & & & \\ \hline 38 & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow{2}{*}{ Number of acres 2020} & \multirow{2}{*}{250Nerake} & \multirow[t]{2}{*}{ Nov } & Dec & \multirow[t]{2}{*}{ Total } & & \multirow{2}{*}{\multicolumn{6}{|c|}{ "Assume Ointrich's salory is not considened in the cakultions }} & & & \\ \hline & & & & & & & & & & & & & & & \\ \hline & Preceperast & 10,500 & & & & & & & & & & & & +8 & \\ \hline & & & & & & & & H. & & & & & & & \\ \hline & hlows & & & & & & & & & & & & & & \\ \hline & Firw mortepe on lund X fromatank & 75x & 2305,250 & & & & & & & & & & & & \\ \hline & Toeal inflem & & 2,206250 & & 2,305,250 & & & & & & & & & & \\ \hline & & & & : b & & & & & & & & & & & \\ \hline & Outlows. & & & & & & & & & & & & & & \\ \hline & Purthase of land & & & & mansumas & & & & & & & & & & \\ \hline & Loan parment (principletintersest) & & & (9200) & (9,800) & & & & & & & & & & \\ \hline & Fentiliter (2021 com). & 105 & (15,750) & & (15,750) & Ein & & & & & & & & & \\ \hline & Seed (2021 torn) & 100 & (15,000) & & (15,000) & & & & = & & & & & & \\ \hline & Toul outhowi & & & (9,300) & & & & & & & & & & & \\ \hline & & & & & & & & & & & & & & & = \\ \hline & Net canh flown & & (790,500) & (9,800) & & & & 2 & & & & & & & \\ \hline & Opemintcash. & & 500,000 & (299,500) & 500,000 & & & & & & & & & & \\ \hline & Cosingerah & & (253,500) & (309.300) & (109.300) & & & & & & & & & & \\ \hline & & & & & & & & & & & & & & & \\ \hline & 2021 & 1) Feracie & in & leb & Mar & ANr & Mar & lune & luky & Aut & sep & ot & Nov & Der & Total \\ \hline & Number of acio & 150 & & & & & & & & & & & & & \\ \hline & Cres & Com & -3 & & & & & & & & & & & & \\ \hline & & & & & & & & & & & \pm & & & & \\ \hline & Inhewi & & & & & & & & & & & & & & \\ \hline & Diming ef eropians. & & & & & = & & & & & & & & 50x & \\ \hline & Gopectid veld per Kre (bushelin) & & I & & & & & & & & & & & & \\ \hline & Gopected price & & - & & & & & & & & & & & & \\ \hline & Coepintions: & & & & & & & & & & & & & & \\ \hline as & Tetal inflomen & & & & a & s & . & 3 & + & & & . & & & - \\ \hline & & & & & & & & & & & & & & 2x & \\ \hline & Outhows (isee Eabilis sfor drats) & & & & & +2 & & & & & & & & & \\ \hline & ientiren ieptean forzozz & & & & & & & & & & & & {[12000}} & & (12000) \\ \hline & Chemed & 6 & \pm & & & & (5,109) & (5,160) & & & & & & & (10200) \\ \hline 14 & fuet & 20 & & & & (1,500) & & & & & [t.S00) & & & & 0000 \\ \hline is & & y & & & & & & & & & & (14,550) & & & (104510) \\ \hline & Govisovemiferzo2z. & 65 & = & & & & & & E & & & & (B), 50 ) & & 10,750 \\ \hline 17 & Crep intiurence & 20 & & & & & 13,009 & & & & & & & & (9,000) \\ \hline 11 & Propentrases & 30 & (1,125) & & & (0,125) & & & (1,125) & & & (1,125) & & & (4,500) \\ \hline 10 & Cutem mork & 1) & & & & & (9)5) & (975) & & & & & & & (1.080) \\ \hline$0 & & & (900) & 19,000 & & 19,009 & (0,400) & (0800) & (92001 & (i) & Qsoon) & (0.nool & (2sece) & (9A00) & (117), \\ \hline & Totuchitlons & & (10.025) & {[0.000]} & Q.000i & (12425) & 18.875) & (15,A7s). & (10,225) & (Q,aoo) & tassoot & a25,4751 & {11550} & (Q)aoo) & (176,550) \\ \hline 42 & & & & & & & & & & & & & & & \\ \hline 43 & Netcanh flowi & & (10,225) & (3,800) & (9,800) & (12,425) & (16)7s) & (15, ans) & (10,925) & (9.800) & (11,100) & (25,475) & (11,sso) & (9,000) & (17) 5501 \\ \hline 44 & Opening caih & & (009,300) & (30,23) & (asoors) & (a39.075) & (as) 250 & (an,12si & = & & (409,73) & (419,025) & (444,500) & (476050) & 000,100) \\ \hline is & Clotingean & & (120,225) & (130025) & (119829) & {[152,250)} & (971125) & (0a,000) & & (401,729) & (410.023) & (444,500) & (476,050) & (ansesso) & (405s 2300) \\ \hline \end{tabular} Assume Paul Dietrich decides to purchase the 150 acre land for $20,500 per acre and that the annual land appreciation has changed from 10% to 15% per year. How much can Paul Dietrich sell the land for after 10 years? Please round your results to the nearest dollar and enter the amount without \$-sign, comma or decimals. (Hint: the spreadsheet "Land Investment" provides the calculations for 10% land appreciation) Understand the calculations in the spreadsheet "Cash Flow Projection". Which of the following statement(s) are correct? Select all that apply. The gap between (negative) opening cash and (negative) closing cash increases every projected year (2021-2023). This means that the net cash flow is getting worse over time. Cash flow projections for a particular year include the seed purchases of the following year. Cash flow projections for a particular year include the crop revenue of the previous year. Paul Dietrich does not have sufficient cash available to purchase the land in 2020. In the year 2021, how much is the minimum (guaranteed) cash inflow from corn crops, assuming that all corn can be sold at the expteced price? 158,205 0 174,900 87,450 Understand the calculations in the spreadsheet "\% sales method", which assumes that total assets and current liabilities vary with sales and Dietrich Farms use long term debt to support Required New Funds (RNF). Assume the projected sales increase is 50% in 2020 , and the dividend payout ratio is 0%. Under these conditions, the RNF is 1,862,349 1,717,261 1,571,371 718,457 Which of the following statement(s) are correct? Select all that apply. Industry averages refer to Exhibit 4. Dietrich Farms' ROAs in 2018,2019 and 2020 are better than the industry average. Dietrich Farms' debt to equity ratios in 2018, 2019 and 2020 are worse than the industry average. Dietrich Farms' interest coverage ratio in 2018, 2019 and 2020 are worse than the industry average. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & a & c & 0 & E & & 6 & K & \\ \hline & N-mber of aches & 150 & & m= & & & & & \\ \hline & Annual land appreciution & 10x & & & & & +1 & & \\ \hline & Taxnte. & 15s & & & & & & + & \\ \hline & Discount rate & ss & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & com & Soybeans & Wheat & & & & \\ \hline 7 & Equipenent depreciation per acre & & 75 & 73 & 70 & & & & \\ \hline 8 & Equpment deprecation & & 11250 & 10350 & 10500 & & & & \\ \hline 9 & Takswing due to depredarion & & 1687.5 & 1542.5 & 1575 & 3 & & & \\ \hline 80 & & & & & : & & & & 2 \\ \hline 11 & Diethichs annualsalary & 45,000 & & & & & & & \\ \hline 12 & Working time on new land & 10% & a. & & & & & & \\ \hline 13 & & & & & & & & & \\ \hline 14 & Year 10 Land Price & 7,975,758 & Assume 10 s arnis: & 19,039,589 & Assume 20K amual increas & & & & \\ \hline 15 & Land Cost & 3,075,000 & & & & & & & \\ \hline 16 & Capalcain & 4,500,58 & & & & & & & \\ \hline 17 & Taxable Copral Gain & 2cos0379 & Son of capital cainis & is taxable & & & & & \\ \hline 18 & Coptal Gan Tax & 367.557 & & & & & & & \\ \hline 10. & Aher Tax Cash inflows: & 7608201 & & & & & & & \\ \hline 20 & & & & & & & & & \\ \hline 21 & "Gash outflows dont include loan repayments, lenore & re interestcost. & & & & & & & \\ \hline & Year & Preduction: & Tetaicathinflow & Total Cath Outfows & Ointichissiany & Net Conhflow & Orortciation Aleer Tox Soving & Afer TaxOihflow & \\ \hline 23 & 0 & & 2,305,750 & (3,115,550) & & (809,300) & & (587,905) & \\ \hline 24 & 18 & com & - & (158950) & (4,500) & (59,450) & 1,5ks & (52,245) & \\ \hline 25 & =25 & soybeans & 139,200 & (43,350) & (4,50) & 91,350 & 1,643 & 79,290 & \\ \hline 26 & 3x & What & 110,250 & (54,300) & (4,500) & 51,450 & 1,575 & 45,308 & \\ \hline 23 & 40 & com & & (SB950) & (4,500) & (63/450) & 1,628 & (52245) & \\ \hline 23 & 5 & Soybeufs & 139200 & (43,350) & 145001 & 91,350 & 1,643 & 79,290 & \\ \hline 29 & 6 & Whest & 110,250 & (56,300) & (4,500) & 51=50 & 1,575 & 45,308 & \\ \hline 30 & 70 & com & 5 & (issasen) & (4.500) & & Leas & (52,245) & \\ \hline nI & 8. & Soyteans & 139,200 & (43,350) & (4,500) & 91,350 & 1,543 & 79,290 & \\ \hline 32 & 3x & Whent & 110,250 & (54,300) & (4,500) & 51450 & 155 & 45,300 & \\ \hline 33 & 100 & com & . & (5k.950) & (4.500) & (694400) & 1,k31 & 2555046 & Adtand: \\ \hline 34 & + & & E & & & & & & nov \\ \hline 351 & & & & & & & & & ling \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & 20x2 & 2 Nerace. & lan & feb & Mar & Ap & Mar & hine & & A4 & sen & ors & Now & Dex & Total \\ \hlinea & & 150 & & & & & & & & & & & H & & \\ \hline 490 & 000 & Sogean & & 2 & & & & & & & & & & & \\ \hline so & & & & & & & & & & = & & 4 & = & & \\ \hline & Inlown & & & & & & & & & & & & & & \\ \hline 80 & Timint ol oos rintur & & & & & & 4 & & & & & 300 & sos & & \\ \hline 31 & & $ & & & & & & & & & & & & & \\ \hline 4E & Evenced onion & 16. & & & & & & & & & & & & & \\ \hline 350 & Crog infous & & = & * & & & & & & & & c9,600 & 6900 & & 239,200 \\ \hline & Total infison. & y= & + & & = & & & & ? & (. & & 69600 & 69600 & . & 1920 \\ \hline 37) & & 3 & & & & & & + & & & & & & n & \\ \hline 80 & outhion & & & & & & & & & & & & & & \\ \hline & Fentilier: =hent or 2003 & 5 & & 1 & Ex & & & & & & & & (22,250) & & \\ \hline 60 & Oenirial & 85 & & & & & (5.35) & 5,3m & & & & & & & \\ \hline & Foel & 17 & & & & {[2,2ms} & & & & x1 & {[1,2m)} & & & & \\ \hline0 & Drgins and sorat: & a & & & & & & & & & & asco) & & & a,00 \\ \hlineas & Sondiminent terious & 35 & & & & & & & & & & & {[5,250)} & 4 & 15,259 \\ \hline 40 & & n & & & & & (1.650)3 & & & & & & & & 11000 \\ \hline is & Propety ines & & (213) & & & (2,18) & & & (12.25) & & & & & & |s.soo| \\ \hline 48 & Cutoen wers & & & & & & & & & & & & & & \\ \hline ar & Loun purment berinopintinteredi & & D.000 & R & 0,000 & & & P.5001 & & 0,006 & p.socel & & & & (117,600) \\ \hline & Total enenoms. & & (a033) & paso: & 0.000 & (12,200) & & (16,7s) & (a) 225) & DAOOS & (1) ons) & (14005) & (27) & D, loo & (riasso) \\ \hline is & & & & & & & & & & & & & & & \\ \hline & Not aufirm & & (20025): & D)1 & P.000 & (12,2) & & [6,13) & 00925) & & (ators) & 54,m5 & 41,000 & Dioet & 01,730 \\ \hlinenc & oseving ash. & & Juswoi! & (10xkns) & ponsts: & 3 [3ic,sis] & & {[346,400)} & i) (067,575) & prissoos & (censoo) & (BA.MS) & 519.600 & & (Assese \\ \hlinec & & & & (00655) & (sigins) & 7. isanssi & & (86)575) & enssoo & & (pouss) & & (4mponi & (Bor, 600 . & ser, 600 \\ \hline 7 & & & & & & & & & & & & & & & \\ \hline 24 & 2023 & Nerteofe & Int & Fot: & Mar & Arr & May & & hey & Ais: & Sope & ot & Now & Oes: & Total \\ \hlinen & Number dogn & 130 & & & & & & & & & & & & & \\ \hline 360 & osp & whent. & & & & & & & & & & & & & \\ \hlinen & & & & & & & & & - & & & & & & \\ \hline 3x & intion: & & & & & & & & & & & & & & - \\ \hline 31 & Tinive of eropievere & & & & & = & E & & & ex: & sen & & & & \\ \hline0 & Ispected vietid per aco Brakelel & 105 & & & & & & & & & & & & & \\ \hline & Coected prise & 7 & & & & 6 & & & & & & & & & \\ \hline u & Crop infoust: & & & & & & & & & 5x125 & 55,135 & & & & 130,250 \\ \hlinent & tetalinflom & & & 2 & & & & \% & . & Ssuas & ss.12s & . & & . & Ha reo \\ \hline 4 & & & & & & +1 & & E & E- & 8 & & & & & \\ \hline 750 & outlown & & & & = & & & & & & 3 & & & & \\ \hline & fertilint corn for 2024 & 105 & & & & & & & & & & & a5,7501 & & \\ \hline ir & Oumial & 40 & & = & & & 0.000001 & 0.00000 & . & = & & & & & \\ \hlinem6 & Fuel & 20 & & & E & 1950000 & & & & & a.s.0001 & & & & 0,008 \\ \hlinem0 & Oryivend inor ats & 265 & & & - & & & +1 & & & & a,ms+ & & & a,msi \\ \hline so 5 & Setd com for zole & 100 & & & = & & & & & 3 & & & is, 00 & & issocoi \\ \hline & Gopinavaner & 105 & & & & & (1,5750) & & & & & & & & (15) \\ \hlinenh & mopetortans & 10 & [i, 135 & & & 0,125) & & & 0,125 & & & 0.128 & & & Hesom \\ \hlinen & Cuitemwer. & 30 & & & & & 0,20001 & 0,25000 & & s. & & & & & kso \\ \hlineM & Can paycuent brincipletinterest) & & D.100: & & Q.1001 & 0.000 & enoi & P.ook & & & 0,800 & 0,100 & & Qunoo & ais, \\ \hline Bs & Total eation & & {[10,35]} & asool & B,000 & & asens! & ascos: & & anom & & & 1aseser & ascoi & aroos \\ \hline & & & & & & & & & & & & & & & \\ \hline s. & wat ainh flios: & & (10,38) & & p.Nom & (12,es) & (16.625). & as,osel & (10035) & 45,325 & & {[04,900} & 10069 & Now & arses: \\ \hline 10 & Coening anh & & {[507,00} & & (oxalas) & (5),18s) & 1550,5501 & (69,175s & cos, ms & (593150 & {[54705]} & pet,000 & & osenes & nos, exy \\ \hlinenc & donicas & & & (5)ansi & (siansi & asasise & 1. 150,13) & 502,207 & (x93,150) & & Botpooi & Bis, 100 & ciseasei. & corasi. & \\ \hline \end{tabular} Using expected yield and expected price in Exhibit 7&8, which crop is most profitable? Please consider both, revenues and cost. Ignore taxes and depreciation. Wheat Corn Soybeans Which of the following statement(s) are correct? As Dietrich Farms grows, Paul Dietrich will have to consider hiring employees in addition to the occasional equipment operators. The land purchase opportunity of 150 acres goes beyond Paul Dietrich's regular expansion (growth) plans. Dietrich Farms depends heavily on family members for the physical labour on the Farm. Paul Dietrich will have to consider the impact of his parents' aging on the ability to operate their own farm as he is currently benefitting from formal and informal cooperation between his Farm and the Farm owned by his parents. Which of the following statement(s) are correct? Dietrich Farms expects crop revenues for 2021 to realize in October and November. Deprecitation expenses reduce the taxable income. The projected cash inflow from crop sales revenue for 2021 is 174,900 . Based on the cash flow projections, Dietrich Farms will require additional financing of $485,850 by the end of 2021 . The spreadsheet "Tile Drainage" uses a 10% expected yield increase for each of the three crops (corn, soybeans, wheat) and calculates the average revenue increase over all three of them. Assume that the tile drainage can increase the yield by 20% (instead of 10% ). How much is the average revenue increase under this new assumption? Please round your calculation to the nearest dollar. Do not enter \$-signs, comma or decimals. \begin{tabular}{|c|c|c|c|c|} \hline Median Profitability Ratio for Ontario Field Crop Farms & 2018 & 2019 & 2020 & (as \% of sales) \\ \hline Contribution margin & 0.66 & 0.65 & 0.64 & \\ \hline EBIT & 0.18 & 0.11 & 0.12 & \\ \hline Interest expenses & 0.02 & 0.04 & 0.03 & \\ \hline EBT (Net Farm Income) & 0.15 & 0.08 & 0.09 & \\ \hline & & & & \\ \hline Dietrich Farms & 2018 & 2019 & 2020 & (as % of sales) \\ \hline Contribution margin & 0.61 & & & \\ \hline EBIT & 0.43 & & & \\ \hline Interest expenses & 0.04 & & & \\ \hline EBT & 0.39 & & & \\ \hline Net Income & 0.33 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline A & a & c & 0 & E & E & 6 & H & 1 & J & k \\ \hline Cop & Corn & Soybeans & Whest & & & & & & & \\ \hline Expected yeld per acre without drainage & 220 & 58 & 105 & & & & & & & \\ \hline Yedd boost 10x & 22 & 6 & 11 & & & & & & & \\ \hline Gopected price per acie & 8- & 16 & 7 & & & & & & & \\ \hline Additional revmue per acre & 117 & 93 & 74 & & .. & & & & & \\ \hline Additional revenue & 17,490 & 13,920 & 11,025 & 150 acte & 11 & E & & at & & \\ \hline Averabe revenue increase & 14,145 & & & & & & & & & \\ \hline & & + & & & & & & & & \\ \hline Acres tiled & 150 & & & & & & & & & \\ \hline Price per acie for tle. & 1,500 & & & & & & & & & \\ \hline Fotal investment & 225000 & & & & & & & & & \\ \hline Taxinte & 15x & & & & & & & & & \\ \hline Capital cost allowance (depreciation) & 25 & & & & & \pm & & 7 & & \\ \hline Discount rate & 6 & & & r & & 2 & & & IIIII & \\ \hline Epected yeld boost & 10N & E & & & & & & & & \\ \hline & & & & 4 & & & & & & \\ \hline . & & & & & & & & & & \\ \hline Year & ucc Bosinnin & ACCA & ucc ending & & Depreciation Tax savene & & Investiment & increaserevenue: & - Afte tar Coshit & \\ \hline 0 & 225,000 & 28,125 & 196,875 & half year tule & 4,219 & & (225,000) & & (187,031) & \\ \hline 1 & 196,175 & 49,219 & 147,656 & & 7,383 & & & 14,145 & 19,406 & \\ \hline 2 & 147,656 & 36,914 & 110,742 & & 5,537 & & & 14,145 & 17,560 & \\ \hline 3 & 110,742 & 27,686 & 83,057 & & 4,153 & & & 14,145 & 16,176 & \\ \hline 4 & 13,057 & 20,764 & 62,292 & & 3,115 & & & 14,145 & 15,138 & \\ \hline & 62,292 & 15,573 & 46,719 & & 2,336 & & & 14,145 & 14,359 & \\ \hline 3 & 46,719 & 11,680 & 35040 & & 1,752 & & & 14,145 & 13,775 & \\ \hline 7 & 35,040 & 8,760 & 26,2110 & & 1,314 & & 4 & 14,145 & 13,337 & \\ \hline a & 26,250 & 6,570 & 19,710 & & 985 & & & 14,145 & 13,009 & \\ \hline 9 & 19,710 & 4,927 & 14,732 & & 739 & & & 14,145 & 12,767 & \\ \hline 5x & 14,732 & 3,696 & 11,067 & % & 554 & & & 14,145 & 12,571 & \\ \hline Exto & 11,007 & 2,m & 0,315 & & 416 & & & 14,145 & 12,439 & \\ \hline & 8,315 & 2,079 & 6,236 & & 312 & & & 14,145 & 12,315 & \\ \hline 11 & 6,236 & 1,559 & 4,677 & & 2n & & & 14,145 & 12,257 & \\ \hline 14 & 4,677 & 1,169 & 3,508 & & 175 & & & 14,145 & 12,199 & \\ \hline+1 & 3,508 & an & 2.631 & & 132 & & & 14,145 & 12,155 & \\ \hline 16 & 2,631 & 658 & 1,977 & & n & & & 14,245 & 12,122 & \\ \hline 17 & 1,973 & 493 & 1,40 & & 74 & 3 & the & 14,145 & 12.097 & \\ \hline 18 & 1.480 & 370 & 1,110 & & 55 & & & 14,145 & 12,079 & \\ \hline 19 & 1,110 & m & 832 & & 4) & & & 34,145 & 12.065 & \\ \hlineE & 132 & 200 & 624 & & 3 & 4 & & 14,145 & 12,054 & \\ \hline 21 & 624 & 156 & 468 & & 23 & & & 14,145 & 12,047 & \\ \hline 22 & 468 & 117 & 151 & & 11 & & & 14,145 & 12,041 & \\ \hline 23 & 351 & ai & 263 & III. & 13 & & & 14,145 & 12,036 & \\ \hline 24 & 263 & 66 & 198 & & 10 & & +4 & 14,145 & 12,033 & \\ \hline 25 & 198 & 49 & 148 & & 7 & & & 14,145 & 12011 & \\ \hline & & 11 & & & & +2 & 7 & & & INen \\ \hline=0 & & & & & & & & & & \\ \hline \end{tabular} Which of the following statement(s) are correct? Select all that apply. Industry averages refer to Exhibit 4. Dietrich Farms' interest expenses (in \% of sales) in 2020 are lower than the 5-year industry average. Dietrich Farms' contribution margin (in \% of sales) is better in 2020 than the 5year industry average. Dietrich Farms' EBIT (in \% of sales) in 2020 is better than the 5-year industry average. Dietrich Farms' EBT (in \% of sales) in 2018 and 2019 is higher than the industry average (median) in those respective years. \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline A & a & c & 0 & t & f. & G & H & 1 \\ \hline Number of acres & 150 & & & & & & & \\ \hline Ansual land appreciation & 10x & & & & & & & \\ \hline Taxrote & 15x & = & & & & & & \\ \hline \multirow[t]{3}{*}{ Discount rome } & 6x & & & & & s. & & \\ \hline & & & & & & & & \\ \hline & & Com & Soybeans & Wheat : & 1 & & & \\ \hline Equipment depreciation per acre & & 75 & n & 70 & & & & \\ \hline fquipment depreciation & & 11250 & 10.950 & 10,500 & & & & \\ \hline Tax saving due to depreciation & & 1687.5 & 16425 & 1575 & & & & \\ \hline & & & & 10 & & & & \\ \hline Dietrichis annual wary & 45,000 & & & & & 9 & & \\ \hline Working time on new land & 10x & & & & & & & \\ \hline & & & & = & & & & \\ \hline Vear 10 Lund Price & 7,975,758 & \multicolumn{2}{|c|}{ Assume 10K arnual appreciation } & & & & & \\ \hline Land Cost & 3,075,000 & & & & +1 & & & \\ \hline Capital Gain & 4,900,758 & & & & & & & \\ \hline Taxable Capitat Gain & 2,450,378 & \multicolumn{2}{|c|}{ Sok of capital ean is taxuble } & & & & & \\ \hline Copital Gain Tan & 367,557 & & & & & & & \\ \hline Nite Tax Cash infloms & 7,608,201 & \% & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & \\ \hline rear & Production & Total Cash inflowe & Total Cash Outfion & Dietrich's Salary & Net Cash How & Depreciation Arter Tax Soming & \multicolumn{2}{|l|}{ Aher Tar Conhilow } \\ \hline 0 & & 2,306,250 & (3,115,550) & & (1009,300) & & (6.7,905) & \\ \hline 1 & Com & & (58,550) & (4,500) & (6)A50) & 1,684 & (52,245) & \\ \hline & Soybeans: & 139,260 & (43,350) & (4.500) & 91,350 & 1,543 & 79,290 & \\ \hline & When & 110,250 & (54,300) & (4,500) & 51450 & 1,575 & 45,304 & \\ \hline & Corn & & (58,950) & (4,500) & (63,A50) & 1,6811 & (52,245) & \\ \hline & sorbeans. & 139,200 & (43,350) & (4,500) & 91,350 & 1,643 & 29,290 & \\ \hline It & When & 110,250 & (54,300) & (4.500) & 51,450 & 1,575 & 45, 3011 & \\ \hline= & carn & & (5s.950) & (4,500) & (63,450) & 1,681 & (52,245) & \\ \hline & Soyeans: & 139,200 & (43,350) & (4,500) & 81,350 & 1,64) & 70,250 & \\ \hlinex= & Wheat & 110,250 & (54,300) & (4500) & 51,450 & 1,575 & 45,301 & \\ \hline & com & . & (58.250) & (4,5) & (63,450) & 1,683 & 2555.256 & \multirow{2}{*}{\begin{tabular}{l} Add Lind sales \\ J ver \end{tabular}} \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & \\ \hline Ved & Production & Total Cash inflow: & Total Canh Outflow & Dietrichs salary & Net Conh fiow & Oegrecixion After Tra Saving & \multicolumn{2}{|l|}{ Ater far Conhfore } \\ \hline a & & 2,306,250 & 0,115.550) & & (809.300) & & (6a7905) & \\ \hline 3 & Con & & (176.550) & (6,500) & (181050) & 1.68a & (152,205) & \\ \hline 2 & Soybeans & 139200 & (160,950) & (4,500) & (26,250) & 1.543 & (20,670) & \\ \hline 3 & Whent & 110,250 & (171,900) & (4,500) & (66,150) & 1,575 & (54,653) & \\ \hline 4 & Con & & (176,550) & (4,500) & (131,050) & 1,688 & (152,205) & \\ \hline 2= & Soybeans & 139,200 & (160,950) & (4.500) & (26,250) & 1,643 & 020,5701 & \\ \hline & Whest & 110,250 & (171,9) & (0,500) & (66,150) & 1,575 & (54,653) & \\ \hline & Corn & = & [176,550] & (4,500) & (181,050) & 1,68s & (152,205) & \\ \hline 5 & Soyprass & 139,200 & (160,950) & (4,500) & (26,250) & 1,643 & (20,670) & \\ \hline 9 & Whes: & 110,250 & (171,900) & (4,500) & (66,150) & 1,575 & (54,653) & \\ \hline 10 & conn & + & (176,550) & (4,500) & (181050) & 1, 5BB & 7455.996A & Add Land Sule \\ \hline & & & & & & & & NPV \\ \hline \end{tabular} Which of the following statement(s) are correct. Select all that apply. Considering the difference between historical cost of the farm land and its fair value might improve Paul Dietrich's position to secure a bank loan. If the farm land in Dietrich Farms' Balance Sheet was valued at the current market price (fair value), return-on-assets would increase. The land owned by Dietrich Farms according to the information in the 2020 Balance Sheet is valued higher than the current fair value of farm land. Based on the information provided in Dietrich Farms' Balance Sheet (Exhibit 6), the land owned by Dietrich Farms in 2020 is valued at approx. $10,700 per acre. Understand the calculations in the spreadsheet "Land Investment". Which of the following statement(s) are correct? Select all that apply. The required discount rate is 6%. Increasing the discount rate will increase the NPV (net present value) and consequently make the project more favorable. Based on the NPV (net present value) calculations, Paul Dietrich should accept the land investment project as NPV is positive in both scenarios (with / without loan payments). Half of the capital gains are taxable. Which of the following aspect(s) are mentioned in the case to reduce risk? Purchase of production insurance Which of the following statement(s) are correct? Dietrich Farms has been able to increase total revenues over time (2018-2020). Dietrich Farms' contribution margin remained more or less the same over the period 2018-2020. Dietrich Farms has been more profitable in 2020 than in 2019. Dietrich Farms has been able to increase crop sales steadily over time (2018-2020) Expected Income Expected Sales Expected Expenses Fertilizer Seed Production insurance premium Fuel Chemical Custom work Drying, storage, and other expenses 1 Total Expenses Which of the following aspects are mentioned in the case? The impact of speculation on commodity prices and futures markets. The importance of the "right to repair" for farm equipment. The fact that vast majority of farms in Canada are family-owned and operated. The impact of farm expansions on biodiversity (loss). Which of the following statement(s) are correct. Select all that apply. Paul Dietrich has the power to withdraw a higher salary than $45,000 per year if he wants since he is the sole owner of the business. Dietrich Farms has invested significantly in capital assets in 2019 (compared to 2018). Paul Dietrich does not have to pay any personal tax on his salary because the Farm is paying taxes already. Capital assets in Dietrich Farms' case include equipment as well as land. Which of the following statement(s) are correct? Select all that apply. According to the changes in Retained Earnings based on Dietrich Farms' Balance Sheet, Paul Dietrich has not paid out any dividends to himself in 2019. The debt-to-equity ratio increased every year over the period 2018-2020. Dietrich Farms has issued new equity capital in 2020. Dietrich Farms' debt increased every year over the period 2018-2020. Understand the calculations in the spreadsheet "Tile Drainage". Which of the following statement(s) are correct? Select all that apply. Based on the current assumptions of 25 years useful life and 10% yield increase, Paul Dietrich should not invest in the tile drainage project since the NPV (net present value) is negative. If the expected yield increase was 14% instead of 10%, the NPV (net present value) of the tile drainage project (over 25 years) would be positive and should therefore be realized. The NPV (net present value) will increase if the tile drainage could be effective for 50 years, i.e., the useful life increases to 50 years, all else equal. Under the current assumptions, the tile drainage project will pay for itself (amortize) within 10 years. Which of the following statement(s) are correct? Select all that apply. Dietrich Farms rotates three crops. Dietrich Farms pruchases seeds and fertilizers in the same year of the growing season. Dietrich Farms has 2 non-family employees. Dietrich Farms is exempted from tax. \begin{tabular}{|c|c|c|c|c|c|} \hline 1 & Average Financial Ratios for all Ontartio Farms & 2018 & 2019 & 2020 & \\ \hline 2 & Current Ratio & 1.922 & 1.996 & 2.165 & \\ \hline 3 & Acid test (quick ratio) & 0.450 & 0.462 & 0.484 & \\ \hline 4 & Debt to equity & 0.198 & 0.202 & 0.204 & \\ \hline 5 & Return on assets & 0.016 & 0.017 & 0.022 & \\ \hline 6 & Return on equity & 0.011 & 0.011 & 0.017 & a. \\ \hline 7 & Interest coverage (Times interest earned) & 2.247 & 2.215 & 2.994 & B \\ \hline 8 & & 8 & x0 & & \\ \hline 9 & Dietrich Farms & 2018 & 2019 & 2020 & \\ \hline 10 & Current Ratio & 3.827[ & & & Current Assets/Current Liabilities \\ \hline 11 & Acid test (quick ratio) & 1.019 & & & (Cash+Accounts Receivable)/Current Liablitilie \\ \hline 12 & Debt to equity & 1.346 & & & Total Debt/Total Equity \\ \hline 13 & Return on assets & 0.118 & & & Net Income/Total Assets \\ \hline 14 & Return on equity & 0.277 & & & Net Income/Total Equity \\ \hline 15 & Interest coverage (Times interest earned) & 11.656 & & & EBIT/Interest \\ \hline 16 & & . & & & \\ \hline 17 & & & & & \\ \hline \end{tabular} Which of the following statement(s) are correct? Select all that apply. Capital assets have remained more or less the same over the time period 2018 2020. While the cash balance dropped significantly between 2019 and 2018 , bank overdrafts (indebtedness) increased significantly during that time. A cash flow statement would be useful in determining why the cash position changed so strongly over the years 2018-2019. The current ratio in 2019 fell below 0.5 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & & & 2018 & & 2019 & & 2020 & \\ \hline & & & Actual & % of sales & Actual & \% of sales & Actual & \%of sales \\ \hline & Revenue & A & 7 & & & & & \\ \hline & Crop Sales & . & 818,564 & 96% & 795,377 & 90% & 1,049,760 & 85% \\ \hline & Crop Insurance & & 9,375 & 1% & - & 0% & 68,201 & 5% \\ \hline & Custom work & & 8,672 & 1% & 73,039 & 8% & 80,606 & 6% \\ \hline & Other income & & 17,771 & 2% & 18,020 & 2% & 42,999 & 3% \\ \hline & Total Revenue & & 854,382 & 100% & 886,436 & 100% & 1,241,566 & 100% \\ \hline & & & & & & & & \\ \hline & Production Costs & & & & & & & \\ \hline & Opening inventory & & 243,500 & 29% & 251,700 & 28% & 288,100 & 23% \\ \hline & Fertilizer and chemicals & . & 220,399 & 26% & 193,396 & 22% & 189,326 & 15% \\ \hline & Land rent & & 10,320 & 1% & 49,920 & 6% & 52,320 & 4% \\ \hline & Seed & & 42,033 & 5% & 50,655 & 6% & 45,593 & 4% \\ \hline & Drying and storage . & + & 29,277 & 3% & 52,789 & 6% & 41,755 & 3% \\ \hline & Fuel & & 24,236 & 3% & 26,805 & 