Answered step by step

Verified Expert Solution

Question

1 Approved Answer

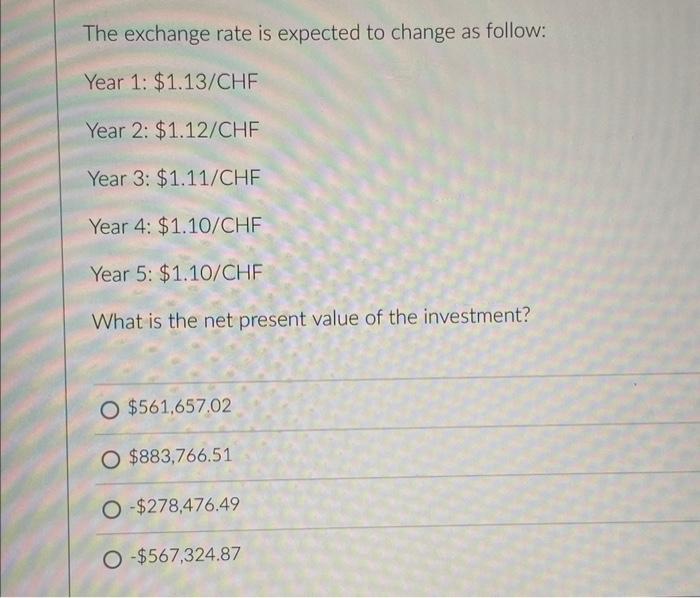

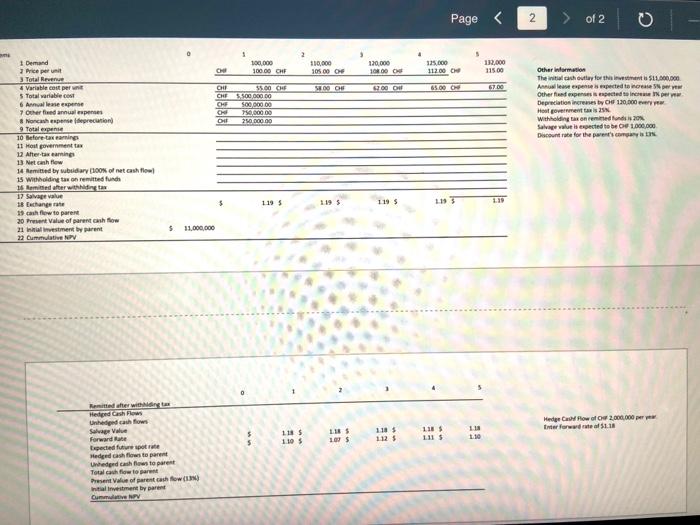

The exchange rate is expected to change as follow: Year 1: $1.13/CHF Year 2: $1.12/CHF Year 3: $1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What

The exchange rate is expected to change as follow: Year 1: $1.13/CHF Year 2: $1.12/CHF Year 3: $1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? A-$561,657.02 B-$883,766.51 C-$278,476.49 D-$567,324.87

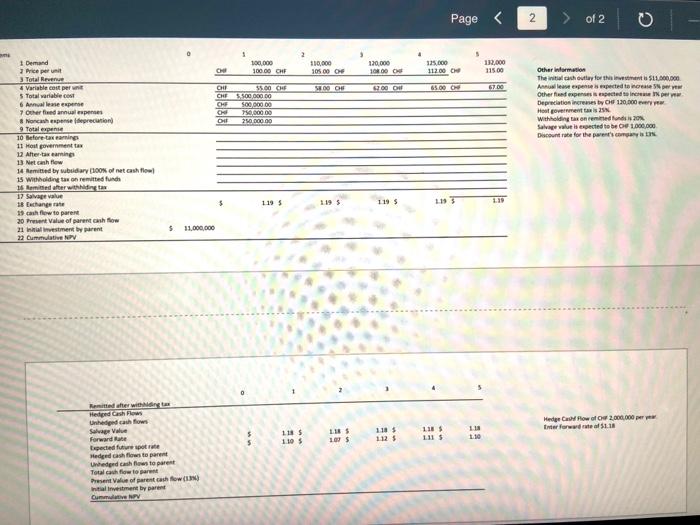

The exchange rate is expected to change as follow: Year 1: \$1.13/CHF Year 2: \$1.12/CHF Year 3: \$1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? $561,657.02 $883,766.51 $278,476.49 $567,324.87 Other intarm etion The initial tash ostlar for this investhant in 511,200Nen. Hool gortinitivt tar is 25W. Docount rabe for the perentis enwivang in lis. Hedge Cash flowe of ore 2.000. 009 per par thter fara id rate at $1.1 th The exchange rate is expected to change as follow: Year 1: \$1.13/CHF Year 2: \$1.12/CHF Year 3: \$1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? $561,657.02 $883,766.51 $278,476.49 $567,324.87 Other intarm etion The initial tash ostlar for this investhant in 511,200Nen. Hool gortinitivt tar is 25W. Docount rabe for the perentis enwivang in lis. Hedge Cash flowe of ore 2.000. 009 per par thter fara id rate at $1.1 th

The exchange rate is expected to change as follow: Year 1: \$1.13/CHF Year 2: \$1.12/CHF Year 3: \$1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? $561,657.02 $883,766.51 $278,476.49 $567,324.87 Other intarm etion The initial tash ostlar for this investhant in 511,200Nen. Hool gortinitivt tar is 25W. Docount rabe for the perentis enwivang in lis. Hedge Cash flowe of ore 2.000. 009 per par thter fara id rate at $1.1 th The exchange rate is expected to change as follow: Year 1: \$1.13/CHF Year 2: \$1.12/CHF Year 3: \$1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? $561,657.02 $883,766.51 $278,476.49 $567,324.87 Other intarm etion The initial tash ostlar for this investhant in 511,200Nen. Hool gortinitivt tar is 25W. Docount rabe for the perentis enwivang in lis. Hedge Cash flowe of ore 2.000. 009 per par thter fara id rate at $1.1 th

The exchange rate is expected to change as follow: Year 1: $1.13/CHF Year 2: $1.12/CHF Year 3: $1.11/CHF Year 4: $1.10/CHF Year 5: $1.10/CHF What is the net present value of the investment? A-$561,657.02 B-$883,766.51 C-$278,476.49 D-$567,324.87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started