Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. The expected return of a small stock portfolio return is 18% and the expected return of a large stock portfolio is 14%. The

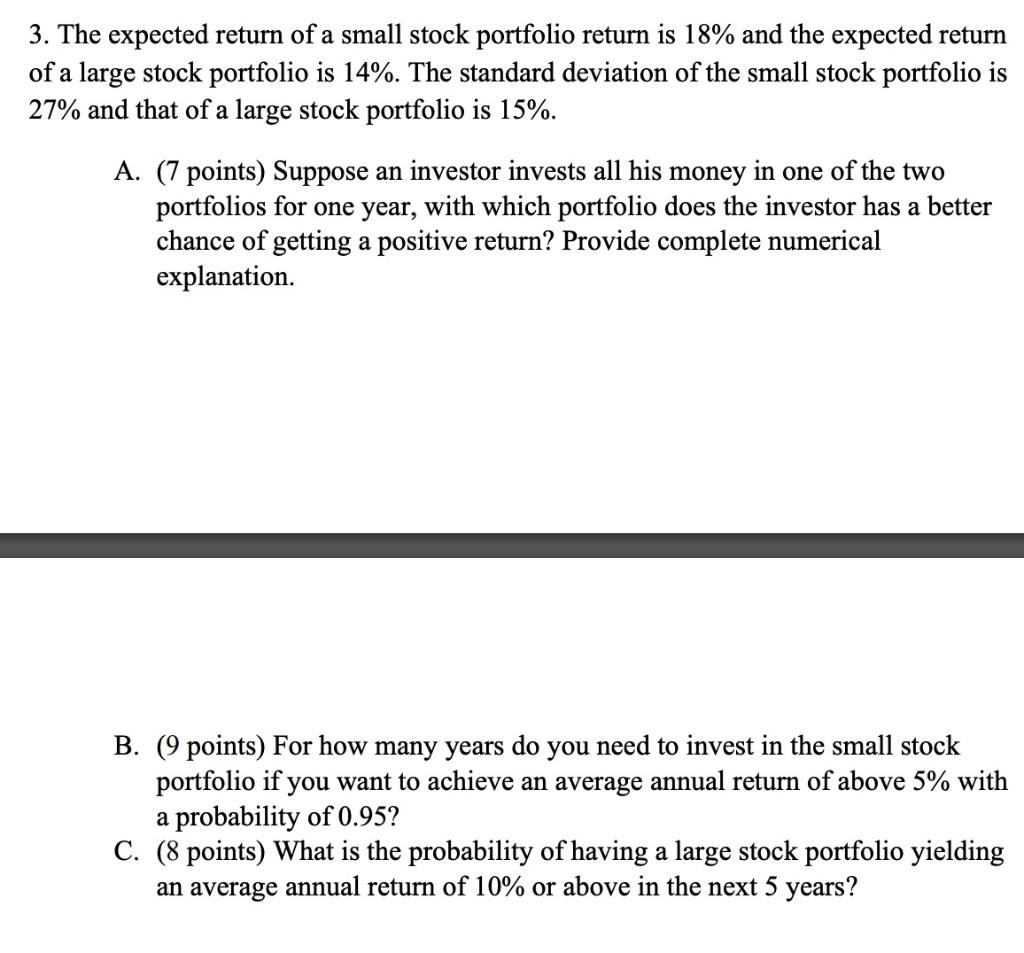

3. The expected return of a small stock portfolio return is 18% and the expected return of a large stock portfolio is 14%. The standard deviation of the small stock portfolio is 27% and that of a large stock portfolio is 15%. A. (7 points) Suppose an investor invests all his money in one of the two portfolios for one year, with which portfolio does the investor has a better chance of getting a positive return? Provide complete numerical explanation. B. (9 points) For how many years do you need to invest in the small stock portfolio if you want to achieve an average annual return of above 5% with a probability of 0.95? C. (8 points) What is the probability of having a large stock portfolio yielding an average annual return of 10% or above in the next 5 years? 3. The expected return of a small stock portfolio return is 18% and the expected return of a large stock portfolio is 14%. The standard deviation of the small stock portfolio is 27% and that of a large stock portfolio is 15%. A. (7 points) Suppose an investor invests all his money in one of the two portfolios for one year, with which portfolio does the investor has a better chance of getting a positive return? Provide complete numerical explanation. B. (9 points) For how many years do you need to invest in the small stock portfolio if you want to achieve an average annual return of above 5% with a probability of 0.95? C. (8 points) What is the probability of having a large stock portfolio yielding an average annual return of 10% or above in the next 5 years? 3. The expected return of a small stock portfolio return is 18% and the expected return of a large stock portfolio is 14%. The standard deviation of the small stock portfolio is 27% and that of a large stock portfolio is 15%. A. (7 points) Suppose an investor invests all his money in one of the two portfolios for one year, with which portfolio does the investor has a better chance of getting a positive return? Provide complete numerical explanation. B. (9 points) For how many years do you need to invest in the small stock portfolio if you want to achieve an average annual return of above 5% with a probability of 0.95? C. (8 points) What is the probability of having a large stock portfolio yielding an average annual return of 10% or above in the next 5 years?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A ANS WER The investor has a better chance of getting a positive return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started