3% & 33,952 & 3% \\ \hline & Crop insurance & & 15,011 & 2% & 12,089 & 1% & 9,414 & 1% \\ \hline & Marketing fees and levies & & 2,827 & 0% & 2,358 & 0% & 2,768 & 0% \\ \hline & Inventory available for sale & & 587,603 & 69% & 639,712 & 72% & 663,228 & 53% \\ \hline & Closing inventory & & 251,700 & 29% & 288,100 & 33% & 312,100 & 25% \\ \hline & Cost of Goods Sold (COGS) & & 335,903 & 39% & 351,612 & 40%[ & 351,128 & 28% \\ \hline & & & * & & & & & \\ \hline & Contribution Margin & & 518,479 & 61% & 534,824 & 60% & 890,438 & 72% \\ \hline 24 & Amortization of capital assets & & (95,056) & 11% & (101,451) & 11% & (99,955) & .8% \\ \hline 5 & Interest on long term debt & & (31,386) & 4% & (38,371) & 4% & (70,223) & .6% \\ \hline 26 & Other expenses & & (57,573) & 7% & (67,909) & 8% & (112,023) & 9% \\ \hline 27 & & & & & & & & \\ \hline 28 & Income Before Management Sal & laries and Income Taxes & 334,464 & 39% & 327,093 & 37% & 608,237 & 49% \\ \hline 29 & Management salaries & 4 & . & 0% & - & 0% & 45,540 & 4% \\ \hline 30 & Income Before Income Taxes & & 334,464 & 39% & 327,093 & 37% & 562,697 & 45% \\ \hline 31 & Income Taxes & & & 8 & & & & \\ \hline 32 & Current & & 50,800 & 6% & 44,000 & 5% & 49,500 & 4% \\ \hline 33 & Future & & 2,000 & 0% & 3,400 & 0% & 17,200 & 1% \\ \hline 34 & & & 52,800 & 6% & 47,400 & 5% & 66,700 & 5% \\ \hline 15 & Net income & & 281,664 & 33% & 279,693 & 32% & 495,997 & 40% \\ \hline 36 & & & 21 & & & & & \\ \hline 37 & & & = & & & & & \\ \hline 38 & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow{2}{*}{ Number of acres 2020} & \multirow{2}{*}{250Nerake} & \multirow[t]{2}{*}{ Nov } & Dec & \multirow[t]{2}{*}{ Total } & & \multirow{2}{*}{\multicolumn{6}{|c|}{ "Assume Ointrich's salory is not considened in the cakultions }} & & & \\ \hline & & & & & & & & & & & & & & & \\ \hline & Preceperast & 10,500 & & & & & & & & & & & & +8 & \\ \hline & & & & & & & & H. & & & & & & & \\ \hline & hlows & & & & & & & & & & & & & & \\ \hline & Firw mortepe on lund X fromatank & 75x & 2305,250 & & & & & & & & & & & & \\ \hline & Toeal inflem & & 2,206250 & & 2,305,250 & & & & & & & & & & \\ \hline & & & & : b & & & & & & & & & & & \\ \hline & Outlows. & & & & & & & & & & & & & & \\ \hline & Purthase of land & & & & mansumas & & & & & & & & & & \\ \hline & Loan parment (principletintersest) & & & (9200) & (9,800) & & & & & & & & & & \\ \hline & Fentiliter (2021 com). & 105 & (15,750) & & (15,750) & Ein & & & & & & & & & \\ \hline & Seed (2021 torn) & 100 & (15,000) & & (15,000) & & & & = & & & & & & \\ \hline & Toul outhowi & & & (9,300) & & & & & & & & & & & \\ \hline & & & & & & & & & & & & & & & = \\ \hline & Net canh flown & & (790,500) & (9,800) & & & & 2 & & & & & & & \\ \hline & Opemintcash. & & 500,000 & (299,500) & 500,000 & & & & & & & & & & \\ \hline & Cosingerah & & (253,500) & (309.300) & (109.300) & & & & & & & & & & \\ \hline & & & & & & & & & & & & & & & \\ \hline & 2021 & 1) Feracie & in & leb & Mar & ANr & Mar & lune & luky & Aut & sep & ot & Nov & Der & Total \\ \hline & Number of acio & 150 & & & & & & & & & & & & & \\ \hline & Cres & Com & -3 & & & & & & & & & & & & \\ \hline & & & & & & & & & & & \pm & & & & \\ \hline & Inhewi & & & & & & & & & & & & & & \\ \hline & Diming ef eropians. & & & & & = & & & & & & & & 50x & \\ \hline & Gopectid veld per Kre (bushelin) & & I & & & & & & & & & & & & \\ \hline & Gopected price & & - & & & & & & & & & & & & \\ \hline & Coepintions: & & & & & & & & & & & & & & \\ \hline as & Tetal inflomen & & & & a & s & . & 3 & + & & & . & & & - \\ \hline & & & & & & & & & & & & & & 2x & \\ \hline & Outhows (isee Eabilis sfor drats) & & & & & +2 & & & & & & & & & \\ \hline & ientiren ieptean forzozz & & & & & & & & & & & & {[12000}} & & (12000) \\ \hline & Chemed & 6 & \pm & & & & (5,109) & (5,160) & & & & & & & (10200) \\ \hline 14 & fuet & 20 & & & & (1,500) & & & & & [t.S00) & & & & 0000 \\ \hline is & & y & & & & & & & & & & (14,550) & & & (104510) \\ \hline & Govisovemiferzo2z. & 65 & = & & & & & & E & & & & (B), 50 ) & & 10,750 \\ \hline 17 & Crep intiurence & 20 & & & & & 13,009 & & & & & & & & (9,000) \\ \hline 11 & Propentrases & 30 & (1,125) & & & (0,125) & & & (1,125) & & & (1,125) & & & (4,500) \\ \hline 10 & Cutem mork & 1) & & & & & (9)5) & (975) & & & & & & & (1.080) \\ \hline$0 & & & (900) & 19,000 & & 19,009 & (0,400) & (0800) & (92001 & (i) & Qsoon) & (0.nool & (2sece) & (9A00) & (117), \\ \hline & Totuchitlons & & (10.025) & {[0.000]} & Q.000i & (12425) & 18.875) & (15,A7s). & (10,225) & (Q,aoo) & tassoot & a25,4751 & {11550} & (Q)aoo) & (176,550) \\ \hline 42 & & & & & & & & & & & & & & & \\ \hline 43 & Netcanh flowi & & (10,225) & (3,800) & (9,800) & (12,425) & (16)7s) & (15, ans) & (10,925) & (9.800) & (11,100) & (25,475) & (11,sso) & (9,000) & (17) 5501 \\ \hline 44 & Opening caih & & (009,300) & (30,23) & (asoors) & (a39.075) & (as) 250 & (an,12si & = & & (409,73) & (419,025) & (444,500) & (476050) & 000,100) \\ \hline is & Clotingean & & (120,225) & (130025) & (119829) & {[152,250)} & (971125) & (0a,000) & & (401,729) & (410.023) & (444,500) & (476,050) & (ansesso) & (405s 2300) \\ \hline \end{tabular} Assume Paul Dietrich decides to purchase the 150 acre land for $20,500 per acre and that the annual land appreciation has changed from 10% to 15% per year. How much can Paul Dietrich sell the land for after 10 years? Please round your results to the nearest dollar and enter the amount without \$-sign, comma or decimals. (Hint: the spreadsheet "Land Investment" provides the calculations for 10% land appreciation) Understand the calculations in the spreadsheet "Cash Flow Projection". Which of the following statement(s) are correct? Select all that apply. The gap between (negative) opening cash and (negative) closing cash increases every projected year (2021-2023). This means that the net cash flow is getting worse over time. Cash flow projections for a particular year include the seed purchases of the following year. Cash flow projections for a particular year include the crop revenue of the previous year. Paul Dietrich does not have sufficient cash available to purchase the land in 2020. In the year 2021, how much is the minimum (guaranteed) cash inflow from corn crops, assuming that all corn can be sold at the expteced price? 158,205 0 174,900 87,450 Understand the calculations in the spreadsheet "\% sales method", which assumes that total assets and current liabilities vary with sales and Dietrich Farms use long term debt to support Required New Funds (RNF). Assume the projected sales increase is 50% in 2020 , and the dividend payout ratio is 0%. Under these conditions, the RNF is 1,862,349 1,717,261 1,571,371 718,457 Which of the following statement(s) are correct? Select all that apply. Industry averages refer to Exhibit 4. Dietrich Farms' ROAs in 2018,2019 and 2020 are better than the industry average. Dietrich Farms' debt to equity ratios in 2018, 2019 and 2020 are worse than the industry average. Dietrich Farms' interest coverage ratio in 2018, 2019 and 2020 are worse than the industry average. