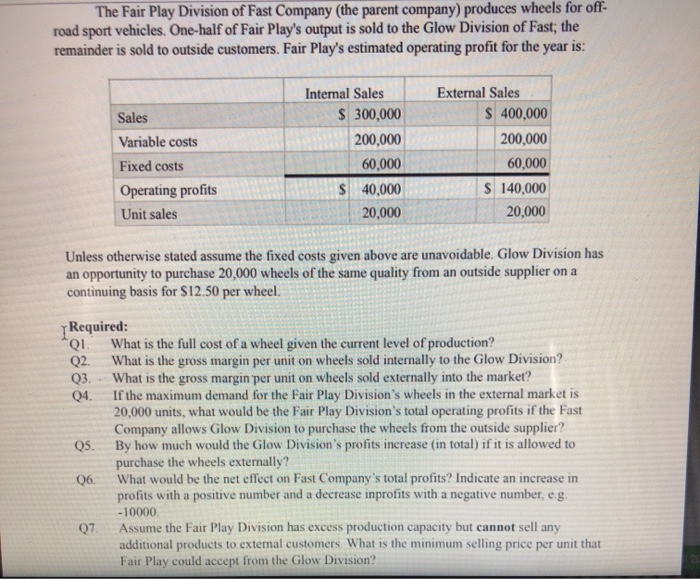

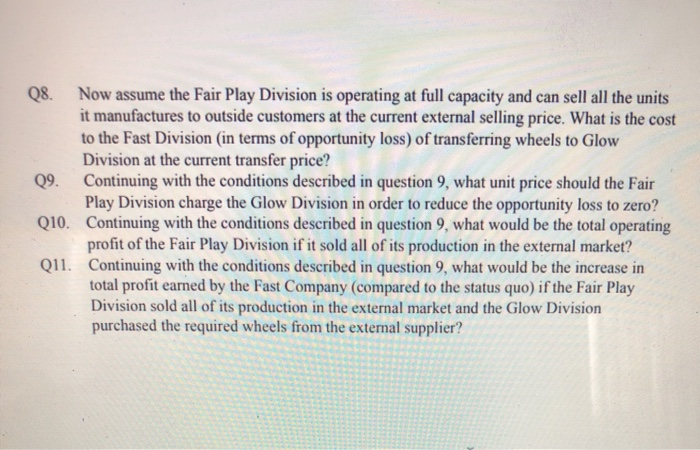

The Fair Play Division of Fast Company (the parent company) produces wheels for off- road sport vehicles. One-half of Fair Play's output is sold to the Glow Division of Fast; the remainder is sold to outside customers. Fair Play's estimated operating profit for the year is: Sales Variable costs Fixed costs Operating profits Unit sales Intemal Sales $ 300,000 200,000 60,000 40,000 20,000 External Sales $ 400,000 200,000 60,000 $ 140,000 20,000 Unless otherwise stated assume the fixed costs given above are unavoidable. Glow Division has an opportunity to purchase 20,000 wheels of the same quality from an outside supplier on a continuing basis for $12.50 per wheel. Required: 01 What is the full cost of a wheel given the current level of production? Q2. What is the gross margin per unit on wheels sold internally to the Glow Division? Q3. What is the gross margin per unit on wheels sold externally into the market? Q4. If the maximum demand for the Fair Play Division's wheels in the external market is 20,000 units, what would be the Fair Play Division's total operating profits if the Fast Company allows Glow Division to purchase the wheels from the outside supplier? By how much would the Glow Division's profits increase (in total) if it is allowed to purchase the wheels externally? What would be the net effect on Fast Company's total profits? Indicate an increase in profits with a positive number and a decrease inprofits with a negative number, eg. -10000 Q7. Assume the Fair Play Division has excess production capacity but cannot sell any additional products to external customers. What is the minimum selling price per unit that Fair Play could accept from the Glow Division? 09. 08. Now assume the Fair Play Division is operating at full capacity and can sell all the units it manufactures to outside customers at the current external selling price. What is the cost to the Fast Division (in terms of opportunity loss) of transferring wheels to Glow Division at the current transfer price? Continuing with the conditions described in question 9. what unit price should the Fair Play Division charge the Glow Division in order to reduce the opportunity loss to zero? Q10. Continuing with the conditions described in question 9, what would be the total operating profit of the Fair Play Division if it sold all of its production in the external market? Q11 Continuing with the conditions described in question 9, what would be the increase in total profit earned by the Fast Company (compared to the status quo) if the Fair Play Division sold all of its production in the external market and the Glow Division purchased the required wheels from the external supplier