Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst

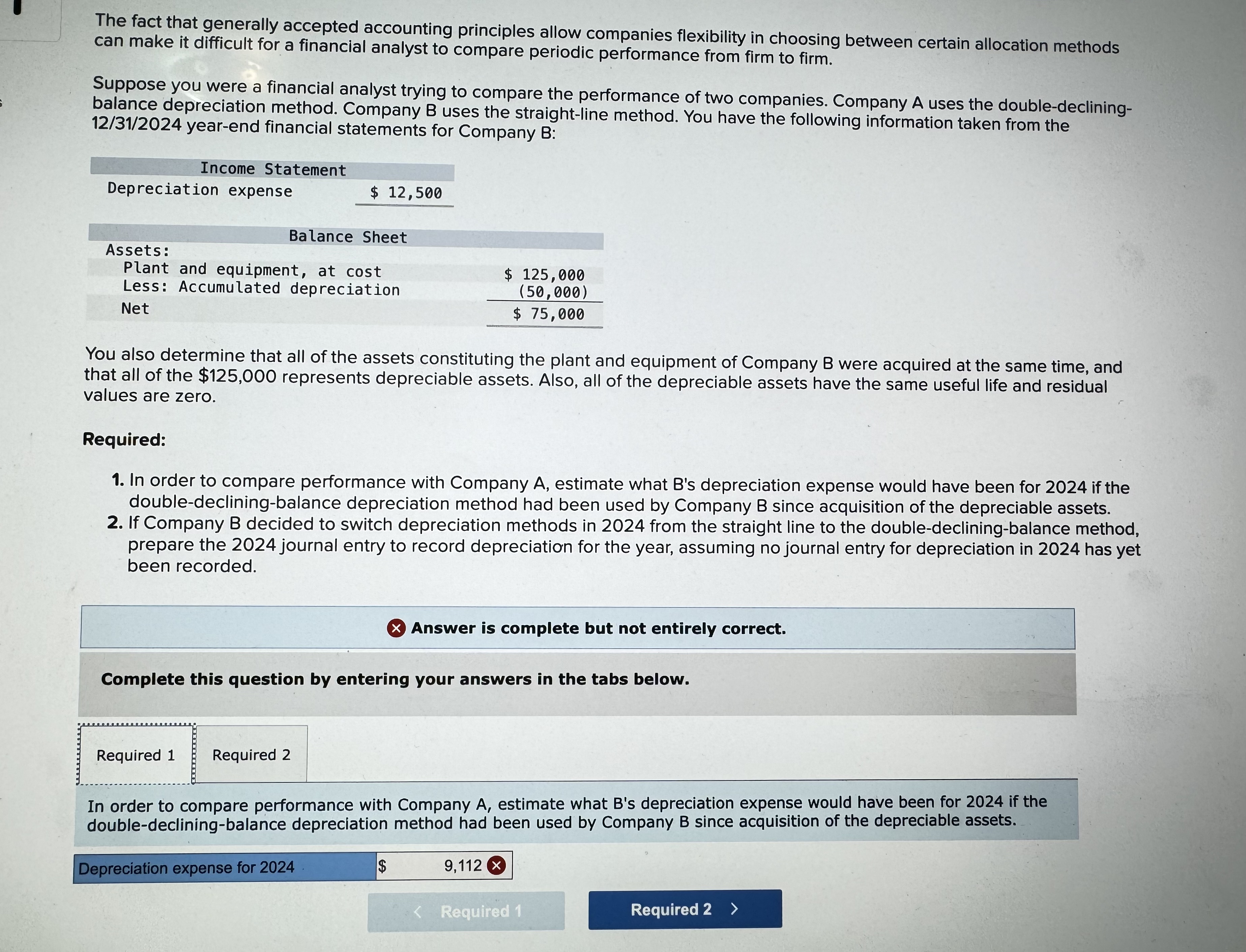

The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst to compare periodic performance from firm to firm. Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining- balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2024 year-end financial statements for Company B: Income Statement Depreciation expense $ 12,500 Balance Sheet $ 125,000 (50,000) Assets: Plant and equipment, at cost Less: Accumulated depreciation Net $ 75,000 You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that all of the $125,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are zero. Required: 1. In order to compare performance with Company A, estimate what B's depreciation expense would have been for 2024 if the double-declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets. 2. If Company B decided to switch depreciation methods in 2024 from the straight line to the double-declining-balance method, prepare the 2024 journal entry to record depreciation for the year, assuming no journal entry for depreciation in 2024 has yet been recorded. > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 In order to compare performance with Company A, estimate what B's depreciation expense would have been for 2024 if the double-declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets. Depreciation expense for 2024 $ 9,112 X < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 To estimate Company Bs depreciation expense for 2024 using the doubledecliningbalance met...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started