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & a & c & 0 & E & & 6 & K & \\ \hline & N-mber of aches & 150 & & m= & & & & & \\ \hline & Annual land appreciution & 10x & & & & & +1 & & \\ \hline & Taxnte. & 15s & & & & & & + & \\ \hline & Discount rate & ss & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & com & Soybeans & Wheat & & & & \\ \hline 7 & Equipenent depreciation per acre & & 75 & 73 & 70 & & & & \\ \hline 8 & Equpment deprecation & & 11250 & 10350 & 10500 & & & & \\ \hline 9 & Takswing due to depredarion & & 1687.5 & 1542.5 & 1575 & 3 & & & \\ \hline 80 & & & & & : & & & & 2 \\ \hline 11 & Diethichs annualsalary & 45,000 & & & & & & & \\ \hline 12 & Working time on new land & 10% & a. & & & & & & \\ \hline 13 & & & & & & & & & \\ \hline 14 & Year 10 Land Price & 7,975,758 & Assume 10 s arnis: & 19,039,589 & Assume 20K amual increas & & & & \\ \hline 15 & Land Cost & 3,075,000 & & & & & & & \\ \hline 16 & Capalcain & 4,500,58 & & & & & & & \\ \hline 17 & Taxable Copral Gain & 2cos0379 & Son of capital cainis & is taxable & & & & & \\ \hline 18 & Coptal Gan Tax & 367.557 & & & & & & & \\ \hline 10. & Aher Tax Cash inflows: & 7608201 & & & & & & & \\ \hline 20 & & & & & & & & & \\ \hline 21 & "Gash outflows dont include loan repayments, lenore & re interestcost. & & & & & & & \\ \hline & Year & Preduction: & Tetaicathinflow & Total Cath Outfows & Ointichissiany & Net Conhflow & Orortciation Aleer Tox Soving & Afer TaxOihflow & \\ \hline 23 & 0 & & 2,305,750 & (3,115,550) & & (809,300) & & (587,905) & \\ \hline 24 & 18 & com & - & (158950) & (4,500) & (59,450) & 1,5ks & (52,245) & \\ \hline 25 & =25 & soybeans & 139,200 & (43,350) & (4,50) & 91,350 & 1,643 & 79,290 & \\ \hline 26 & 3x & What & 110,250 & (54,300) & (4,500) & 51,450 & 1,575 & 45,308 & \\ \hline 23 & 40 & com & & (SB950) & (4,500) & (63/450) & 1,628 & (52245) & \\ \hline 23 & 5 & Soybeufs & 139200 & (43,350) & 145001 & 91,350 & 1,643 & 79,290 & \\ \hline 29 & 6 & Whest & 110,250 & (56,300) & (4,500) & 51=50 & 1,575 & 45,308 & \\ \hline 30 & 70 & com & 5 & (issasen) & (4.500) & & Leas & (52,245) & \\ \hline nI & 8. & Soyteans & 139,200 & (43,350) & (4,500) & 91,350 & 1,543 & 79,290 & \\ \hline 32 & 3x & Whent & 110,250 & (54,300) & (4,500) & 51450 & 155 & 45,300 & \\ \hline 33 & 100 & com & . & (5k.950) & (4.500) & (694400) & 1,k31 & 2555046 & Adtand: \\ \hline 34 & + & & E & & & & & & nov \\ \hline 351 & & & & & & & & & ling \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & 20x2 & 2 Nerace. & lan & feb & Mar & Ap & Mar & hine & & A4 & sen & ors & Now & Dex & Total \\ \hlinea & & 150 & & & & & & & & & & & H & & \\ \hline 490 & 000 & Sogean & & 2 & & & & & & & & & & & \\ \hline so & & & & & & & & & & = & & 4 & = & & \\ \hline & Inlown & & & & & & & & & & & & & & \\ \hline 80 & Timint ol oos rintur & & & & & & 4 & & & & & 300 & sos & & \\ \hline 31 & & $ & & & & & & & & & & & & & \\ \hline 4E & Evenced onion & 16. & & & & & & & & & & & & & \\ \hline 350 & Crog infous & & = & * & & & & & & & & c9,600 & 6900 & & 239,200 \\ \hline & Total infison. & y= & + & & = & & & & ? & (. & & 69600 & 69600 & . & 1920 \\ \hline 37) & & 3 & & & & & & + & & & & & & n & \\ \hline 80 & outhion & & & & & & & & & & & & & & \\ \hline & Fentilier: =hent or 2003 & 5 & & 1 & Ex & & & & & & & & (22,250) & & \\ \hline 60 & Oenirial & 85 & & & & & (5.35) & 5,3m & & & & & & & \\ \hline & Foel & 17 & & & & {[2,2ms} & & & & x1 & {[1,2m)} & & & & \\ \hline0 & Drgins and sorat: & a & & & & & & & & & & asco) & & & a,00 \\ \hlineas & Sondiminent terious & 35 & & & & & & & & & & & {[5,250)} & 4 & 15,259 \\ \hline 40 & & n & & & & & (1.650)3 & & & & & & & & 11000 \\ \hline is & Propety ines & & (213) & & & (2,18) & & & (12.25) & & & & & & |s.soo| \\ \hline 48 & Cutoen wers & & & & & & & & & & & & & & \\ \hline ar & Loun purment berinopintinteredi & & D.000 & R & 0,000 & & & P.5001 & & 0,006 & p.socel & & & & (117,600) \\ \hline & Total enenoms. & & (a033) & paso: & 0.000 & (12,200) & & (16,7s) & (a) 225) & DAOOS & (1) ons) & (14005) & (27) & D, loo & (riasso) \\ \hline is & & & & & & & & & & & & & & & \\ \hline & Not aufirm & & (20025): & D)1 & P.000 & (12,2) & & [6,13) & 00925) & & (ators) & 54,m5 & 41,000 & Dioet & 01,730 \\ \hlinenc & oseving ash. & & Juswoi! & (10xkns) & ponsts: & 3 [3ic,sis] & & {[346,400)} & i) (067,575) & prissoos & (censoo) & (BA.MS) & 519.600 & & (Assese \\ \hlinec & & & & (00655) & (sigins) & 7. isanssi & & (86)575) & enssoo & & (pouss) & & (4mponi & (Bor, 600 . & ser, 600 \\ \hline 7 & & & & & & & & & & & & & & & \\ \hline 24 & 2023 & Nerteofe & Int & Fot: & Mar & Arr & May & & hey & Ais: & Sope & ot & Now & Oes: & Total \\ \hlinen & Number dogn & 130 & & & & & & & & & & & & & \\ \hline 360 & osp & whent. & & & & & & & & & & & & & \\ \hlinen & & & & & & & & & - & & & & & & \\ \hline 3x & intion: & & & & & & & & & & & & & & - \\ \hline 31 & Tinive of eropievere & & & & & = & E & & & ex: & sen & & & & \\ \hline0 & Ispected vietid per aco Brakelel & 105 & & & & & & & & & & & & & \\ \hline & Coected prise & 7 & & & & 6 & & & & & & & & & \\ \hline u & Crop infoust: & & & & & & & & & 5x125 & 55,135 & & & & 130,250 \\ \hlinent & tetalinflom & & & 2 & & & & \% & . & Ssuas & ss.12s & . & & . & Ha reo \\ \hline 4 & & & & & & +1 & & E & E- & 8 & & & & & \\ \hline 750 & outlown & & & & = & & & & & & 3 & & & & \\ \hline & fertilint corn for 2024 & 105 & & & & & & & & & & & a5,7501 & & \\ \hline ir & Oumial & 40 & & = & & & 0.000001 & 0.00000 & . & = & & & & & \\ \hlinem6 & Fuel & 20 & & & E & 1950000 & & & & & a.s.0001 & & & & 0,008 \\ \hlinem0 & Oryivend inor ats & 265 & & & - & & & +1 & & & & a,ms+ & & & a,msi \\ \hline so 5 & Setd com for zole & 100 & & & = & & & & & 3 & & & is, 00 & & issocoi \\ \hline & Gopinavaner & 105 & & & & & (1,5750) & & & & & & & & (15) \\ \hlinenh & mopetortans & 10 & [i, 135 & & & 0,125) & & & 0,125 & & & 0.128 & & & Hesom \\ \hlinen & Cuitemwer. & 30 & & & & & 0,20001 & 0,25000 & & s. & & & & & kso \\ \hlineM & Can paycuent brincipletinterest) & & D.100: & & Q.1001 & 0.000 & enoi & P.ook & & & 0,800 & 0,100 & & Qunoo & ais, \\ \hline Bs & Total eation & & {[10,35]} & asool & B,000 & & asens! & ascos: & & anom & & & 1aseser & ascoi & aroos \\ \hline & & & & & & & & & & & & & & & \\ \hline s. & wat ainh flios: & & (10,38) & & p.Nom & (12,es) & (16.625). & as,osel & (10035) & 45,325 & & {[04,900} & 10069 & Now & arses: \\ \hline 10 & Coening anh & & {[507,00} & & (oxalas) & (5),18s) & 1550,5501 & (69,175s & cos, ms & (593150 & {[54705]} & pet,000 & & osenes & nos, exy \\ \hlinenc & donicas & & & (5)ansi & (siansi & asasise & 1. 