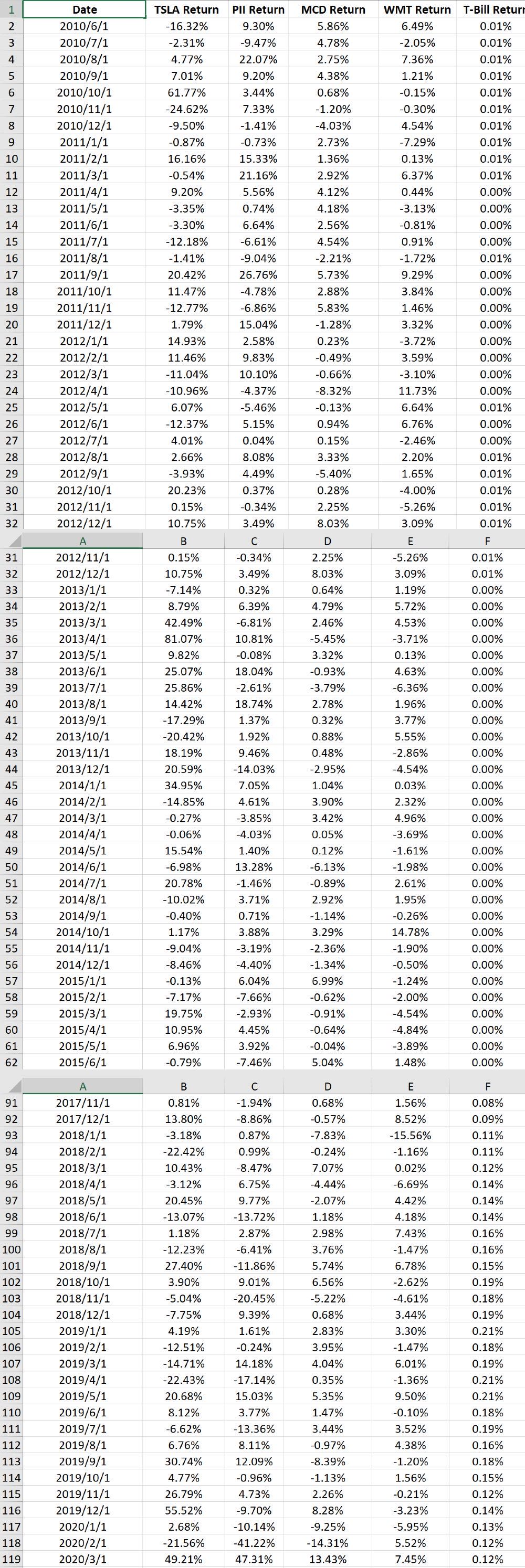

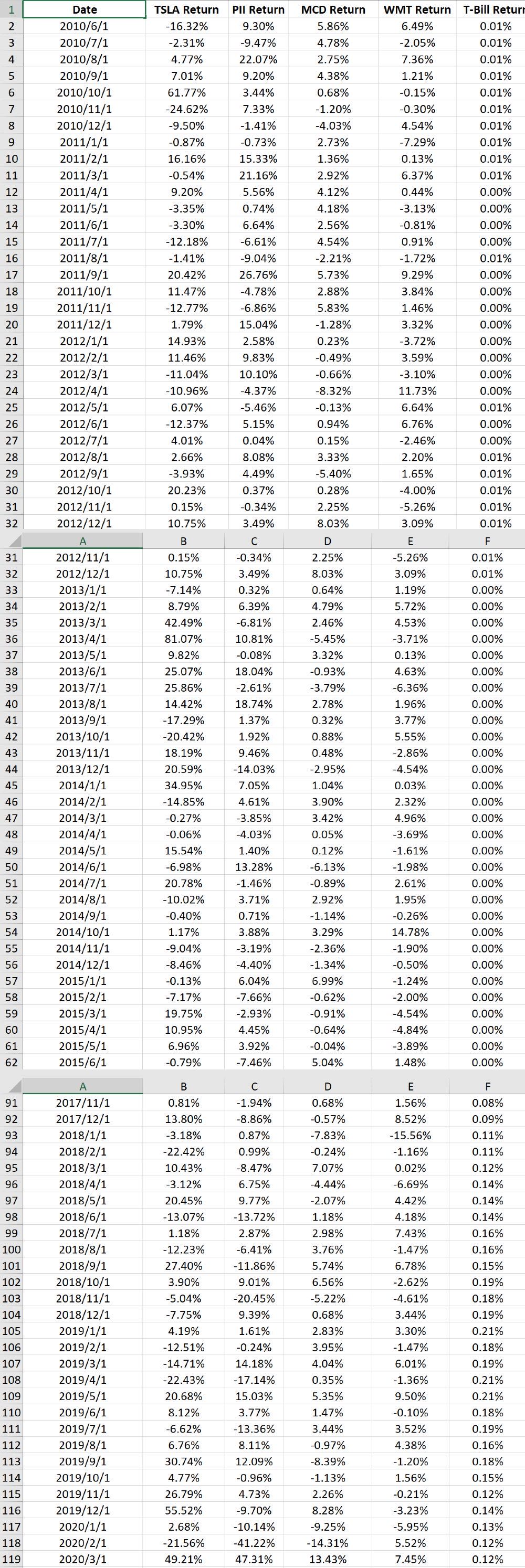

The Excel workbook titled "Return.xls" (available on the class web page) contains monthly returns on 4 stocks (TSLA: Tesla, PII: Polaris, MCD: MacDonald's, WMT: Walmart) and one-month US T-bills for the period June 2010-March 20201.

For the 4 stocks and T-bill, calculate the following statistics based on the data during 2010 and 2020: (20 points

A.Find the arithmetic mean, variance, and standard deviation of monthly returns. Also state the annualized mean and standard deviation, assuming monthly compounding. (5 points)

b. Find the skewness and kurtosis of monthly returns. Also interpret the findings. (5 points)

c. Find the pair-wise covariances (in the form of a covariance matrix) for each set of assets. (5 points)

d. Find the pair-wise correlations (in the form of a correlation matrix) for each set of assets. (5 points)

2 Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defineo as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points)

Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defineo as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points)

