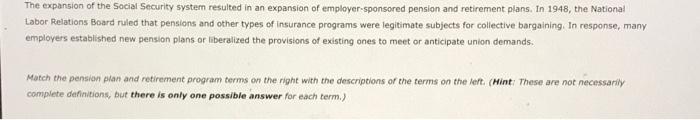

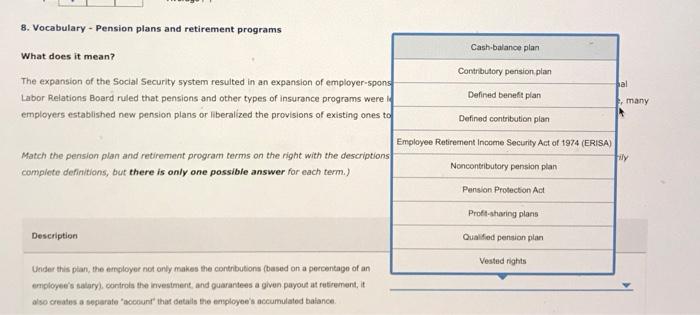

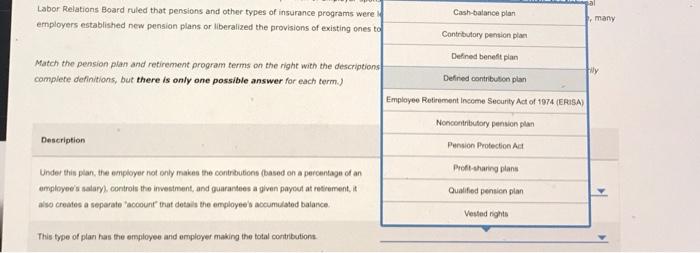

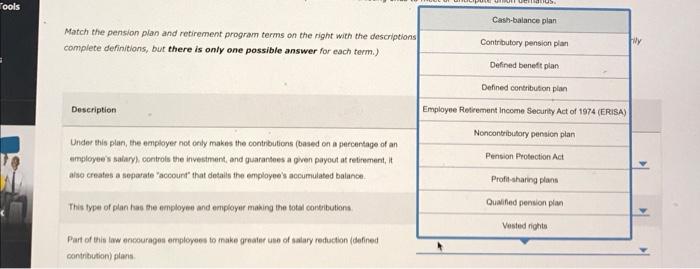

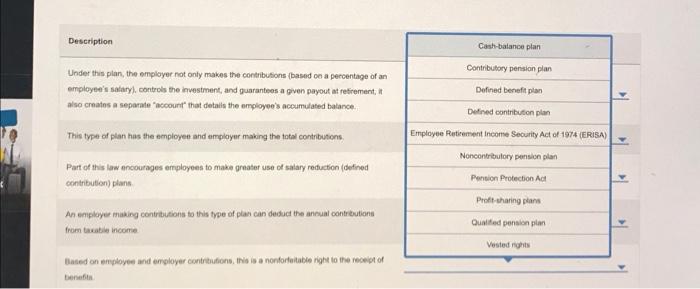

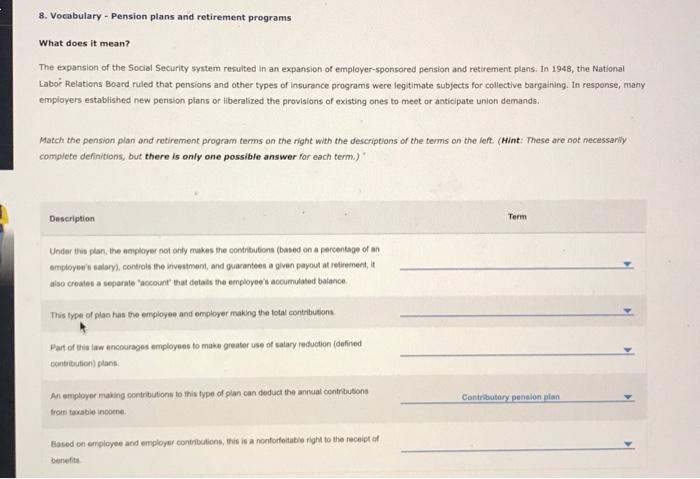

The expansion of the Social Security system resulted in an expansion of employer-sponsored pension and retirement plans, In 1948 , the National Labor Relations Board ruled that pensions and other types of insurance programs were legitimate subjects for coliective bargaining. In response, many employers established new pension plans or liberalized the provisions of existing ones to meet or anticipate union demands. Match the pension phan and retirement program terms on the right with the descriptions or the terms on the left. (Hint: These are not necessarily complete definitions, but there is only one possible answer for each term.) 8. Vocabulary - Pension plans and retirement programs What does it mean? The expansion of the Social Security system resulted in an expansion of employer-spon Labor Relations Board ruled that pensions and other types of insurance programs were employers established new pension plans or liberalized the provisions of existing ones t Match the pension plan and retirement program terms on the right with the description compiete definitions, but there is only one possible answer for each term.) Description Ukder this plan, the employer not only makes the contributions (based on a percentage of an employee's salaryl, conirola the investment, and quarantees a given payout at retrement, it also creates a segarate "aoctunt' that detals the employee's accumulated balance. Labor Relations Board ruled that pensions and other types of insurance programs were I employers established new pension plans or liberalized the provisions of existing ones to Match the pension plan and retirement program terms on the right with the descriptions camplete definitions, but there is only one possible answer for each term.) Description Under thin plan, the employer not only makes the contributions (based on a percentage of an employee's salary), controis the investment, and guarantees a given payout at retrement, it also creates a separate 'acoount' that detals the employee's accumulated balance. This type of plan has the empleyee and eriployer making the total contributions Match the pension plan and retirement programn terms on the right with the descriptions complete definitions, but there is only one possible answer for each term.) Description Employee Retrement income Security Act of 1974 (ERISA) Under this plan, the employer not only makns the contributions (based on a percentage of an employee is salary), controis the invesiment, and guarantees a pven payout at retirement, it alse crnates a separate "accourt" that details the employee's accumulated balance. This type of plan has the employee and enployer making the total contributions Part of Enis law encourages employees to make grnater use of salary reduction (defined contribution) plans Description Under this plan, the employer not only makes the contribusons (based oe a percentage of an employee's sadary), controls the investment, and guaranteos a given payout at retrement, it also creatos a separale "account" that detalis the employee's accumulated balance. This type of plan has the employen and employer making the total contributons Part of this law encourages employees to make greater use of salary refuction (defined contribution) plans. An employe making contribusons to this type of plas can deded the ancual contrevtions from tasatie income. Eased on enployes and employer contrtudions, this is a nonforfelabie nighe to the receict of benefin 8. Vocabulary - Pension plans and retirement programs What does it mean? The expansion of the Social Security system resulted in an expansion of employer-sponsored pension and retirement plans. In 1948, the National Laboi Relations Board ruled that pensions and other types of insurance programs were legitimate subjects for collective bargaining. In response, many empioyers established new pension plans of liberalized the provisions of existing ones to meet or anticipate union demands. Match the pension plan and retirement program tems on the right with the descriptions of the terms on the left: (Hint: These are not necessarily compiefe definitions, but there is only one possible answer for each term.) Deseription Term Under thit plan, the ecciloyer not only makes the contribubions (based on a percentage of an employee's salory), controis the investment, and guarantees a given payout at istirement, it aiso creales a segarale "account" that detals the employees accumulated balance This lype of plan has the empioyee and employer making the fotal eontributions Part of this law encourages employees to make greater use of salary reduction (defiried contritution) plans An empioyer making contributions to this type of plan can deduct the annual contribubons Contributory penalon plan