Answered step by step

Verified Expert Solution

Question

1 Approved Answer

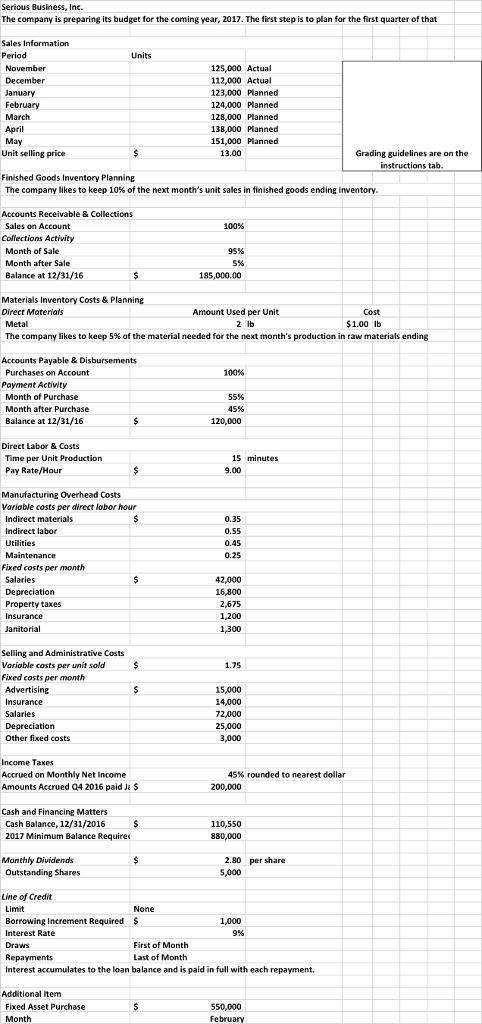

The facts for this problem are presented on the Facts tab of this workbook. Instructions - Your solutions should be clearly labeled on the Solutions

| The facts for this problem are presented on the Facts tab of this workbook. | ||

| Instructions - Your solutions should be clearly labeled on the Solutions tab of this workbook. | ||

| For the first quarter of 2017, do the following. | ||

| (a) Prepare a sales budget. This is similar to Illustration 21-3 on page 1088 of your textbook. | ||

| (b) Prepare a production budget. This is similar to Illustration 21-5 on page 1089 of your textbook. | ||

| (c) Prepare a direct materials budget. (Round to nearest dollar) This is similar to Illustration 21-7 on page 1091 of your textbook. | ||

| (d) Prepare a direct labor budget. (For calculations, round to the nearest hour.) This is similar to Illustration 21-9 on page 1094 of your textbook. | ||

| (e) Prepare a manufacturing overhead budget. (Round intermediate amounts to the nearest dollar.) This is similar to Illustration 21-10 on page 1094 of your textbook. | ||

| (f) Prepare a selling and administrative budget. This is similar to Illustration 21-11 on page 1095 of your textbook. | ||

| (g) Prepare a budgeted income statement. (Round intermediate calculations to the nearest dollar.) This is similar to Illustration 21-13 on page 1096 of your textbook. | ||

| (h) Prepare a cash budget. This is similar to Illustration 21-17 on page 1100 of your textbook. | ||

| (You will need to prepare schedules for expected collections from customers and expected payments to vendors first. See Illustrations 21-15 and 21-16 on page 1099 of your textbook for guidance.) | ||

| Rules: | ||

| * Use Excel's functionality to your benefit. Points are lost for lack of formula. | ||

| * Use proper formats for schedules, following the referenced textbook examples. | ||

| * Use dollar-signs and underscores where appropriate. | ||

| * Double-check your work! Verify your formula and logic! | ||

| Grading Guidelines: | ||

| Effective Use of Excel | 40% | |

| Facts, Logic | 20% | |

| Completeness | 30% | |

| Spelling, Punctuation, Value Format | 10% | |

OPEN IMAGE IN A NEW TAB TO ZOOM IN AND VIEW / PLEASE SHOW FORMULAS

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started