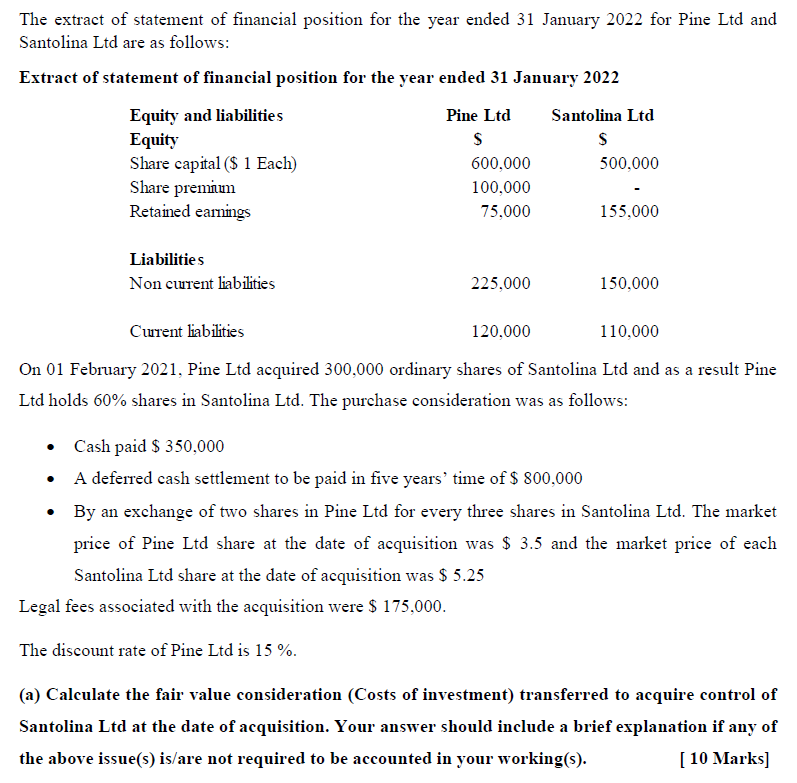

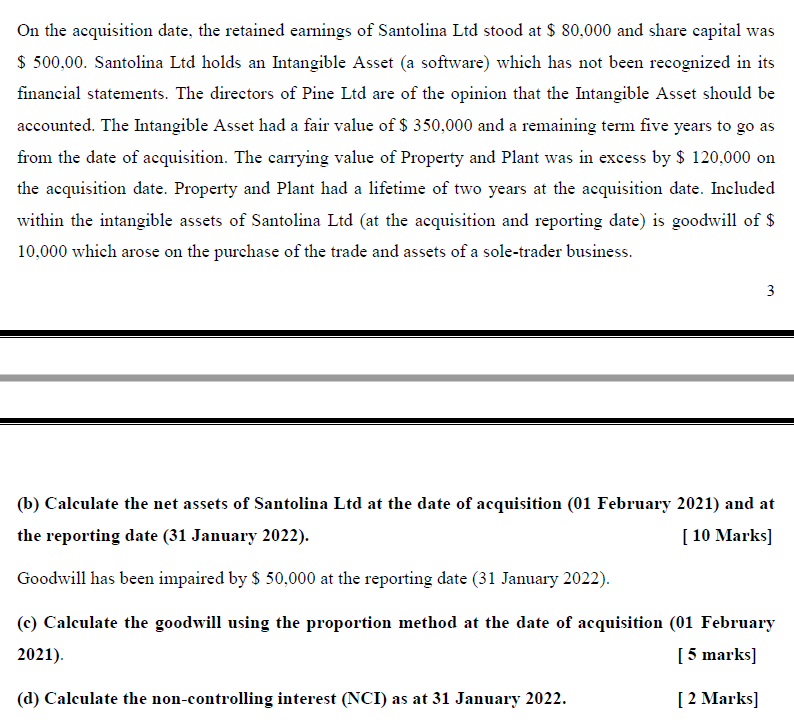

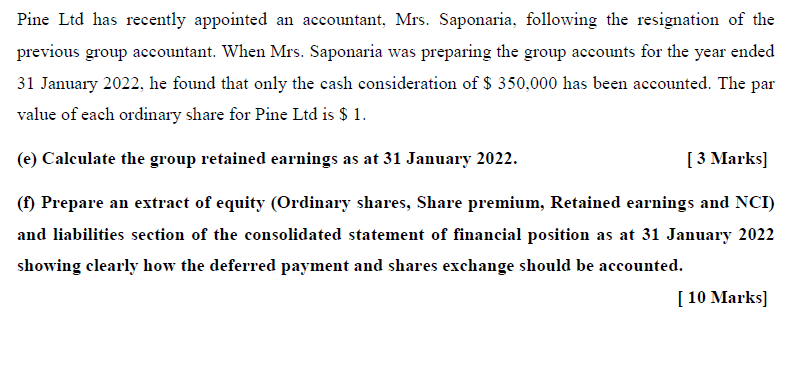

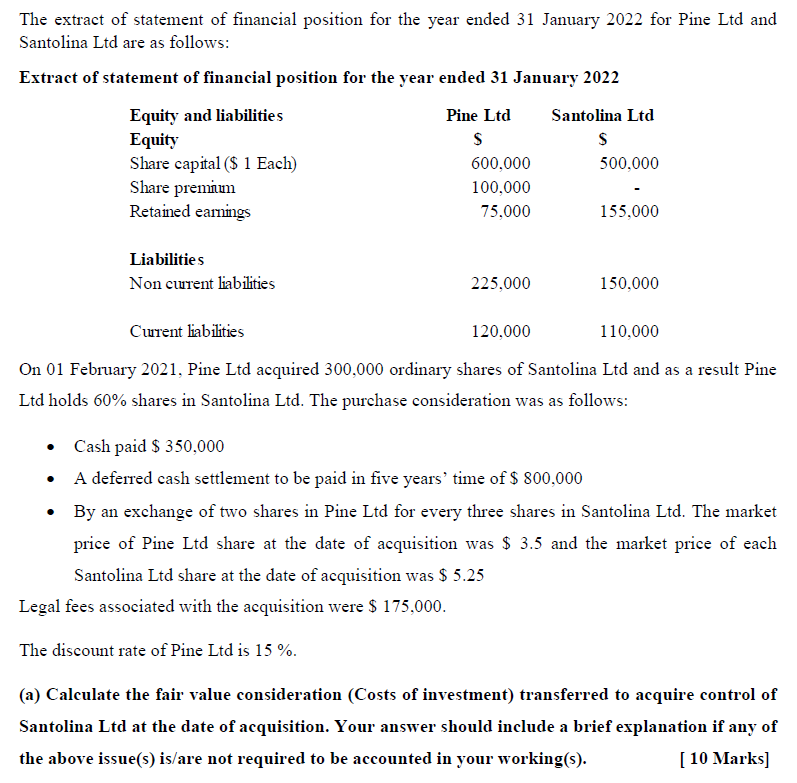

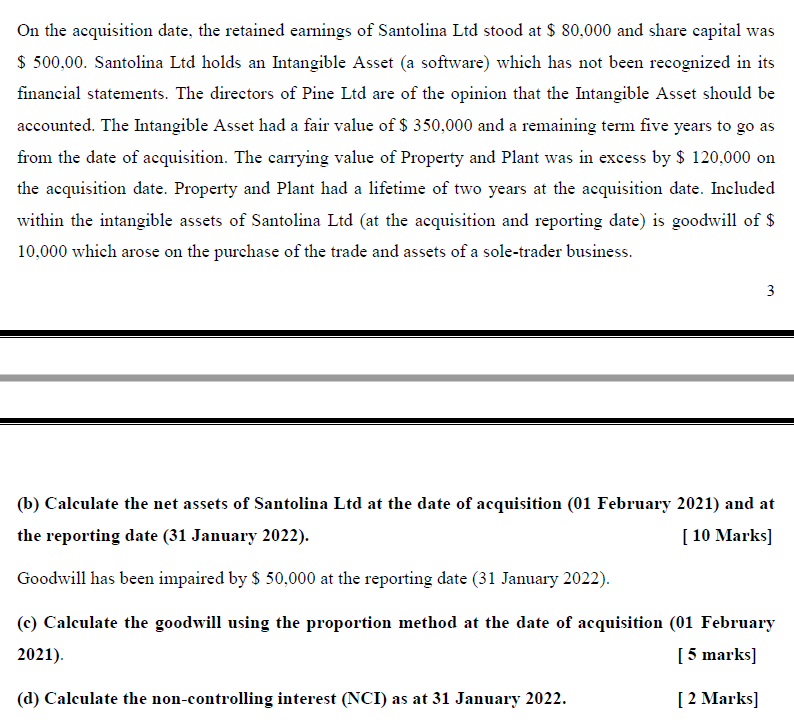

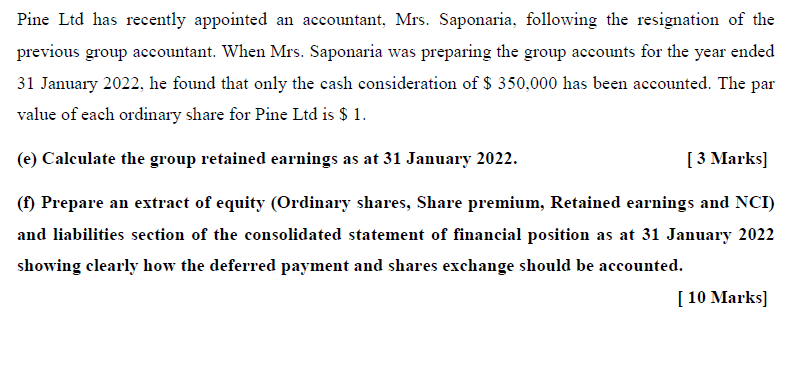

The extract of statement of financial position for the year ended 31 January 2022 for Pine Ltd and Santolina Ltd are as follows: Extract of statement of financial position for the year ended 31 January 2022 Equity and liabilities Pine Ltd Equity S Share capital ($1 Each) Share premium Retained earnings Liabilities Non current liabilities 600,000 100,000 75,000 225,000 The discount rate of Pine Ltd is 15 %. 120,000 Santolina Ltd S 500,000 155,000 Current liabilities 110,000 On 01 February 2021, Pine Ltd acquired 300,000 ordinary shares of Santolina Ltd and as a result Pine Ltd holds 60% shares in Santolina Ltd. The purchase consideration was as follows: 150,000 Cash paid $ 350,000 A deferred cash settlement to be paid in five years' time of $ 800,000 By an exchange of two shares in Pine Ltd for every three shares in Santolina Ltd. The market price of Pine Ltd share at the date of acquisition was $ 3.5 and the market price of each Santolina Ltd share at the date of acquisition was $5.25 Legal fees associated with the acquisition were $ 175,000. (a) Calculate the fair value consideration (Costs of investment) transferred to acquire control of Santolina Ltd at the date of acquisition. Your answer should include a brief explanation if any of the above issue(s) is/are not required to be accounted in your working(s). [10 Marks] On the acquisition date, the retained earnings of Santolina Ltd stood at $ 80,000 and share capital was $ 500,00. Santolina Ltd holds an Intangible Asset (a software) which has not been recognized in its financial statements. The directors of Pine Ltd are of the opinion that the Intangible Asset should be accounted. The Intangible Asset had a fair value of $ 350,000 and a remaining term five years to go as from the date of acquisition. The carrying value of Property and Plant was in excess by $ 120,000 on the acquisition date. Property and Plant had a lifetime of two years at the acquisition date. Included within the intangible assets of Santolina Ltd (at the acquisition and reporting date) is goodwill of $ 10,000 which arose on the purchase of the trade and assets of a sole-trader business. 3 (b) Calculate the net assets of Santolina Ltd at the date of acquisition (01 February 2021) and at the reporting date (31 January 2022). [ 10 Marks] Goodwill has been impaired by $ 50,000 at the reporting date (31 January 2022). (c) Calculate the goodwill using the proportion method at the date of acquisition 2021). (d) Calculate the non-controlling interest (NCI) as at 31 January 2022. (01 February [5 marks] [2 marks] Pine Ltd has recently appointed an accountant, Mrs. Saponaria, following the resignation of the previous group accountant. When Mrs. Saponaria was preparing the group accounts for the year ended 31 January 2022, he found that only the cash consideration of $ 350,000 has been accounted. The par value of each ordinary share for Pine Ltd is $ 1. (e) Calculate the group retained earnings as at 31 January 2022. [3 marks] (f) Prepare an extract of equity (Ordinary shares, Share premium, Retained earnings and NCI) and liabilities section of the consolidated statement of financial position as at 31 January 2022 showing clearly how the deferred payment and shares exchange should be accounted. [10 Marks]