1 Date PII Return 9.30% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 TSLA Return -16.32% -2.31% 4.77% 7.01% 61.77% -24.62% -9.50% -0.87% 16.16% -0.54% 9.20% -3.35% -3.30% -12.18% -1.41% 20.42% 11.47% -12.77% 1.79% 14.93% 11.46% -11.04% -10.96% 6.07% -12.37% 4.01% 2.66% -3.93% 20.23% 0.15% 10.75% -9.47% 22.07% 9.20% 3.44% 7.33% -1.41% -0.73% 15.33% 21.16% 5.56% 0.74% 6.64% -6.61% -9.04% 26.76% -4.78% -6.86% 15.04% 2.58% 9.83% 10.10% -4.37% -5.46% 5.15% 0.04% 8.08% 4.49% 0.37% -0.34% 3.49% MCD Return 5.86% 4.78% 2.75% 4.38% 0.68% -1.20% -4.03% 2.73% 1.36% 2.92% 4.12% 4.18% 2.56% 4.54% -2.21% 5.73% 2.88% 5.83% -1.28% 0.23% -0.49% -0.66% -8.32% -0.13% 0.94% 0.15% 3.33% -5.40% 0.28% 2.25% 8.03% WMT Return 6.49% -2.05% 7.36% 1.21% -0.15% -0.30% 4.54% -7.29% 0.13% 6.37% 0.44% -3.13% -0.81% 0.91% -1.72% 9.29% 3.84% 1.46% 3.32% -3.72% 3.59% -3.10% 11.73% 6.64% 6.76% -2.46% 2.20% 1.65% -4.00% -5.26% 3.09% T-Bill Returr 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 22 23 24 25 26 27 28 29 30 31 32 B C D E F 2010/6/1 2010/7/1 2010/8/1 2010/9/1 2010/10/1 2010/11/1 2010/12/1 2011/1/1 2011/2/1 2011/3/1 2011/4/1 2011/5/1 2011/6/1 2011/7/1 2011/8/1 2011/9/1 2011/10/1 2011/11/1 2011/12/1 2012/1/1 2012/2/1 2012/3/1 2012/4/1 2012/5/1 2012/6/1 2012/7/1 2012/8/1 2012/9/1 2012/10/1 2012/11/1 2012/12/1 A 2012/11/1 2012/12/1 2013/1/1 2013/2/1 2013/3/1 2013/4/1 2013/5/1 2013/6/1 2013/7/1 2013/8/1 2013/9/1 2013/10/1 2013/11/1 2013/12/1 2014/1/1 2014/2/1 2014/3/1 2014/4/1 2014/5/1 2014/6/1 2014/7/1 2014/8/1 2014/9/1 2014/10/1 2014/11/1 2014/12/1 2015/1/1 2015/2/1 2015/3/1 2015/4/1 2015/5/1 2015/6/1 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 0.15% 10.75% -7.14% 8.79% 42.49% 81.07% 9.82% 25.07% 25.86% 14.42% -17.29% -20.42% 18.19% 20.59% 34.95% -14.85% -0.27% -0.06% 15.54% -6.98% 20.78% -10.02% -0.40% 1.17% -9.04% -8.46% -0.13% -7.17% 19.75% 10.95% 6.96% -0.79% -0.34% 3.49% 0.32% 6.39% -6.81% 10.81% -0.08% 18.04% -2.61% 18.74% 1.37% 1.92% 9.46% -14.03% 7.05% 4.61% -3.85% -4.03% 1.40% 13.28% -1.46% 3.71% 0.71% 3.88% -3.19% -4.40% 6.04% -7.66% -2.93% 4.45% 3.92% -7.46% 2.25% 8.03% 0.64% 4.79% 2.46% -5.45% 3.32% -0.93% -3.79% 2.78% 0.32% 0.88% 0.48% -2.95% 1.04% 3.90% 3.42% 0.05% 0.12% -6.13% -0.89% 2.92% -1.14% 3.29% -2.36% -1.34% 6.99% -0.62% -0.91% -0.64% -0.04% 5.04% -5.26% 3.09% 1.19% 5.72% 4.53% -3.71% 0.13% 4.63% -6.36% 1.96% 3.77% 5.55% -2.86% -4.54% 0.03% 2.32% 4.96% -3.69% -1.61% -1.98% 2.61% 1.95% -0.26% 14.78% -1.90% -0.50% -1.24% -2.00% -4.54% -4.84% -3.89% 1.48% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 B D E 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 A 2017/11/1 2017/12/1 2018/1/1 2018/2/1 2018/3/1 2018/4/1 