Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Exercises can be found from the Image 7. You visited the foreign exchange trading room ofa major bank when a trader asked for quotes

The Exercises can be found from the Image

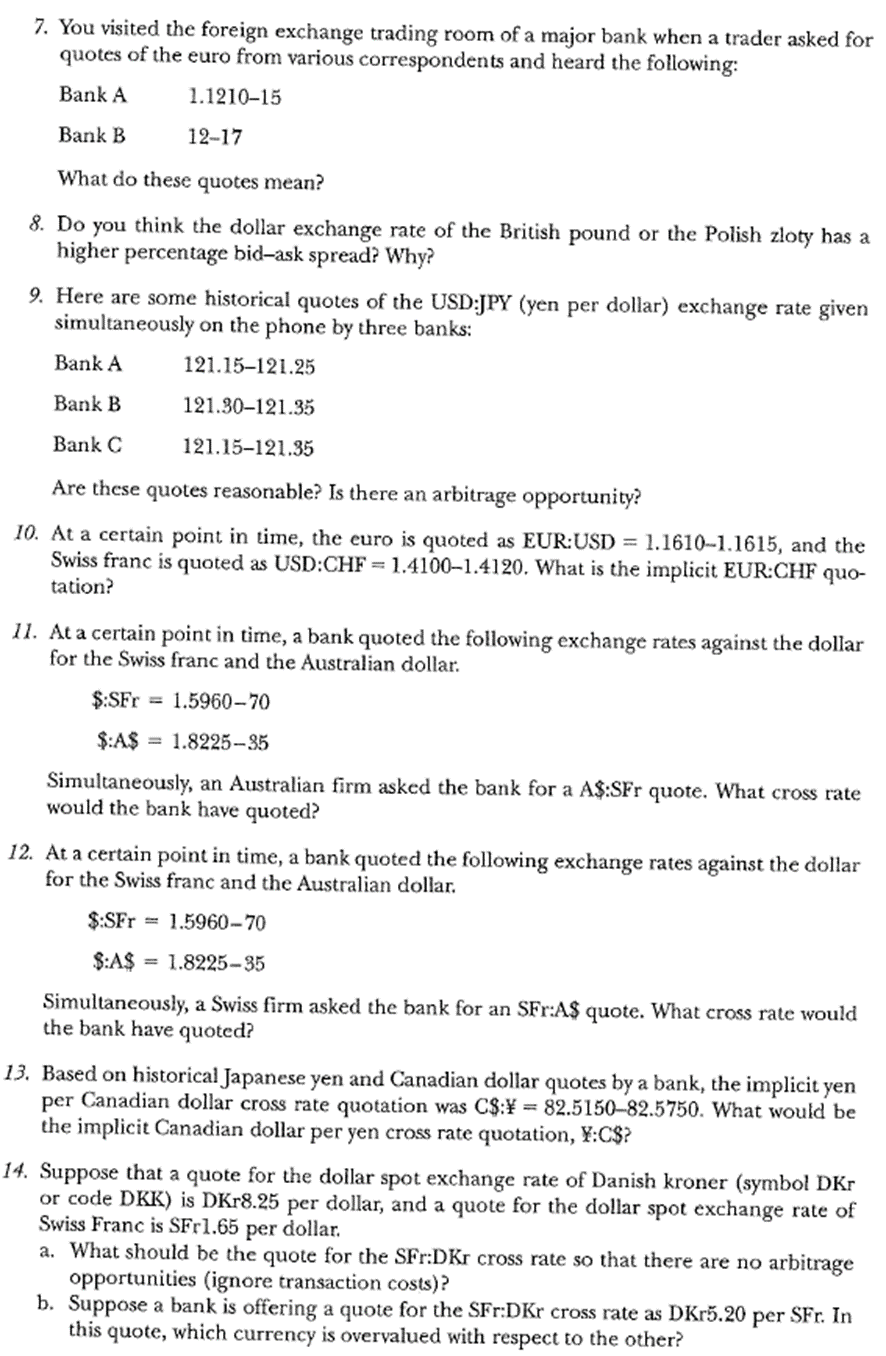

7. You visited the foreign exchange trading room ofa major bank when a trader asked for quotes of the euro from various correspondents and heard the following: Bank A 1.1210-15 Bank B 12-17 What do these quotes mean? 8. Do you think the dollar exchange rate of thc British pound or thc Polish zloty has a higher percentage bidask spread? Why? 9. Here are some historical quotes of the USD:JPY (yen per dollar) exchange rate given simultaneously on the phone by three banks: Bank A Bank B Bank C 121.15-121.25 121.30-121.35 121.15-121.35 Are these quotes reasonable? Is there an arbitrage opportunity? 10. At a certain point in time, the euro is quoted as EUR:USD = 1.16101.1615, and the Swiss franc is quoted as USD:CHF 1.41001.4120. What is the implicit EUR:CHF quo- tation? II. At a certain point in time, a bank quoted the following exchange rates against the dollar for the Swiss franc and the Australian dollar. $:SFr = 1.5960-70 $:A$ = 1.8225-&5 Simultaneously, an Australian firm asked the bank for a A$:SFr quote. What cross rate would the bank have quoted? 12. At a certain pointin time, a bank quoted the following exchange rates against the dollar for the Swiss franc and the Australian dollar. $:SFr 1.5960-70 $:A$ = 1.8225-35 Simultaneously, a Swiss firm asked thc bank for an SFr.A$ quote. What cross ratc would the bank have quoted? 13. Based on historical Japanese yen and Canadian dollar quotes by a bank, the implicit yen per Canadian dollar cross rate quotation was C$:Y = 82.515082.5750. What would be the implicit Canadian dollar per yen cross rate quotation, Y:C$? 14. Suppose that a quote for the dollar spot exchange rate of Danish kroner (symbol DKr or code DKK) is DKr8.25 per dollar, and a quote for the dollar spot exchange rate of Swiss Franc is SFrI.65 per dollar. a. What should be the quote for the SFr:DKr cross rate so that there are no arbitrage opportunities (ignore transaction costs)? b. Suppose a bank is offering a quote for the SFr:DKr cross rate as DKr5.20 per SFr. In this quote, which currency is overvalued with respect to the other?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started