from tassble incorne Based ch errployee and employar contributions, this is a nonforfeitabie right to the receigt af bentwefiti The expansion of the Social Security system resulted in an expansion of employer-sponsored pension and retirement plans, In 1948 , the National Labor Relations Board ruled that pensions and other types of insurance programs were legitimate subjects for coliective bargaining. In response, many employers established new pension plans or liberalized the provisions of existing ones to meet or anticipate union demands. Match the pension phan and retirement program terms on the right with the descriptions or the terms on the left. (Hint: These are not necessarily complete definitions, but there is only one possible answer for each term.) 8. Vocabulary - Pension plans and retirement programs What does it mean? The expansion of the Social Security system resulted in an expansion of employer-spon Labor Relations Board ruled that pensions and other types of insurance programs were employers established new pension plans or liberalized the provisions of existing ones t Match the pension plan and retirement program terms on the right with the description compiete definitions, but there is only one possible answer for each term.) Description Ukder this plan, the employer not only makes the contributions (based on a percentage of an employee's salaryl, conirola the investment, and quarantees a given payout at retrement, it also creates a segarate "aoctunt' that detals the employee's accumulated balance. Labor Relations Board ruled that pensions and other types of insurance programs were I employers established new pension plans or liberalized the provisions of existing ones to Match the pension plan and retirement program terms on the right with the descriptions camplete definitions, but there is only one possible answer for each term.) Description Under thin plan, the employer not only makes the contributions (based on a percentage of an employee's salary), controis the investment, and guarantees a given payout at retrement, it also creates a separate 'acoount' that detals the employee's accumulated balance. This type of plan has the empleyee and eriployer making the total contributions Match the pension plan and retirement programn terms on the right with the descriptions complete definitions, but there is only one possible answer for each term.) Description Employee Retrement income Security Act of 1974 (ERISA) Under this plan, the employer not only makns the contributions (based on a percentage of an employee is salary), controis the invesiment, and guarantees a pven payout at retirement, it alse crnates a separate "accourt" that details the employee's accumulated balance. This type of plan has the employee and enployer making the total contributions Part of Enis law encourages employees to make grnater use of salary reduction (defined contribution) plans Description Under this plan, the employer not only makes the contribusons (based oe a percentage of an employee's sadary), controls the investment, and guaranteos a given payout at retrement, it also creatos a separale "account" that detalis the employee's accumulated balance. This type of plan has the employen and employer making the total contributons Part of this law encourages employees to make greater use of salary refuction (defined contribution) plans. An employe making contribusons to this type of plas can deded the ancual contrevtions from tasatie income. Eased on enployes and employer contrtudions, this is a nonforfelabie nighe to the receict of benefin 8. Vocabulary - Pension plans and retirement programs What does it mean? The expansion of the Social Security system resulted in an expansion of employer-sponsored pension and retirement plans. In 1948, the National Laboi Relations Board ruled that pensions and other types of insurance programs were legitimate subjects for collective bargaining. In response, many empioyers established new pension plans of liberalized the provisions of existing ones to meet or anticipate union demands. Match the pension plan and retirement program tems on the right with the descriptions of the terms on the left: (Hint: These are not necessarily compiefe definitions, but there is only one possible answer for each term.) Deseription Term Under thit plan, the ecciloyer not only makes the contribubions (based on a percentage of an employee's salory), controis the investment, and guarantees a given payout at istirement, it aiso creales a segarale "account" that detals the employees accumulated balance This lype of plan has the empioyee and employer making the fotal eontributions Part of this law encourages employees to make greater use of salary reduction (defiried contritution) plans An empioyer making contributions to this type of plan can deduct the annual contribubons Contributory penalon plan from tassble incorne Based ch errployee and employar contributions, this is a nonforfeitabie right to the receigt af bentwefiti