150,13) & 502,207 & (x93,150) & & Botpooi & Bis, 100 & ciseasei. & corasi. & \\ \hline \end{tabular} Using expected yield and expected price in Exhibit 7&8, which crop is most profitable? Please consider both, revenues and cost. Ignore taxes and depreciation. Wheat Corn Soybeans Which of the following statement(s) are correct? As Dietrich Farms grows, Paul Dietrich will have to consider hiring employees in addition to the occasional equipment operators. The land purchase opportunity of 150 acres goes beyond Paul Dietrich's regular expansion (growth) plans. Dietrich Farms depends heavily on family members for the physical labour on the Farm. Paul Dietrich will have to consider the impact of his parents' aging on the ability to operate their own farm as he is currently benefitting from formal and informal cooperation between his Farm and the Farm owned by his parents. Which of the following statement(s) are correct? Dietrich Farms expects crop revenues for 2021 to realize in October and November. Deprecitation expenses reduce the taxable income. The projected cash inflow from crop sales revenue for 2021 is 174,900 . Based on the cash flow projections, Dietrich Farms will require additional financing of $485,850 by the end of 2021 . The spreadsheet "Tile Drainage" uses a 10% expected yield increase for each of the three crops (corn, soybeans, wheat) and calculates the average revenue increase over all three of them. Assume that the tile drainage can increase the yield by 20% (instead of 10% ). How much is the average revenue increase under this new assumption? Please round your calculation to the nearest dollar. Do not enter \$-signs, comma or decimals. \begin{tabular}{|c|c|c|c|c|} \hline Median Profitability Ratio for Ontario Field Crop Farms & 2018 & 2019 & 2020 & (as \% of sales) \\ \hline Contribution margin & 0.66 & 0.65 & 0.64 & \\ \hline EBIT & 0.18 & 0.11 & 0.12 & \\ \hline Interest expenses & 0.02 & 0.04 & 0.03 & \\ \hline EBT (Net Farm Income) & 0.15 & 0.08 & 0.09 & \\ \hline & & & & \\ \hline Dietrich Farms & 2018 & 2019 & 2020 & (as % of sales) \\ \hline Contribution margin & 0.61 & & & \\ \hline EBIT & 0.43 & & & \\ \hline Interest expenses & 0.04 & & & \\ \hline EBT & 0.39 & & & \\ \hline Net Income & 0.33 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline A & a & c & 0 & E & E & 6 & H & 1 & J & k \\ \hline Cop & Corn & Soybeans & Whest & & & & & & & \\ \hline Expected yeld per acre without drainage & 220 & 58 & 105 & & & & & & & \\ \hline Yedd boost 10x & 22 & 6 & 11 & & & & & & & \\ \hline Gopected price per acie & 8- & 16 & 7 & & & & & & & \\ \hline Additional revmue per acre & 117 & 93 & 74 & & .. & & & & & \\ \hline Additional revenue & 17,490 & 13,920 & 11,025 & 150 acte & 11 & E & & at & & \\ \hline Averabe revenue increase & 14,145 & & & & & & & & & \\ \hline & & + & & & & & & & & \\ \hline Acres tiled & 150 & & & & & & & & & \\ \hline Price per acie for tle. & 1,500 & & & & & & & & & \\ \hline Fotal investment & 225000 & & & & & & & & & \\ \hline Taxinte & 15x & & & & & & & & & \\ \hline Capital cost allowance (depreciation) & 25 & & & & & \pm & & 7 & & \\ \hline Discount rate & 6 & & & r & & 2 & & & IIIII & \\ \hline Epected yeld boost & 10N & E & & & & & & & & \\ \hline & & & & 4 & & & & & & \\ \hline . & & & & & & & & & & \\ \hline Year & ucc Bosinnin & ACCA & ucc ending & & Depreciation Tax savene & & Investiment & increaserevenue: & - Afte tar Coshit & \\ \hline 0 & 225,000 & 28,125 & 196,875 & half year tule & 4,219 & & (225,000) & & (187,031) & \\ \hline 1 & 196,175 & 49,219 & 147,656 & & 7,383 & & & 14,145 & 19,406 & \\ \hline 2 & 147,656 & 36,914 & 110,742 & & 5,537 & & & 14,145 & 17,560 & \\ \hline 3 & 110,742 & 27,686 & 83,057 & & 4,153 & & & 14,145 & 16,176 & \\ \hline 4 & 13,057 & 20,764 & 62,292 & & 3,115 & & & 14,145 & 15,138 & \\ \hline & 62,292 & 15,573 & 46,719 & & 2,336 & & & 14,145 & 14,359 & \\ \hline 3 & 46,719 & 11,680 & 35040 & & 1,752 & & & 14,145 & 13,775 & \\ \hline 7 & 35,040 & 8,760 & 26,2110 & & 1,314 & & 4 & 14,145 & 13,337 & \\ \hline a & 26,250 & 6,570 & 19,710 & & 985 & & & 14,145 & 13,009 & \\ \hline 9 & 19,710 & 4,927 & 14,732 & & 739 & & & 14,145 & 12,767 & \\ \hline 5x & 14,732 & 3,696 & 11,067 & % & 554 & & & 14,145 & 12,571 & \\ \hline Exto & 11,007 & 2,m & 0,315 & & 416 & & & 14,145 & 12,439 & \\ \hline & 8,315 & 2,079 & 6,236 & & 312 & & & 14,145 & 12,315 & \\ \hline 11 & 6,236 & 1,559 & 4,677 & & 2n & & & 14,145 & 12,257 & \\ \hline 14 & 4,677 & 1,169 & 3,508 & & 175 & & & 14,145 & 12,199 & \\ \hline+1 & 3,508 & an & 2.631 & & 132 & & & 14,145 & 12,155 & \\ \hline 16 & 2,631 & 658 & 1,977 & & n & & & 14,245 & 12,122 & \\ \hline 17 & 1,973 & 493 & 1,40 & & 74 & 3 & the & 14,145 & 12.097 & \\ \hline 18 & 1.480 & 370 & 1,110 & & 55 & & & 14,145 & 12,079 & \\ \hline 19 & 1,110 & m & 832 & & 4) & & & 34,145 & 12.065 & \\ \hlineE & 132 & 200 & 624 & & 3 & 4 & & 14,145 & 12,054 & \\ \hline 21 & 624 & 156 & 468 & & 23 & & & 14,145 & 12,047 & \\ \hline 22 & 468 & 117 & 151 & & 11 & & & 14,145 & 12,041 & \\ \hline 23 & 351 & ai & 263 & III. & 13 & & & 14,145 & 12,036 & \\ \hline 24 & 263 & 66 & 198 & & 10 & & +4 & 14,145 & 12,033 & \\ \hline 25 & 198 & 49 & 148 & & 7 & & & 14,145 & 12011 & \\ \hline & & 11 & & & & +2 & 7 & & & INen \\ \hline=0 & & & & & & & & & & \\ \hline \end{tabular} Which of the following statement(s) are correct? Select all that apply. Industry averages refer to Exhibit 4. Dietrich Farms' interest expenses (in \% of sales) in 2020 are lower than the 5-year industry average. Dietrich Farms' contribution margin (in \% of sales) is better in 2020 than the 5year industry average. Dietrich Farms' EBIT (in \% of sales) in 2020 is better than the 5-year industry average. Dietrich Farms' EBT (in \% of sales) in 2018 and 2019 is higher than the industry average (median) in those respective years. \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline A & a & c & 0 & t & f. & G & H & 1 \\ \hline Number of acres & 150 & & & & & & & \\ \hline Ansual land appreciation & 10x & & & & & & & \\ \hline Taxrote & 15x & = & & & & & & \\ \hline \multirow[t]{3}{*}{ Discount rome } & 6x & & & & & s. & & \\ \hline & & & & & & & & \\ \hline & & Com & Soybeans & Wheat : & 1 & & & \\ \hline Equipment depreciation per acre & & 75 & n & 70 & & & & \\ \hline fquipment depreciation & & 11250 & 10.950 & 10,500 & & & & \\ \hline Tax saving due to depreciation & & 1687.5 & 16425 & 1575 & & & & \\ \hline & & & & 10 & & & & \\ \hline Dietrichis annual wary & 45,000 & & & & & 9 & & \\ \hline Working time on new land & 10x & & & & & & & \\ \hline & & & & = & & & & \\ \hline Vear 10 Lund Price & 7,975,758 & \multicolumn{2}{|c|}{ Assume 10K arnual appreciation } & & & & & \\ \hline Land Cost & 3,075,000 & & & & +1 & & & \\ \hline Capital Gain & 4,900,758 & & & & & & & \\ \hline Taxable Capitat Gain & 2,450,378 & \multicolumn{2}{|c|}{ Sok of capital ean is taxuble } & & & & & \\ \hline Copital Gain Tan & 367,557 & & & & & & & \\ \hline Nite Tax Cash infloms & 7,608,201 & \% & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & \\ \hline rear & Production & Total Cash inflowe & Total Cash Outfion & Dietrich's Salary & Net Cash How & Depreciation Arter Tax Soming & \multicolumn{2}{|l|}{ Aher Tar Conhilow } \\ \hline 0 & & 2,306,250 & (3,115,550) & & (1009,300) & & (6.7,905) & \\ \hline 1 & Com & & (58,550) & (4,500) & (6)A50) & 1,684 & (52,245) & \\ \hline & Soybeans: & 139,260 & (43,350) & (4.500) & 91,350 & 1,543 & 