Question: The expected return on Big Time Toys is 11% and its standard deviation is 21.6%. The expected return on Chemical Industries is 13% and its

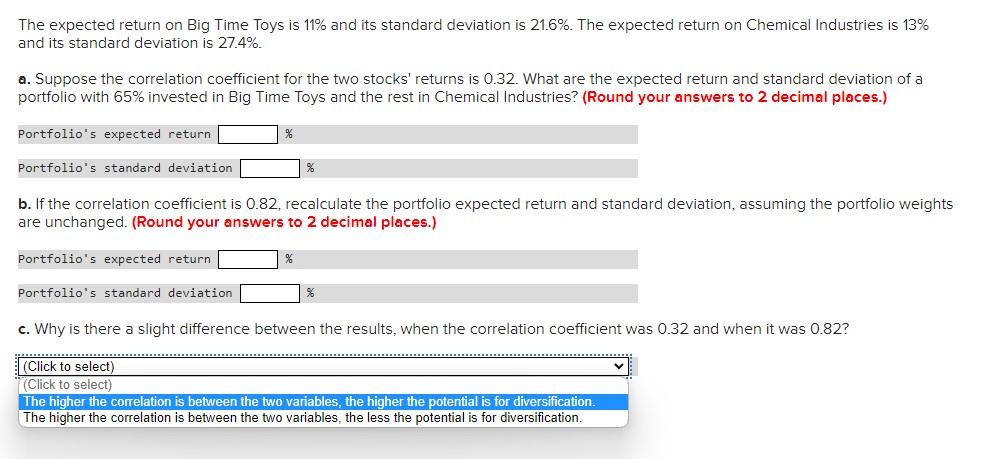

The expected return on Big Time Toys is 11% and its standard deviation is 21.6%. The expected return on Chemical Industries is 13% and its standard deviation is 27.4%. a. Suppose the correlation coefficient for the two stocks' returns is 0.32. What are the expected return and standard deviation of a portfolio with 65% invested in Big Time Toys and the rest in Chemical Industries? (Round your answers to 2 decimal places.) Portfolio's expected return Portfolio's standard deviation b. If the correlation coefficient is 0.82, recalculate the portfolio expected return and standard deviation, assuming the portfolio weights are unchanged. (Round your answers to 2 decimal places.) Portfolio's expected return Portfolio's standard deviation % c. Why is there a slight difference between the results, when the correlation coefficient was 0.32 and when it was 0.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts