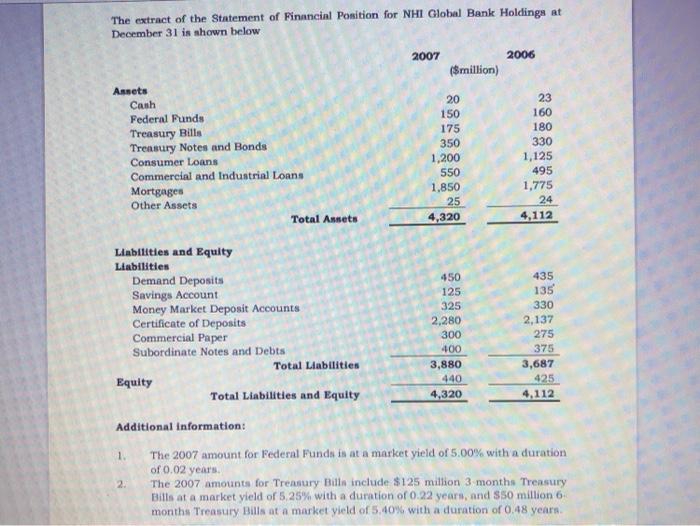

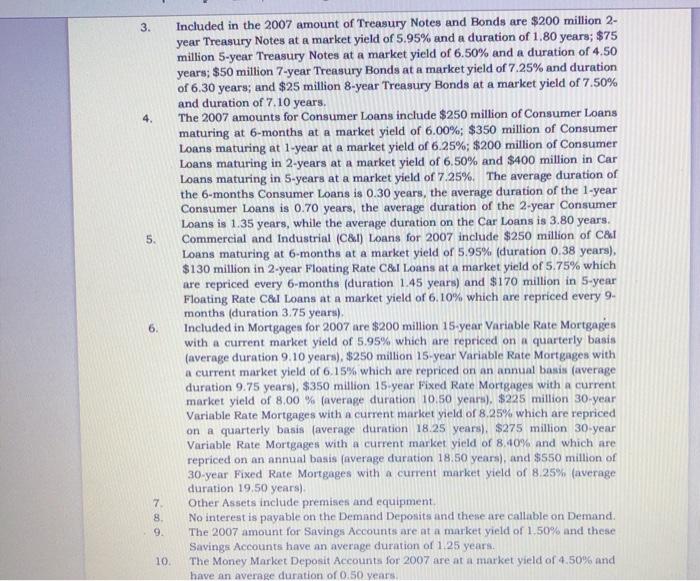

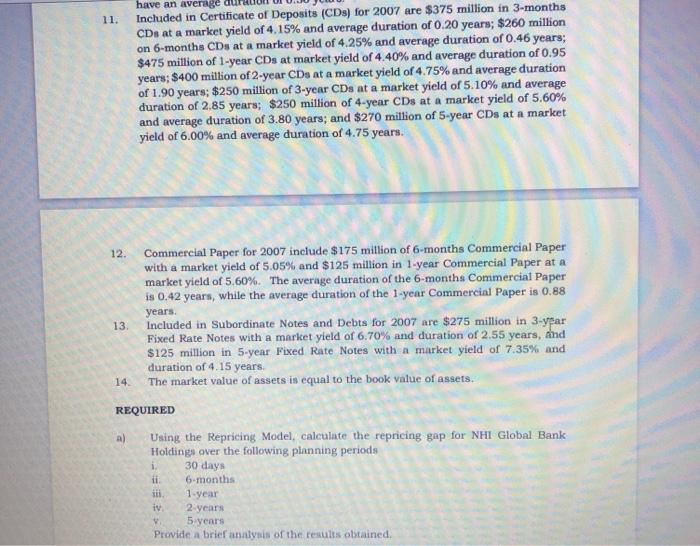

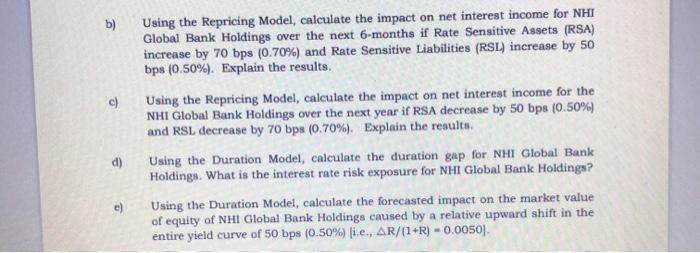

The extract of the Statement of Financial Position for NHI Global Bank Holdings at December 31 is shown below 2007 2006 ($million) Assets Cash Federal Funds Treasury Bills Treasury Notes and Bonds Consumer Loans Commercial and Industrial Loans Mortgages Other Assets Total Assets 20 150 175 350 1,200 550 1,850 25 4,320 23 160 180 330 1,125 495 1,775 24 4,112 Liabilities and Equity Liabilities Demand Deposits Savings Account Money Market Deposit Accounts Certificate of Deposits Commercial Paper Subordinate Notes and Debts Total Liabilities Equity Total Liabilities and Equity 450 125 325 2,280 300 400 3,880 440 4,320 435 135 330 2,137 275 375 3,687 425 4,112 Additional information: 1. The 2007 amount for Federal Funds in at a market yield of 5.00% with a duration of 0.02 years 2 The 2007 amounts for Treasury Bills include $125 million 3 months Treasury Bills at a market yield of 5.25% with a duration of 0.22 years, and 850 million 6 months Treasury Bills at a market yield of 5.40% with a duration of 0.48 years 3. 4. 5 Included in the 2007 amount of Treasury Notes and Bonds are $200 million 2- year Treasury Notes at a market yield of 5.95% and a duration of 1,80 years; $75 million 5-year Treasury Notes at a market yield of 6.50% and a duration of 4.50 years; $50 million 7-year Treasury Bonds at a market yield of 7.25% and duration of 6.30 years; and $25 million 8-year Treasury Bonds at a market yield of 7.50% and duration of 7.10 years. The 2007 amounts for Consumer Loans include $250 million of Consumer Loans maturing at 6-months at a market yield of 6.00%; $350 million of Consumer Loans maturing at 1-year at a market yield of 6.25%; $200 million of Consumer Loans maturing in 2 years at a market yield of 6.50% and $400 million in Car Loans maturing in 5-years at a market yield of 7.25%. The average duration of the 6-months Consumer Loans is 0.30 years, the average duration of the 1-year Consumer Loans is 0.70 years, the average duration of the 2-year Consumer Loans is 1.35 years, while the average duration on the Car Loans is 3.80 years. Commercial and Industrial (C&I) Loans for 2007 include $250 million of C&I Loans maturing at 6-months at a market yield of 5.95% (duration 0.38 years), $130 million in 2-year Floating Rate C&I Loans at a market yield of 5.75% which are repriced every 6 months (duration 1.45 years) and $170 million in 5-year Floating Rate Cal Loans at a market yield of 6.10% which are repriced every 9. months (duration 3.75 years) Included in Mortgages for 2007 are $200 million 15-year Variable Rate Mortgages with a current market yield of 5.95% which are repriced on a quarterly basis (average duration 9.10 years), $250 million 15-year Variable Rate Mortgages with a current market yield of 6.15% which are repriced on an annual basis (average duration 9.75 years). $350 million 15 year Fixed Rate Mortgages with a current market yield of 8,00 % (average duration 10.50 years). $225 million 30-year Variable Rate Mortgages with a current market yield of 8.25% which are repriced on a quarterly basis (average duration 18.25 years) $275 million 30-year Variable Rate Mortgages with a current market yield of 8.40% and which are repriced on an annual basis (average duration 18.50 years), and $550 million of 30-year Fixed Rate Mortgages with a current market yield of 8.25% (average duration 19,50 years) Other Assets include premises and equipment No interest is payable on the Demand Deposits and these are callable on Demand. The 2007 amount for Savings Accounts are at a market yield of 1.50% and these Savings Accounts have an average duration of 125 years The Money Market Deposit Accounts for 2007 are at a market yield of 4.50% and have an average duration of 0.50 vears 6. 7 8 9. 10 11. have an average au Included in Certificate of Deposits (CDs) for 2007 are $375 million in 3-months CDs at a market yield of 4.15% and average duration of 0.20 years; $260 million on 6-months CDs at a market yield of 4.25% and average duration of 0.46 years; $475 million of 1-year CDs at market yield of 4.40% and average duration of 0.95 years; $400 million of 2-year CDs at a market yield of 4.75% and average duration of 1.90 years; $250 million of 3-year CDs at a market yield of 5.10% and average duration of 2.85 years; $250 million of 4-year CDs at a market yield of 5.60% and average duration of 3.80 years; and $270 million of 5-year CDs at a market yield of 6.00% and average duration of 4.75 years. 12 Commercial Paper for 2007 include $175 million of 6 months Commercial Paper with a market yield of 5.05% and $125 million in 1-year Commercial Paper at a market yield of 5.60%. The average duration of the 6-months Commercial Paper is 0.42 years, while the average duration of the 1-year Commercial Paper is 0.88 years. Included in Subordinate Notes and Debts for 2007 are $275 million in 3-year Fixed Rate Notes with a market yield of 6.70% and duration of 2.55 years, and $125 million in 5-year Fixed Rate Notes with a market yield of 7.35% and duration of 4.15 years The market value of assets is equal to the book value of assets. 13. 14. REQUIRED a) Using the Repricing Model, calculate the repricing gap for NHI Global Bank Holdings over the following planning periods 1. 30 days il 6 months ii 1 year iv 2 years 5 years Provide a brief analysis of the results obtained b) c) Using the Repricing Model, calculate the impact on net interest income for NHI Global Bank Holdings over the next 6-months if Rate Sensitive Assets (RSA) increase by 70 bps (0.70%) and Rate Sensitive Liabilities (RSL) increase by 50 bps (0.50%). Explain the results. Using the Repricing Model, calculate the impact on net interest income for the NHI Global Bank Holdings over the next year if RSA decrease by 50 bps (0.50%) and RSL decrease by 70 bps (0.70%). Explain the results. Using the Duration Model, calculate the duration gap for NHI Global Bank Holdings. What is the interest rate risk exposure for NHI Global Bank Holdinga? Using the Duration Model, calculate the forecasted impact on the market value of equity of NHI Global Bank Holdings caused by a relative upward shift in the entire yield curve of 50 bps (0.50%) i.e., AR/(1+R) - 0.0050). d) e) The extract of the Statement of Financial Position for NHI Global Bank Holdings at December 31 is shown below 2007 2006 ($million) Assets Cash Federal Funds Treasury Bills Treasury Notes and Bonds Consumer Loans Commercial and Industrial Loans Mortgages Other Assets Total Assets 20 150 175 350 1,200 550 1,850 25 4,320 23 160 180 330 1,125 495 1,775 24 4,112 Liabilities and Equity Liabilities Demand Deposits Savings Account Money Market Deposit Accounts Certificate of Deposits Commercial Paper Subordinate Notes and Debts Total Liabilities Equity Total Liabilities and Equity 450 125 325 2,280 300 400 3,880 440 4,320 435 135 330 2,137 275 375 3,687 425 4,112 Additional information: 1. The 2007 amount for Federal Funds in at a market yield of 5.00% with a duration of 0.02 years 2 The 2007 amounts for Treasury Bills include $125 million 3 months Treasury Bills at a market yield of 5.25% with a duration of 0.22 years, and 850 million 6 months Treasury Bills at a market yield of 5.40% with a duration of 0.48 years 3. 4. 5 Included in the 2007 amount of Treasury Notes and Bonds are $200 million 2- year Treasury Notes at a market yield of 5.95% and a duration of 1,80 years; $75 million 5-year Treasury Notes at a market yield of 6.50% and a duration of 4.50 years; $50 million 7-year Treasury Bonds at a market yield of 7.25% and duration of 6.30 years; and $25 million 8-year Treasury Bonds at a market yield of 7.50% and duration of 7.10 years. The 2007 amounts for Consumer Loans include $250 million of Consumer Loans maturing at 6-months at a market yield of 6.00%; $350 million of Consumer Loans maturing at 1-year at a market yield of 6.25%; $200 million of Consumer Loans maturing in 2 years at a market yield of 6.50% and $400 million in Car Loans maturing in 5-years at a market yield of 7.25%. The average duration of the 6-months Consumer Loans is 0.30 years, the average duration of the 1-year Consumer Loans is 0.70 years, the average duration of the 2-year Consumer Loans is 1.35 years, while the average duration on the Car Loans is 3.80 years. Commercial and Industrial (C&I) Loans for 2007 include $250 million of C&I Loans maturing at 6-months at a market yield of 5.95% (duration 0.38 years), $130 million in 2-year Floating Rate C&I Loans at a market yield of 5.75% which are repriced every 6 months (duration 1.45 years) and $170 million in 5-year Floating Rate Cal Loans at a market yield of 6.10% which are repriced every 9. months (duration 3.75 years) Included in Mortgages for 2007 are $200 million 15-year Variable Rate Mortgages with a current market yield of 5.95% which are repriced on a quarterly basis (average duration 9.10 years), $250 million 15-year Variable Rate Mortgages with a current market yield of 6.15% which are repriced on an annual basis (average duration 9.75 years). $350 million 15 year Fixed Rate Mortgages with a current market yield of 8,00 % (average duration 10.50 years). $225 million 30-year Variable Rate Mortgages with a current market yield of 8.25% which are repriced on a quarterly basis (average duration 18.25 years) $275 million 30-year Variable Rate Mortgages with a current market yield of 8.40% and which are repriced on an annual basis (average duration 18.50 years), and $550 million of 30-year Fixed Rate Mortgages with a current market yield of 8.25% (average duration 19,50 years) Other Assets include premises and equipment No interest is payable on the Demand Deposits and these are callable on Demand. The 2007 amount for Savings Accounts are at a market yield of 1.50% and these Savings Accounts have an average duration of 125 years The Money Market Deposit Accounts for 2007 are at a market yield of 4.50% and have an average duration of 0.50 vears 6. 7 8 9. 10 11. have an average au Included in Certificate of Deposits (CDs) for 2007 are $375 million in 3-months CDs at a market yield of 4.15% and average duration of 0.20 years; $260 million on 6-months CDs at a market yield of 4.25% and average duration of 0.46 years; $475 million of 1-year CDs at market yield of 4.40% and average duration of 0.95 years; $400 million of 2-year CDs at a market yield of 4.75% and average duration of 1.90 years; $250 million of 3-year CDs at a market yield of 5.10% and average duration of 2.85 years; $250 million of 4-year CDs at a market yield of 5.60% and average duration of 3.80 years; and $270 million of 5-year CDs at a market yield of 6.00% and average duration of 4.75 years. 12 Commercial Paper for 2007 include $175 million of 6 months Commercial Paper with a market yield of 5.05% and $125 million in 1-year Commercial Paper at a market yield of 5.60%. The average duration of the 6-months Commercial Paper is 0.42 years, while the average duration of the 1-year Commercial Paper is 0.88 years. Included in Subordinate Notes and Debts for 2007 are $275 million in 3-year Fixed Rate Notes with a market yield of 6.70% and duration of 2.55 years, and $125 million in 5-year Fixed Rate Notes with a market yield of 7.35% and duration of 4.15 years The market value of assets is equal to the book value of assets. 13. 14. REQUIRED a) Using the Repricing Model, calculate the repricing gap for NHI Global Bank Holdings over the following planning periods 1. 30 days il 6 months ii 1 year iv 2 years 5 years Provide a brief analysis of the results obtained b) c) Using the Repricing Model, calculate the impact on net interest income for NHI Global Bank Holdings over the next 6-months if Rate Sensitive Assets (RSA) increase by 70 bps (0.70%) and Rate Sensitive Liabilities (RSL) increase by 50 bps (0.50%). Explain the results. Using the Repricing Model, calculate the impact on net interest income for the NHI Global Bank Holdings over the next year if RSA decrease by 50 bps (0.50%) and RSL decrease by 70 bps (0.70%). Explain the results. Using the Duration Model, calculate the duration gap for NHI Global Bank Holdings. What is the interest rate risk exposure for NHI Global Bank Holdinga? Using the Duration Model, calculate the forecasted impact on the market value of equity of NHI Global Bank Holdings caused by a relative upward shift in the entire yield curve of 50 bps (0.50%) i.e., AR/(1+R) - 0.0050). d) e)