2018/5/1 2018/6/1 2018/7/1 2018/8/1 2018/9/1 2018/10/1 2018/11/1 2018/12/1 2019/1/1 2019/2/1 2019/3/1 2019/4/1 2019/5/1 2019/6/1 2019/7/1 2019/8/1 2019/9/1 2019/10/1 2019/11/1 2019/12/1 2020/1/1 2020/2/1 2020/3/1 0.81% 13.80% -3.18% -22.42% 10.43% -3.12% 20.45% -13.07% 1.18% -12.23% 27.40% 3.90% -5.04% -7.75% 4.19% -12.51% -14.71% -22.43% 20.68% 8.12% -6.62% 6.76% 30.74% 4.77% 26.79% 55.52% 2.68% -21.56% 49.21% C -1.94% -8.86% 0.87% 0.99% -8.47% 6.75% 9.77% -13.72% 2.87% -6.41% -11.86% 9.01% -20.45% 9.39% 1.61% -0.24% 14.18% -17.14% 15.03% 3.77% -13.36% 8.11% 12.09% -0.96% 4.73% -9.70% -10.14% -41.22% 47.31% 0.68% -0.57% -7.83% -0.24% 7.07% -4.44% -2.07% 1.18% 2.98% 3.76% 5.74% 6.56% -5.22% 0.68% 2.83% 3.95% 4.04% 0.35% 5.35% 1.47% 3.44% -0.97% -8.39% -1.13% 2.26% 8.28% -9.25% -14.31% 13.43% 1.56% 8.52% -15.56% -1.16% 0.02% -6.69% 4.42% 4.18% 7.43% -1.47% 6.78% -2.62% -4.61% 3.44% 3.30% -1.47% 6.01% -1.36% 9.50% -0.10% 3.52% 4.38% -1.20% 1.56% -0.21% -3.23% -5.95% 5.52% 7.45% F 0.08% 0.09% 0.11% 0.11% 0.12% 0.14% 0.14% 0.14% 0.16% 0.16% 0.15% 0.19% 0.18% 0.19% 0.21% 0.18% 0.19% 0.21% 0.21% 0.18% 0.19% 0.16% 0.18% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 110 111 112 113 114 115 116 117 118 119 1 Date PII Return 9.30% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 TSLA Return -16.32% -2.31% 4.77% 7.01% 61.77% -24.62% -9.50% -0.87% 16.16% -0.54% 9.20% -3.35% -3.30% -12.18% -1.41% 20.42% 11.47% -12.77% 1.79% 14.93% 11.46% -11.04% -10.96% 6.07% -12.37% 4.01% 2.66% -3.93% 20.23% 0.15% 10.75% -9.47% 22.07% 9.20% 3.44% 7.33% -1.41% -0.73% 15.33% 21.16% 5.56% 0.74% 6.64% -6.61% -9.04% 26.76% -4.78% -6.86% 15.04% 2.58% 9.83% 10.10% -4.37% -5.46% 5.15% 0.04% 8.08% 4.49% 0.37% -0.34% 3.49% MCD Return 5.86% 4.78% 2.75% 4.38% 0.68% -1.20% -4.03% 2.73% 1.36% 2.92% 4.12% 4.18% 2.56% 4.54% -2.21% 5.73% 2.88% 5.83% -1.28% 0.23% -0.49% -0.66% -8.32% -0.13% 0.94% 0.15% 3.33% -5.40% 0.28% 2.25% 8.03% WMT Return 6.49% -2.05% 7.36% 1.21% -0.15% -0.30% 4.54% -7.29% 0.13% 6.37% 0.44% -3.13% -0.81% 0.91% -1.72% 9.29% 3.84% 1.46% 3.32% -3.72% 3.59% -3.10% 11.73% 6.64% 6.76% -2.46% 2.20% 1.65% -4.00% -5.26% 3.09% T-Bill Returr 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 22 23 24 25 26 27 28 29 30 31 32 B C D E F 2010/6/1 2010/7/1 2010/8/1 2010/9/1 2010/10/1 2010/11/1 2010/12/1 2011/1/1 2011/2/1 2011/3/1 2011/4/1 2011/5/1 2011/6/1 2011/7/1 2011/8/1 2011/9/1 2011/10/1 2011/11/1 2011/12/1 2012/1/1 2012/2/1 2012/3/1 2012/4/1 2012/5/1 2012/6/1 2012/7/1 2012/8/1 2012/9/1 2012/10/1 2012/11/1 2012/12/1 A 2012/11/1 2012/12/1 2013/1/1 2013/2/1 2013/3/1 2013/4/1 2013/5/1 2013/6/1 2013/7/1 2013/8/1 2013/9/1 2013/10/1 2013/11/1 2013/12/1 2014/1/1 2014/2/1 