79,290 & \\ \hline & When & 110,250 & (54,300) & (4,500) & 51450 & 1,575 & 45,304 & \\ \hline & Corn & & (58,950) & (4,500) & (63,A50) & 1,6811 & (52,245) & \\ \hline & sorbeans. & 139,200 & (43,350) & (4,500) & 91,350 & 1,643 & 29,290 & \\ \hline It & When & 110,250 & (54,300) & (4.500) & 51,450 & 1,575 & 45, 3011 & \\ \hline= & carn & & (5s.950) & (4,500) & (63,450) & 1,681 & (52,245) & \\ \hline & Soyeans: & 139,200 & (43,350) & (4,500) & 81,350 & 1,64) & 70,250 & \\ \hlinex= & Wheat & 110,250 & (54,300) & (4500) & 51,450 & 1,575 & 45,301 & \\ \hline & com & . & (58.250) & (4,5) & (63,450) & 1,683 & 2555.256 & \multirow{2}{*}{\begin{tabular}{l} Add Lind sales \\ J ver \end{tabular}} \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & \\ \hline Ved & Production & Total Cash inflow: & Total Canh Outflow & Dietrichs salary & Net Conh fiow & Oegrecixion After Tra Saving & \multicolumn{2}{|l|}{ Ater far Conhfore } \\ \hline a & & 2,306,250 & 0,115.550) & & (809.300) & & (6a7905) & \\ \hline 3 & Con & & (176.550) & (6,500) & (181050) & 1.68a & (152,205) & \\ \hline 2 & Soybeans & 139200 & (160,950) & (4,500) & (26,250) & 1.543 & (20,670) & \\ \hline 3 & Whent & 110,250 & (171,900) & (4,500) & (66,150) & 1,575 & (54,653) & \\ \hline 4 & Con & & (176,550) & (4,500) & (131,050) & 1,688 & (152,205) & \\ \hline 2= & Soybeans & 139,200 & (160,950) & (4.500) & (26,250) & 1,643 & 020,5701 & \\ \hline & Whest & 110,250 & (171,9) & (0,500) & (66,150) & 1,575 & (54,653) & \\ \hline & Corn & = & [176,550] & (4,500) & (181,050) & 1,68s & (152,205) & \\ \hline 5 & Soyprass & 139,200 & (160,950) & (4,500) & (26,250) & 1,643 & (20,670) & \\ \hline 9 & Whes: & 110,250 & (171,900) & (4,500) & (66,150) & 1,575 & (54,653) & \\ \hline 10 & conn & + & (176,550) & (4,500) & (181050) & 1, 5BB & 7455.996A & Add Land Sule \\ \hline & & & & & & & & NPV \\ \hline \end{tabular} Which of the following statement(s) are correct. Select all that apply. Considering the difference between historical cost of the farm land and its fair value might improve Paul Dietrich's position to secure a bank loan. If the farm land in Dietrich Farms' Balance Sheet was valued at the current market price (fair value), return-on-assets would increase. The land owned by Dietrich Farms according to the information in the 2020 Balance Sheet is valued higher than the current fair value of farm land. Based on the information provided in Dietrich Farms' Balance Sheet (Exhibit 6), the land owned by Dietrich Farms in 2020 is valued at approx. $10,700 per acre. Understand the calculations in the spreadsheet "Land Investment". Which of the following statement(s) are correct? Select all that apply. The required discount rate is 6%. Increasing the discount rate will increase the NPV (net present value) and consequently make the project more favorable. Based on the NPV (net present value) calculations, Paul Dietrich should accept the land investment project as NPV is positive in both scenarios (with / without loan payments). Half of the capital gains are taxable. Which of the following aspect(s) are mentioned in the case to reduce risk? Purchase of production insurance Which of the following statement(s) are correct? Dietrich Farms has been able to increase total revenues over time (2018-2020). Dietrich Farms' contribution margin remained more or less the same over the period 2018-2020. Dietrich Farms has been more profitable in 2020 than in 2019. Dietrich Farms has been able to increase crop sales steadily over time (2018-2020) Expected Income Expected Sales Expected Expenses Fertilizer Seed Production insurance premium Fuel Chemical Custom work Drying, storage, and other expenses 1 Total Expenses Which of the following aspects are mentioned in the case? The impact of speculation on commodity prices and futures markets. The importance of the "right to repair" for farm equipment. The fact that vast majority of farms in Canada are family-owned and operated. The impact of farm expansions on biodiversity (loss). Which of the following statement(s) are correct. Select all that apply. Paul Dietrich has the power to withdraw a higher salary than $45,000 per year if he wants since he is the sole owner of the business. Dietrich Farms has invested significantly in capital assets in 2019 (compared to 2018). Paul Dietrich does not have to pay any personal tax on his salary because the Farm is paying taxes already. Capital assets in Dietrich Farms' case include equipment as well as land. Which of the following statement(s) are correct? Select all that apply. According to the changes in Retained Earnings based on Dietrich Farms' Balance Sheet, Paul Dietrich has not paid out any dividends to himself in 2019. The debt-to-equity ratio increased every year over the period 2018-2020. Dietrich Farms has issued new equity capital in 2020. Dietrich Farms' debt increased every year over the period 2018-2020. Understand the calculations in the spreadsheet "Tile Drainage". Which of the following statement(s) are correct? Select all that apply. Based on the current assumptions of 25 years useful life and 10% yield increase, Paul Dietrich should not invest in the tile drainage project since the NPV (net present value) is negative. If the expected yield increase was 14% instead of 10%, the NPV (net present value) of the tile drainage project (over 25 years) would be positive and should therefore be realized. The NPV (net present value) will increase if the tile drainage could be effective for 50 years, i.e., the useful life increases to 50 years, all else equal. Under the current assumptions, the tile drainage project will pay for itself (amortize) within 10 years. Which of the following statement(s) are correct? Select all that apply. Dietrich Farms rotates three crops. Dietrich Farms pruchases seeds and fertilizers in the same year of the growing season. Dietrich Farms has 2 non-family employees. Dietrich Farms is exempted from tax. \begin{tabular}{|c|c|c|c|c|c|} \hline 1 & Average Financial Ratios for all Ontartio Farms & 2018 & 2019 & 2020 & \\ \hline 2 & Current Ratio & 1.922 & 1.996 & 2.165 & \\ \hline 3 & Acid test (quick ratio) & 0.450 & 0.462 & 0.484 & \\ \hline 4 & Debt to equity & 0.198 & 0.202 & 0.204 & \\ \hline 5 & Return on assets & 0.016 & 0.017 & 0.022 & \\ \hline 6 & Return on equity & 0.011 & 0.011 & 0.017 & a. \\ \hline 7 & Interest coverage (Times interest earned) & 2.247 & 2.215 & 2.994 & B \\ \hline 8 & & 8 & x0 & & \\ \hline 9 & Dietrich Farms & 2018 & 2019 & 2020 & \\ \hline 10 & Current Ratio & 3.827[ & & & Current Assets/Current Liabilities \\ \hline 11 & Acid test (quick ratio) & 1.019 & & & (Cash+Accounts Receivable)/Current Liablitilie \\ \hline 12 & Debt to equity & 1.346 & & & Total Debt/Total Equity \\ \hline 13 & Return on assets & 0.118 & & & Net Income/Total Assets \\ \hline 14 & Return on equity & 0.277 & & & Net Income/Total Equity \\ \hline 15 & Interest coverage (Times interest earned) & 11.656 & & & EBIT/Interest \\ \hline 16 & & . & & & \\ \hline 17 & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started