2014/3/1 2014/4/1 2014/5/1 2014/6/1 2014/7/1 2014/8/1 2014/9/1 2014/10/1 2014/11/1 2014/12/1 2015/1/1 2015/2/1 2015/3/1 2015/4/1 2015/5/1 2015/6/1 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 0.15% 10.75% -7.14% 8.79% 42.49% 81.07% 9.82% 25.07% 25.86% 14.42% -17.29% -20.42% 18.19% 20.59% 34.95% -14.85% -0.27% -0.06% 15.54% -6.98% 20.78% -10.02% -0.40% 1.17% -9.04% -8.46% -0.13% -7.17% 19.75% 10.95% 6.96% -0.79% -0.34% 3.49% 0.32% 6.39% -6.81% 10.81% -0.08% 18.04% -2.61% 18.74% 1.37% 1.92% 9.46% -14.03% 7.05% 4.61% -3.85% -4.03% 1.40% 13.28% -1.46% 3.71% 0.71% 3.88% -3.19% -4.40% 6.04% -7.66% -2.93% 4.45% 3.92% -7.46% 2.25% 8.03% 0.64% 4.79% 2.46% -5.45% 3.32% -0.93% -3.79% 2.78% 0.32% 0.88% 0.48% -2.95% 1.04% 3.90% 3.42% 0.05% 0.12% -6.13% -0.89% 2.92% -1.14% 3.29% -2.36% -1.34% 6.99% -0.62% -0.91% -0.64% -0.04% 5.04% -5.26% 3.09% 1.19% 5.72% 4.53% -3.71% 0.13% 4.63% -6.36% 1.96% 3.77% 5.55% -2.86% -4.54% 0.03% 2.32% 4.96% -3.69% -1.61% -1.98% 2.61% 1.95% -0.26% 14.78% -1.90% -0.50% -1.24% -2.00% -4.54% -4.84% -3.89% 1.48% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 B D E 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 A 2017/11/1 2017/12/1 2018/1/1 2018/2/1 2018/3/1 2018/4/1 2018/5/1 2018/6/1 2018/7/1 2018/8/1 2018/9/1 2018/10/1 2018/11/1 2018/12/1 2019/1/1 2019/2/1 2019/3/1 2019/4/1 2019/5/1 2019/6/1 2019/7/1 2019/8/1 2019/9/1 2019/10/1 2019/11/1 2019/12/1 2020/1/1 2020/2/1 2020/3/1 0.81% 13.80% -3.18% -22.42% 10.43% -3.12% 20.45% -13.07% 1.18% -12.23% 27.40% 3.90% -5.04% -7.75% 4.19% -12.51% -14.71% -22.43% 20.68% 8.12% -6.62% 6.76% 30.74% 4.77% 26.79% 55.52% 2.68% -21.56% 49.21% C -1.94% -8.86% 0.87% 0.99% -8.47% 6.75% 9.77% -13.72% 2.87% -6.41% -11.86% 9.01% -20.45% 9.39% 1.61% -0.24% 14.18% -17.14% 15.03% 3.77% -13.36% 8.11% 12.09% -0.96% 4.73% -9.70% -10.14% -41.22% 47.31% 0.68% -0.57% -7.83% -0.24% 7.07% -4.44% -2.07% 1.18% 2.98% 3.76% 5.74% 6.56% -5.22% 0.68% 2.83% 3.95% 4.04% 0.35% 5.35% 1.47% 3.44% -0.97% -8.39% -1.13% 2.26% 8.28% -9.25% -14.31% 13.43% 1.56% 8.52% -15.56% -1.16% 0.02% -6.69% 4.42% 4.18% 7.43% -1.47% 6.78% -2.62% -4.61% 3.44% 3.30% -1.47% 6.01% -1.36% 9.50% -0.10% 3.52% 4.38% -1.20% 1.56% -0.21% -3.23% -5.95% 5.52% 7.45% F 0.08% 0.09% 0.11% 0.11% 0.12% 0.14% 0.14% 0.14% 0.16% 0.16% 0.15% 0.19% 0.18% 0.19% 0.21% 0.18% 0.19% 0.21% 0.21% 0.18% 0.19% 0.16% 0.18% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 110 111 112 113 114 115 116 117 118 119

Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defineo as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points)

Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defineo as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points)